SPP’s Market Monitoring Unit (MMU) last week released its quarterly reports for its RTO and Western Energy Imbalance Service markets, saying it is evaluating rule changes in the latter to address limited ramp offerings.

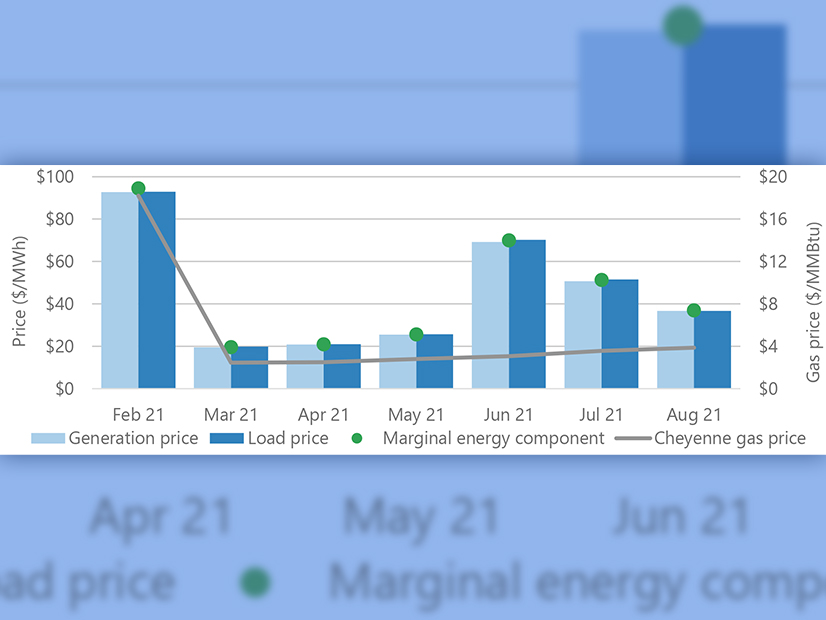

The MMU said in its WEIS report that the lack of offered ramp “presents a significant problem,” and it expressed concern with the fledgling market’s outcomes that resulted in volatile price spikes, including a 174% jump from May to June. WEIS only began operations in February.

While prices scaled back down the following two months, the Monitor said that was not unusual in an energy imbalance-only market. Market participants are not required to offer capacity, few resources are in the market, and limited ramp and capacity is made available. That results in higher-priced resources setting price.

The WEIS market’s registered resource capacity | SPP MMU

The WEIS market’s registered resource capacity | SPP MMU“It is typical for most energy markets to see an increase in prices when demand increases, especially during summer months,” the MMU said. “Price volatility also means that many market participants are hesitant to offer incremental megawatts due to fear of unrecovered costs.”

Demand was up 16% in June and 14% in July. The market has 6.2 GW of capacity from full participation resources and an additional 1.7 GW from partial participation resources.

The Monitor’s RTO market report revealed average day-ahead prices were up 64% when compared to summer 2021, $33.30/MWh from $20.32/MWh. Average real-time prices were $30.68 this summer, a 56% increase from last summer’s $19.69/MWh.

The price increase was driven by natural gas prices, which reached $3.77/MMBtu at the Panhandle Eastern hub. The hub’s prices haven’t been that high since November 2014, with the exception of February during the winter storm. Gas prices were at $1.65/MMBtu during 2020’s summer months.

The MMU said generation outages this summer were comparable to 2019’s, following a one-year decrease in 2020 “due to the lingering effects of deferred maintenance” because of the COVID-19 pandemic.

The Monitor’s staff will hold a webinar Nov. 9 to discuss the RTO report.