Texas regulators are expected to consider an order Thursday that will lower

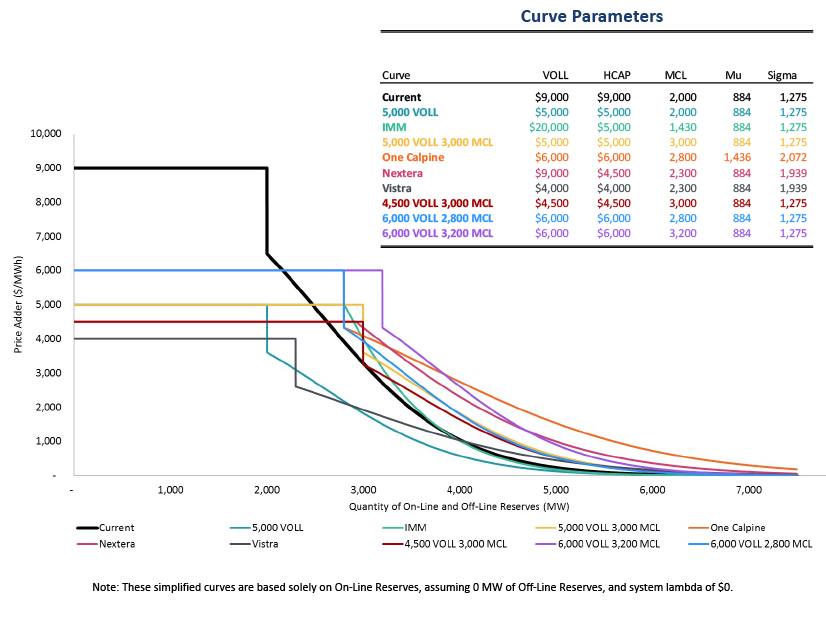

ERCOT’s high systemwide offer cap (HCAP) to $5,000/MWh from $9,000/MWh, a 44% reduction (52631).

The Public Utility Commission’s four members reached consensus during an open meeting Tuesday on $5,000 as the operating reserve demand curve’s (ORDC) top-line number. The ORDC is designed to accurately reflect shortage conditions by increasing power prices through an adder when operating reserves dip below 2 GW. It’s also seen as a price signal to investors that additional generation is needed in the market.

Commissioner Will McAdams offered up $5,000/MWh as an “appropriate level,” saying the ORDC should be designed to stabilize the existing fleet and ensure the real-time market operates effectively.

The ORDC “provides revenues with the right price incentives to behaving as they should … so they are online when the likelihood of scarcity is growing,” he said. “We should use it to stabilize current market conditions.”

Commissioner Lori Cobos agreed, saying the ORDC will help stabilize the existing generation but also “hopefully drive incremental generation.”

“I don’t want to minimize the importance of changes to the ORDC,” she said. “These have been highly contested, debated issues in the past. It is by no means low-hanging fruit.”

McAdams is also proposing to raise the ORDC’s minimum contingency level from 2 GW to 3 GW, saying it will give ERCOT “breathing room” before hitting emergency conditions.

“All of these changes we are considering are expensive, but expensive is relative to the problems,” Commissioner Jimmy Glotfelty said. “It’s warranted based on what all Texans have experienced. It’s the right policy to move forward.”

The HCAP was lowered to the low systemwide offer cap of $2,000/MWh after February’s winter storm, when it exceeded a threshold for too many hours at the limit as the ERCOT system struggled to meet soaring demand. By rule, the HCAP is set to revert to $9,000/MWh on Jan. 1.

“The overall objective is to reduce the HCAP before it resets in January to make sure people in Texas are not exposed to high prices when the calendar rolls over,” PUC Chair Peter Lake said.

PUC Increases Gas Coordination

Facing Wednesday’s statutory deadline to issue orders addressing the storm’s damaging aftereffects, the PUC approved a proposal to increase coordination between the electric and gas industries during an energy emergency (52345).

The rule requires critical natural gas facilities to share “critical customer” information to electric utilities, who then must incorporate the information into their load-shed and power-restoration plans by prioritizing natural gas. It applies statewide. ERCOT manages about 90% of the state’s grid, but staff have assured SPP and MISO that the rule will not conflict with their FERC jurisdiction.

“We want it to be clear they need to be collecting this information and implementing it to the extent they can, but it’s not going to impede their FERC obligations,” the commission’s David Smeltzer said.

The Texas Railroad Commission (RRC), which provides oversight of the state’s natural gas and oil industries, also passed a companion rule Tuesday that requires gas companies prepared to operate during an energy emergency to file necessary forms with regulators.

Those companies that tell the RRC they aren’t prepared to operate during an emergency will have to explain why they can’t and pay a $150 fee. The rule tightens the commission’s original proposal, which would have allowed facilities to opt-out of weatherization requirements by simply paying the $150.

“These requirements represent a fundamental change in the relationship between the natural gas industry and the electric generation industry,” Lake said. “For the first time ever, the electric transmission and distribution utilities will know the locations of the facilities which are critical to keeping natural gas flowing to the power plants that keep our lights on.”

Lake noted that more than 700 gas facilities have identified themselves as critical, up from the 10 or 15 before the storm.

During the RRC’s open meeting, Chair Wayne Christian took aim at the criticism the agency has faced in recent weeks. The Houston Chronicle has urged the RRC’s three commissioners to resign for “[misleading] Texans about the causes of the deadly blackouts” caused by the storm.

Despite FERC’s and NERC’s joint report that fingered the lack of natural gas and other fuel supplies as the main culprit behind the widespread outages, Christian said laying the blame on gas producers was “pure hyperbole.” (See FERC, NERC Release Final Texas Storm Report.)

The PUC also approved a rule requiring ERCOT market participants to update and file emergency operations plans with the commission and to participate in drills to test the plan once the State Operations Center is activated (51841).

The rule is a result of legislation passed by Texas lawmakers earlier this year. Stakeholders have a Jan. 4 deadline to file comments on the proposal.