Louisiana regulators this week said they will split with MISO if their ratepayers are forced to fund major transmission built in the northern reaches of the RTO’s footprint.

During a Wednesday meeting, Louisiana Public Service commissioners cited concerns over an “offset” of the value MISO can provide to southern ratepayers, if it expects them to shoulder future transmission costs in the Midwest region.

A PSC consultant said the grid operator’s long-range transmission plan’s primary function is to support large-scale wind farms and solar arrays, not accomplish future reliability as the RTO claims.

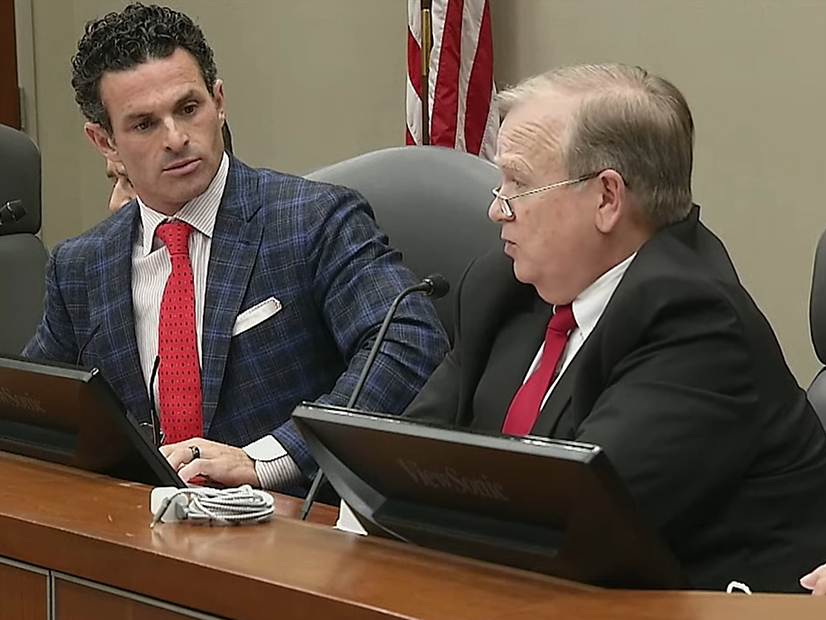

“These front projects are being referred to by MISO as reliability projects,” said Stone Pigman attorney Noel Darce, charged with filing a report on the plan to the commission. “They are primarily designed, however, to allow large quantities of wind resources located in the northwest portions of MISO to be delivered across the MISO footprint.”

Darce said generators in MISO South could be forced to pay for the delivery of other energy sources “to the benefit of states” with lofty renewable energy goals.

MISO has said it could soon recommend up to $30 billion in construction for new transmission as part of its long-range transmission plan, with as much as an additional $100 billion of investments to follow. The RTO has long said it needs more transmission to avoid reliability violations as it faces mounting thermal plant retirements, rising renewable energy use, and a growing reliance on electrification.

Facing recalcitrance from its southern members, MISO decided to first study and recommend long-range projects in MISO Midwest. Planners said they’ll address MISO South’s needs in 2022.

Commissioner Eric Skrmetta said he favors giving MISO a one-year notice to remove Louisiana from membership if the transmission plan contains cost sharing between the RTO’s subregions. He also said he would author a motion to begin the exit process in November, if MISO moves forward with its provisional postage stamp allocation plan.

Some members have said separate but equal cost allocations between MISO Midwest and MISO South will keep the subregions electrically isolated and hinder stronger transmission links between the two. The RTO’s executives have said they could perform a five-year review of long-range projects in MISO Midwest to see if they delivered quantifiable benefits to the South. (See MISO Hopes Bifurcated MVP Cost Allocation Will be Temporary.)

Skrmetta Vows Supreme Court Battle

“We have arrived at the moment where the cost of transmission is going to outweigh the value benefits provided under the market,” Skrmetta said. “We are going to be a member of an organization that is simply going to be burdening our ratepayers with costs.”

Skrmetta said he wasn’t interested in supporting a “tremendous amount” of wind generation in MISO Midwest that was built on production tax credits.

“I remember that an old guy told me, ‘God invented water, but he forgot to lay the pipes,’” he said. “So that’s what makes water companies make money. So, it’s the same thing with this. They’ve gotten free windmill assets and now they want the ratepayers to pay for the transmission from these stranded wind assets.”

He characterized MISO as a “transmission owners’ club” And said state commissions “are looked on as a nuisance.”

“We went through a very extensive, I guess, engagement period and we got married and — all of sudden — things changed,” Skrmetta said of Louisiana’s MISO membership experience.

Louisiana and other MISO South states could join other markets that don’t have a transmission component, Skrmetta said. He said he was prepared to pursue a lengthy court battle for the right to leave MISO.

“We’ve been told by some people in this organization that FERC is never going to let us go. I will let the Supreme Court of the United States tell us we can’t go before I’m going to see ratepayers in this state see a 7%, 8%, 10% immediate increase,” Skrmetta said. “We have been either duped, or we’re being mistreated, or we have been looked at like we’re somewhat less intelligent than our friends up north.

“Either this is going to be a value proposition for ratepayers and for generators and for transmission owners in an equal and balanced situation, or it’s not going to be anything for us,” Skrmetta said. “Everyone floats on a rising tide … but when we’re going to be holding the anchor, and they’re going to be staying on the boat, that is not fair to the ratepayers of this state.”

“I want to be very careful about how we move forward,” Commissioner Lambert Boissiere said. A MISO split could have huge implications on how Louisiana transmits power, he said, urging the state’s utilities and power producers, commission staff and the RTO to work together.

PSC Chairman Craig Greene said an organized wholesale market is a “necessity” for Louisiana.

“Before we divorce one, we need to know which one we’d be going to because it’s important to have the benefits that an organized wholesale market brings,” he said.

But Greene also said it’s “laughable” that MISO can’t single out more specific benefits beyond a postage-stamp allocation.

MISO: Tx Costs Pale Compared to Generation Costs

MISO responded by saying its long-range planning is aimed at accommodating members’ integrated resource plans and most announced carbon-reduction goals by utilities and states.

Spokesperson Brandon Morris said staff has conservatively estimated $135 billion in new generation resources will come online over the next 20 years across the footprint. He said MISO’s initial $30 billion price tag represents just 20% of the planned generation investment.

“This is the investment needed to enable the projected generation costs, which will far outweigh the transmission costs,” Morris said in an emailed statement to RTO Insider.

But Darce recommended a “deceleration” of MISO’s approval goals for projects.

“MISO was in a rush to approve the transmission in this first tranche of transmission projects in March of ’22, and it didn’t want to wait any longer to make a cost allocation filing. This process has all moved quickly in MISO and it’s been changing in the last few months and in the last few weeks,” he told commissioners. “Staff is concerned that the rush to approve these projects by March of 2022 is a self-imposed and artificial deadline and is not leaving enough time for the projects to be vetted [or] the cost allocations to be fully understood.”

Darce said MISO’s proposed 1:1 benefit-to-cost ratio threshold for projects remains too low and that MISO South’s recommended 1.25:1 ratio is more appropriate. He said the RTO rejected MISO South’s cost-allocation proposal “without any real stakeholder discussion.” (See Tensions Boil over MISO South Attitudes on Long-range Transmission Planning.)

“Staff believes that large, expensive projects built based on projections of need decades into the future should not be made with the hope that a dollar spent will return a dollar of benefits,” Darce said.

Darce added that the commission isn’t opposed to renewable energy or long-term transmission planning decisions made for reliability or economic reasons. But he said the cost of a long-range portfolio is a “major concern.” He said costs could exceed the $130 billion top-end estimate.

“The financial impacts of that construction, even over a footprint as large as MISO’s, would be enormous,” he said.

Some MISO South stakeholders have argued that the postage stamp cost allocation would effectively bring Entergy’s system agreement back from the dead.

The utility’s allocation of production costs among its half dozen operating companies under its multistate system agreement has been a source of conflict and complaints for more than a decade. Before 2015, the companies functioned as one system, although each had different operating costs. Under the arrangement, Entergy’s low-cost operating companies made payments to the highest-cost company so that no operating company had production costs more than 11% above or below the system average.