Texas regulators continued to explore load-serving entity resource obligations (LSEROs) with an emphasis on dispatchable resources last week in their quest to modify ERCOT’s market design after its near collapse during the February winter storm.

“There’s no silver bullet, no readily apparent solution,” Public Utility Commission Chair Peter Lake said during Friday’s latest ERCOT market work session.

“The first crack we take won’t be the right answer,” he said. “We very much want to capture the good elements of all these proposals and continue to work going forward to the best solution. We’re in the business of vetting ideas and getting closer and closer to the right solution or the right set of solutions.”

One possible solution is the load-serving obligation that Lake has been championing and that still remains atop the list of potential answers. As proposed by NRG Energy (NYSE:NRG) and Exelon (NASDAQ:EXC), the LSERO would directly address resource adequacy concerns by introducing a formal reliability standard and a mechanism to ensure sufficient resources meet this standard. (See Study Suggests Texas LSEs Can Provide Reliability.)

At staff’s request, Brattle Group’s Sam Newell shared his analysis of the LSERO and another alternative to solving ERCOT’s resource-adequacy issues — targeted fuel and backup reserves — to help inform the commission’s decision-making.

He suggested an “LSERO plus” version that would require generators to bid in their capacity at cost to mitigate market power and allow LSEs to procure their obligation just before the season starts. Newell said this would be the most direct way to address resource adequacy, the PUC’s primary concern.

“If you want to look at the fleet and say, ‘Yup, we’re prepared’; if you think you’re able to look at the fleet and say, ‘That’s what we want — we’re prepared for any plausible event’ — this option is the most direct way to express that to the market,” Newell said. “This is the most direct way to export a resource adequacy objective to the market.”

He expressed concern about LSERO plus’s effect on forward bilateral contracts and the likelihood that LSEs wouldn’t know the prices ahead of the auctions and, thus, couldn’t hedge.

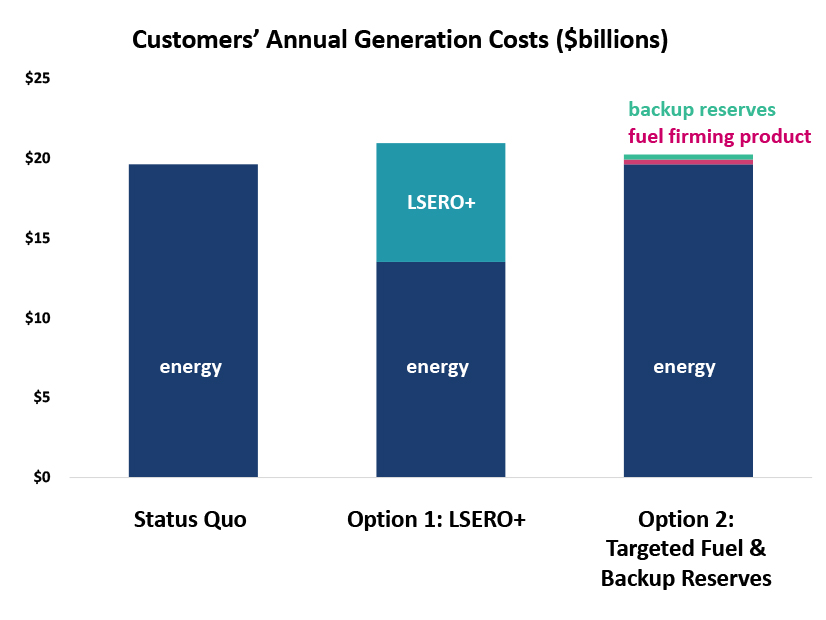

And then there’s the not-so-small matter of costs. Newell said Brattle has estimated the proposal would shift about a third of the ERCOT’s market value to LSEROs and cost “roughly” $300 million a year. The high costs stem primarily from staff managing an accreditation process for each resource and awarding reliability credits.

“A lot of administrative judgment goes into this, which will be the subject of ongoing argument,” Newell said. “The money subject to regulatory capture … [is] the biggest downside.”

“This is a major problem,” Stoic Energy consultant Doug Lewin said as he live tweeted the work session. It’s “a step toward an administered market where market participants spend more time working the refs for more money than providing innovation and lower-cost options.”

Alison Silverstein | ACEEE

Alison Silverstein | ACEEEIndependent consultant Alison Silverstein told RTO Insider that large industrial customers might be tempted to opt out of another ERCOT charge and “dump reliability assurance costs onto small customers.”

As an alternative, Newell suggested a targeted fuel and backup reserves option that would require four days of on-site fuel. He said the gas-fired fleet would be the most likely candidate for that requirement, but it would necessitate the units being “satisfactorily winterized” and would only apply to about 25 GW of resources.

The proposal’s increased generation costs would be about half that of LSERO plus, Newell said.

“Holding out a few megawatts from the energy increased the price signals,” Newell told the PUC. “That can attract capital too. It does depend on people believing in [the proposal].”

Brattle’s alternative is similar to a strategic reliability service (SPS) proposed by Commissioner Lori Cobos that she called a “dynamic and flexible reliability tool” that would act as an insurance policy against reliability issues. She said the service would “prospectively target” and meet specific reliability needs not already addressed by ERCOT’s real-time and ancillary services markets.

Under Cobos’ plan, ERCOT would procure SPS through a competitive request-for-proposals process or auction to ensure the selection of the lowest-cost dispatchable resources. Eligible resources would have to meet weatherization requirements, fuel-supply arrangements and other accreditation requirements to ensure availability and firmness. They would also have to be capable of synchronizing to the grid within two hours and run for at least eight hours a day for multiple consecutive days.

Cobos said SPS would be deployed last in the bid stack to minimize its effect on real-time energy prices. Qualifying resources would be paid the market-clearing price, with those failing to perform assessed a “stringent” nonperformance penalty and its participation payment clawed back.

“We want to give ERCOT the flexibility to procure more than peakers. We need to send stronger price signals because we’re moving away from a crisis-based model,” Cobos said, referring to ERCOT’s current dependence on high prices during scarce times to incent new generation.

Newell pointed out that prices are only high during generation shortages.

“It’s not desired,” he said. “We want more supply and more cushion. The only two thematically ways to get that is to increase total demand, either through real-time reserves or through demand for capacity, as with an LSE obligation.”

The other theme?

“Make a side payment, but hold [the resource] out of the market,” he said. “There’s only so much room for supply and only so much demand. You don’t want to expand demand and pay everything that’s reliable. You want to hold some things out of the market.”

The discussion will continue in December, with the PUC committed to releasing a blueprint of its proposed market redesign before the year is up.

Silverstein, who sat in on the work session, questioned the rush for an LSE obligation when real-time co-optimization won’t be added to the market until 2025 at the earliest. The market tool clears energy and ancillary services every five minutes in the real-time market and would simplify a much more complex security-constrained economic dispatch problem when multiple resources and services are juggled over different interdependent time periods.

“I would prefer to see the commission do more, consistent analysis of every new option in the table … before they pick a single option like LSEO to move forward,” Silverstein said. She added that the PUC should analyze the major changes it’s already made to winterization requirements, the operating reserve demand curve and emergency response service, and determine their effect on reliability, market performance and costs.

“This should be the baseline against which they analyze the next set of potential market modifications,” Silverstein said.

Salty Public Comments

The PUC got more than it bargained for when it resumed in-person public comments during its open meeting Thursday. The commission took comments over the phone during the COVID-19 pandemic.

One speaker said she was upset over seats that some stakeholders reserved for others. “There are more suits in this room than the people who were affected” by the winter storm, she said.

A self-described organizer related a story of a person stuck in her home, battling 20-degree temperatures and ice in her sink.

That prompted a response from the woman who followed her: “We didn’t have ice in our sink, but we had ice on our asses.”

During the open meeting’s normal course of action, the commission also:

- approved a $41.6 million rate-increase request from Southwestern Electric Power Co. (NASDAQ:AEP) but lowered its return on equity rate from 9.45% to 9.25%. SWEPCO had asked for a $90.2 million increase (51415).

- agreed to a certificate of convenience and necessity for CenterPoint Energy’s (NYSE:CNP) 345-kV interconnection project southwest of Houston that will cost at least $22 million. Commissioner Jimmy Glotfelty dissented from the decision. An administrative law judge ruled that CenterPoint should work with a planned solar farm and existing landowners as it links another solar farm to the grid (51568).

- learned from Cobos that she has been selected as vice president of Entergy’s Regional State Committee. The E-RSC comprises regulators from Arkansas, Louisiana, Mississippi, Texas and the city of New Orleans and provides input to Entergy about its operations and transmission upgrades.