RTO to Propose Review of Regulation Market

Stakeholders at last week’s Market Implementation Committee meeting heard PJM’s plan to win endorsement of a solution to deal with its regulation mileage ratio calculation problem after two proposals failed last month.

Adam Keech, PJM’s vice president of market design and economics, discussed the “logical next steps” of the proposal, which seeks to fix the calculation of the ratio to prevent an undefined condition.

PJM’s performance-based regulation market splits the dispatch signal in two: RegA for slower-moving, longer-running units; and RegD for faster-responding units like batteries that operate for shorter periods. If a signal is “pegged” high or low for an entire operating hour, the corresponding mileage would be zero for that hour. There has been an increased frequency of RegA signal pegging and times the RegA signal is pegged for extended periods, creating a divide-by-zero error in the calculation of the mileage ratio.

The RTO’s proposal, which called for setting the RegA dispatch mileage floor at 0.1 instead of zero, failed in a sector-weighted vote of 2.12 (42.4%) at the October Markets and Reliability Committee meeting, short of the 3.33 (66.6%) threshold for endorsement. A separate proposal from the Independent Market Monitor, which called for a cap of 5.5 instead of 0.1, also failed, receiving a sector-weighted vote of 3.07 (61.4%). (See “Regulation Mileage Ratio Fails,” PJM MRC/MC Briefs: Oct. 20, 2021.)

Keech said PJM heard stakeholders’ desire during the voting process to discuss “more systemic issues” with the regulation market and to examine those issues more closely, so it brought forward a proposal to begin a broader market review. Danielle Croop, senior lead market design specialist at PJM, reviewed the problem statement and issue charge. Keech said they were similar to the ones endorsed and created the former Regulation Market Issues Senior Task Force that last met in 2017.

The key work activities include regulation market education, evaluating the benefits factor curve and proscribed RegA/RegD commitment percentages, and proposing any modifications to the regulation market to address issues raised in the evaluation.

Keech said the review would utilize a new senior task force reporting directly to the MRC. PJM plans on conducting a first read of the problem statement and issue charge at the Nov. 17 MRC meeting.

Once the problem statement and issue charge are approved, Keech said, another vote would take place on the short-term solution proposals from PJM and the Monitor that were not endorsed.

“We could go for a vote of the short-term solutions knowing we have the larger regulation market review that we are going to commence,” Keech said.

Fuel-cost Policy Standards and Penalties

Melissa Pilong of PJM provided a first read of an RTO/Monitor proposal addressing clarifications to fuel-cost policy standards in Manual 15 and Operating Agreement Schedule 2 penalty language developed through the Cost Development Subcommittee.

PJM’s fuel cost policy form. | PJM

PJM’s fuel cost policy form. | PJMPilong said the proposal includes a combination of clarifications and language for more elaboration on PJM’s fuel-cost policies that resulted after the RTO examined the fallout from the February winter storm in Texas and other parts of the South and Midwest.

The proposal calls for market sellers of generation units to verify that all intraday offer triggers are specified in the unit’s fuel-cost policy. Market sellers will also have to verify that weekend or holiday natural gas estimation practices match either the default assumptions in the PJM Fuel Cost Policy Guidelines contained in Manual 15 or specify estimation practices in the unit’s policy.

The Manual 15 updates include changes to the intraday update triggers. In order to opt into intraday offers, Pilong said, market sellers need to have a one-time trigger to update the maximum allowable cost offer.

The committee will be asked to endorse the proposal at its next meeting. PJM is seeking final endorsement by the Members Committee in February and a FERC filing following approval by the Board of Managers.

Manual 6 Revisions

Emmy Messina, senior engineer with the PJM market simulation department, presented a first read of conforming changes to Manual 6 resulting from the endorsement of a proposal to address the RTO’s auction revenue rights and financial transmission rights at the October MRC meeting. (See Stakeholders Endorse PJM ARR/FTR Market Changes.)

Messina said the changes would only impact Manual 6 and include language for bid limits and the network model user guide. They would update section 6.6 to reflect an increase of bid limits from 10,000 to 15,000 per corporate entity, auction round and period in FTR auctions. Section 9.1 would also be updated to direct stakeholders to a new network model user guide on the FTR section of the PJM website to get additional information on the auction.

The committee will be asked to endorse the revisions at its next meeting.

Regulation for Virtual Combined Cycles

Michael Olaleye, senior engineer with PJM’s real-time market operations, provided a first read of a proposal by Vistra to revise to Manual 12 addressing regulation for virtual combined cycle units.

The issue charge was originally endorsed at the May MIC meeting. (See “Virtual Combined Cycle Regulation Issue Charge Endorsed,” PJM MIC Briefs: May 13, 2021.)

Units that are modeled virtually by PJM can sometimes receive regulation awards from the market clearing engine that vary, Olaleye said, which Vistra has been experiencing with some of its units. When a combined cycle unit is modeled as multiple virtual units, there is a possibility for unbalanced or unequal regulation awards to each unit by the engine.

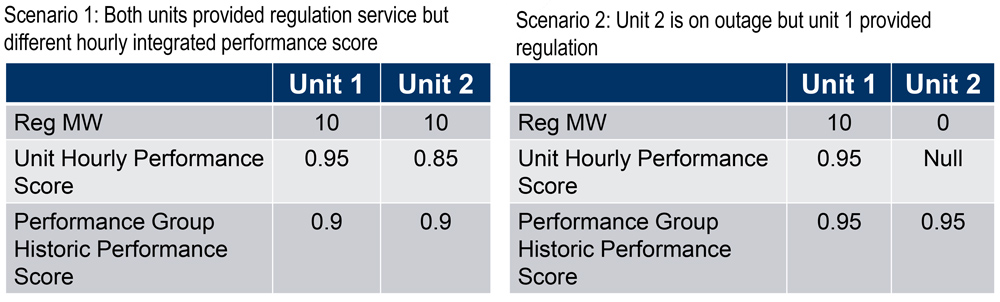

Vistra’s proposed enhancement to performance group scoring calls for calculating the “hourly” score and extending it to each market resource with an assigned regulation for the given hour. It also calls for PJM to also calculate the “historic” performance score and extend it to each market resource in the performance group.

Olaleye said the enhancements would ensure that all resources of the performance group have the same historic performance score, which should fix the regulation clearing calculation problem in the software.

The committee will be asked to endorse the proposals at its next meeting.