MISO officials said Thursday that the RTO’s proposal to conduct its Multi-Value Project (MVP) cost allocation separately for its South and Midwest regions is likely to be in place for three to four years.

Chief Operating Officer Clair Moeller told the Regional Expansion Criteria and Benefits Working Group (RECBWG) that MISO will propose a bifurcated MVP cost allocation because of the limited transfer capability between the subregions and the RTO’s failure to capture what he called the “unicorn” of a more granular cost allocation.

The RTO announced the plan last month. (See Tensions Boil over MISO South Attitudes on Long-range Transmission Planning.)

MISO plans to file the proposal with FERC by the end of November. Officials promised to post tariff redline language by the end of next week and allow at least a week for stakeholder feedback.

Moeller said he hopes the separation of the zones will be temporary, saying it could change as a result of upgrades to relieve the transmission bottleneck or new rules resulting from FERC’s Advanced Notice of Proposed Rulemaking on transmission planning and cost allocation. (See related story, FERC Tx Inquiry: Consensus on Need for Change, Discord Over Solutions.) And he said officials would “continue hunting for the unicorn.”

The COO also said the bifurcated MVP recognizes the limited transfer capability between the subregions to ensure a “roughly commensurate, beneficiaries-pays cost allocation.”

Within five years after implementing the change, MISO will evaluate the transmission investments approved across the subregions and whether the cost allocation results in an equitable outcome for customers “across the entire footprint,” Moeller said.

He challenged the “myth” that previous MVPs built in the Midwest have provided “enormous benefits for the southern region.”

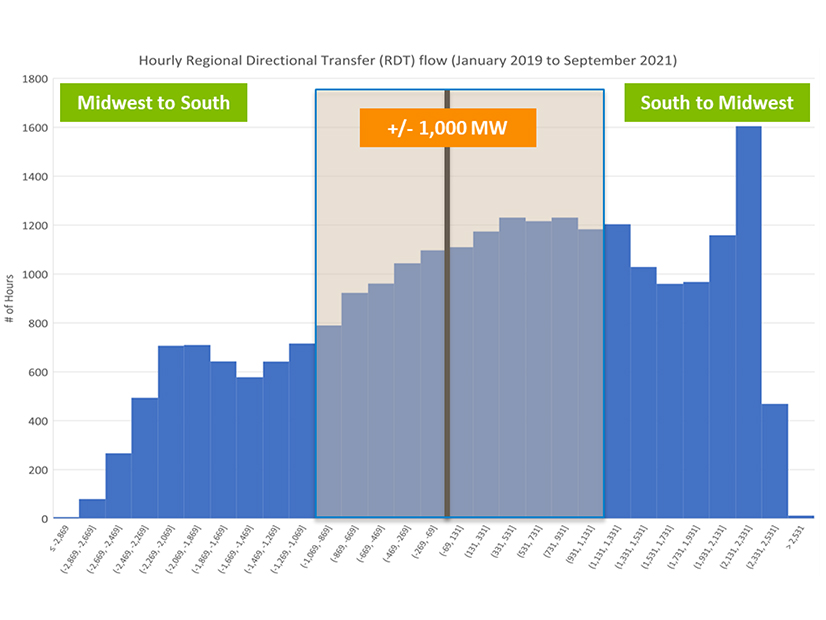

Since 2019, Moeller said, the flow through the Midwest-South interface has been “reciprocal.” For 2021, there has been slightly more flow from the South to the Midwest (52%) than vice versa. About 2% of the intervals found Midwest-South flow at the maximum capacity of 3,000 MW, while 8% of the intervals showed South-Midwest flows at the limit.

Wisconsin Public Service Commissioner Tyler Huebner asked why MISO couldn’t use a metric such as adjusted production costs (APC) for more granular allocations.

Moeller said the northern two-thirds of MISO has “pretty uniform” goals for fleet changes, driven by load. If Michigan benefits from a project in Northern Indiana, MISO must ensure “that costs from Northern Indiana get charged to Michigan.”

“Making sure that the drivers and the payers match is harder to do when you get more granular,” he said.

David Sapper, representing the MISO LSE Coalition, asked about the potential impact of the Southeast Energy Exchange Market (SEEM). The market’s members, including Southern Co. (NYSE:SO), Dominion Energy South Carolina (NYSE:D), the Tennessee Valley Authority and Duke Energy (NYSE:DUK), proposed improving bilateral trading in the region through automation and a move from hourly to 15-minute transactions. The SEEM agreement took effect Oct. 11 after FERC deadlocked 2-2 on the proposal. (See related story, SEEM to Move Ahead, Minus FERC Approval.)

“We’re not sure the Southeast [market] is going to have a big effect,” Moeller responded, saying MISO’s efforts to develop more transfer capacity with Southern and TVA failed to gain “traction.”

“They’re kind of busy doing their own thing right now,” he said. He predicted the SEEM members will see “seams friction” as they proceed. “We hope that that brings to the table” to discuss stronger interconnections, he said.

Steve Leovy of WPPI Energy expressed frustration with MISO’s approach, saying a unicorn “is not an appropriate metaphor” for the RTO’s challenges. “I’ve never seen a unicorn, but I have seen cost allocations that are more granular than 100% postage stamp,” he said.

He said improving transfer capability on the system could reduce required reserve margins in MISO zones. That “has a real economic value that we could measure if we try,” he said.

Lauren Azar, representing the Sustainable FERC Project, said she agreed with Leovy that stakeholders can develop a cost allocation that reflects the goals of the long-range transmission plan to ensure reliability and reduce congestion costs. “But that’s going to take time, creativity and a good-faith effort by all stakeholders,” she said.

Louisiana Hostile to Tx Expansion

The task force voted 32-29 last month against using a cost allocation proposed by Entergy (NYSE:ETR) and its state regulators that would set a higher bar for projects to be cost allocated and assign more specific beneficiaries. Multiple MISO stakeholders have accused Entergy of stalling transmission solutions that could bring outside supply into its territory. (See MISO Stakeholders Blame Entergy for Long-range Transmission Impasse.)

The Louisiana Public Service Commission, which has been clear that it doesn’t want to share in the costs of transmission projects built in the Midwest, will receive a presentation at its Oct. 20 meeting on a staff report looking at the pros and cons of MISO membership.

The PSC said it will pay “particular attention to the need for the state to remove itself from MISO membership prior to 2022 to avoid a negative offset of benefits to ratepayers.”

The Louisiana commission’s move follows an audit from the Mississippi Public Service Commission that questions the continued benefits of MISO membership in light of the long-range transmission plan, a move to a four-season capacity market and an increase of the RTO’s value of lost load. (See Mississippi PSC Audit Questions MISO Membership.)

Election

Meanwhile, the RECBWG will be accepting nominations for chair and vice chair for 2022 at StakeholderRelations@MISOenergy.org until Oct. 21.

Group Chair and Michigan Public Service Commissioner Dan Scripps said both he and Vice Chair Carolyn Wetterlin, of Xcel Energy, plan to seek re-election. If there are more than one candidate for either position, there will be an election by email ballot.