Transource's proposed alternative plan for the eastern segment of its Independence Energy Connection project

Transource Re-evaluation

PJM stakeholders received an update on Transource Energy’s suspended Independence Energy Connection (IEC) transmission project at last week’s Transmission Expansion Advisory Committee meeting.

Nick Dumitriu, PJM

” data-credit=”© RTO Insider” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Dumitriu-Nick-2019-11-15-RTO-Insider-FI-1″ align=”right”>Nick Dumitriu, PJM | © RTO Insider

Nick Dumitriu, principal engineer in PJM’s market simulation department, provided an update on the 2020/21 long-term market efficiency window, highlighting the suspended project in Maryland and Pennsylvania.

The Pennsylvania Public Utility Commission voted 4-0 in May to reject a series of related applications and petitions filed by Transource for lines in Franklin and York counties. The PUC denied the project based on concerns about whether the need established in the PJM planning process met the requirement for needs specific to Pennsylvania. (See Transource Tx Project Rejected by Pa. PUC.)

The PJM Board of Managers endorsed the RTO’s recommendation to suspend the IEC project at its Sept. 22 meeting because of the “permitting risks” and to remove it from the pending Regional Transmission Expansion Plan models.

Dumitriu said PJM is required by schedule 6 of the Operating Agreement to “annually review the cost and benefits” of board-approved market efficiency projects that meet certain criteria to assure that a project continues to be cost beneficial. The annual re-evaluation is not required for projects that have started construction or have received state siting approval, and the Transource IEC was the only eligible project for 2021 re-evaluation.

Dumitriu said the base case analysis conducted by PJM yielded a benefit-to-cost ratio of 1.44, which excluded $131.88 million in sunk costs of incurred spending on the project. Dumitriu said that when the full in-service cost of $428.76 million for the project was analyzed, the benefit-to-cost ratio was 1.

The re-evaluation using a sensitivity scenario with higher load growth in PJM yielded a benefit-cost ratio of 2.08 with the exclusion of sunk costs and 1.44 for the full in-service cost.

A sensitivity scenario using additional coal retirements in the RTO yielded a benefit-cost ratio of 2 with the exclusion of sunk costs and 1.39 for the full in-service cost. Dumitriu said Talen Energy announced that its Montour generation facility in Pennsylvania and the Brandon Shores and H.A. Wagner coal generation facilities in Maryland, totaling more than 3,500 MW of generation, will cease coal-fired operations by the end of 2025 as the company moves toward renewable energy and battery storage projects.

Dumitriu was asked if PJM saw congestion growing on the AP South interface after removing the Transource IEC project. He said there are changes in congestion patterns after removing the IEC and that PJM sees “increasing congestion” on all the nearby constraints.

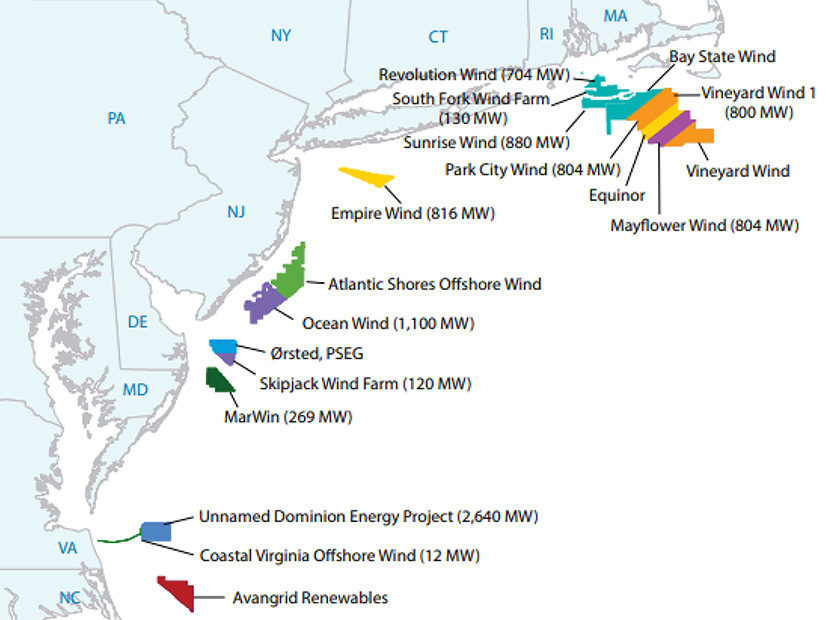

NJ OSW Projects

Work continues on proposals to interconnect New Jersey’s offshore wind projects through the 2021 state agreement approach window. Aaron Berner, PJM senior manager, provided an update on the 2021 RTEP analysis.

Berner said the proposals, which were presented at the October TEAC meeting, have been posted on PJM’s competitive planning page in redacted form. (See “NJ OSW Proposals,” PJM PC/TEAC Briefs: Oct. 5, 2021.)

New Jersey is preparing to be a manufacturing and operational hub for wind projects up and down the East Coast. | AWEA

New Jersey is preparing to be a manufacturing and operational hub for wind projects up and down the East Coast. | AWEAPJM is continuing to work through various analyses as part of the option 1a portion of the OSW window, Berner said, which included onshore upgrades on existing facilities. A total of 45 proposals were submitted for option 1a.

The RTO is working with entities who submitted proposals to identify issues in the planning process, Berner said, while also utilizing consultants as part of the competitive process to begin evaluations of construction processes and financial terms for the proposals.

Aaron Berner, PJM

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Aaron Berner, PJM | © RTO Insider” align=”right”>Aaron Berner, PJM | © RTO Insider LLC

Berner said PJM is concentrating on starting evaluations for 26 proposals that call for new offshore transmission connection facilities and eight proposals looking at offshore transmission networks. Berner said offshore transmission is more complicated because they’re not “traditional” facilities PJM has experience with building.

PJM is working toward adopting the schedule provided in the NJBPU guidance document indicating certain processes to be employed going forward during the project evaluations. New Jersey retains the right to elect to move ahead with any of the projects and is targeting the end of 2022 to make final decisions.

Berner said many of the proposals will be adjustable for changes in “scheduling accommodations” and the megawatt injection quantities based on NJBPU needs.

The BPU has already awarded three offshore wind projects in two solicitations: the 1,100-MW Ocean Wind 1 and 1,148-MW Ocean Wind 2 projects, both developed by Ørsted, and the 1,510-MW Atlantic Shores project, a joint venture between EDF Renewables North America and Shell New Energies US. The BPU is planning to hold three more solicitations over the next five years to help the state reach its goal of supplying 7,500 MW of offshore wind by 2035. (See NJ Awards Two Offshore Wind Projects.)

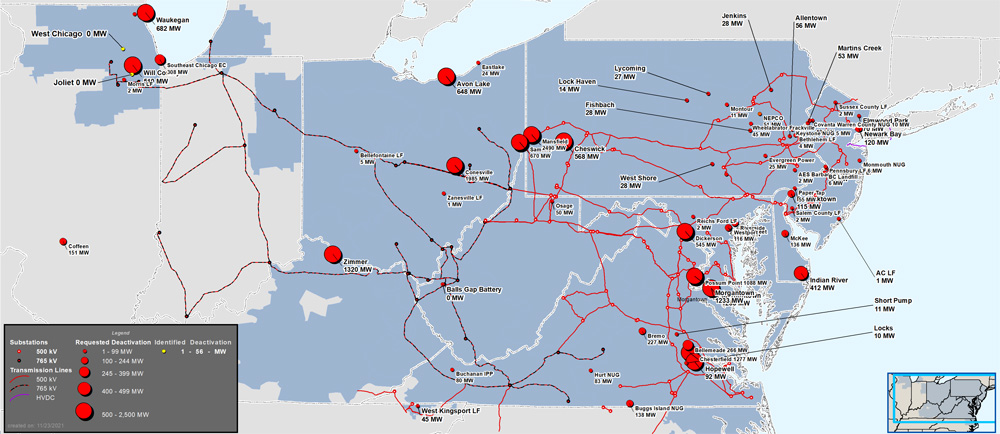

Generation Deactivation Notification

Phil Yum of PJM provided an update on recent generation deactivation notifications.

Yum said PJM received two battery deactivation requests in the ComEd transmission zone, including the Joliet Energy Storage battery and the West Chicago Energy Storage battery, which are both six years old.

Generation deactivation announcements in PJM from 2018-present | PJM

Generation deactivation announcements in PJM from 2018-present | PJMEach battery unit has 20-MW capabilities for the energy portion, Yum said, but they were listed as 0 MW for capacity.

The requested deactivation date for both units is Feb. 8, and a reliability analysis is underway.