Limited natural gas pipeline capacity and global supply chain issues with oil and LNG put the New England grid at heightened risk of emergency actions — including controlled outages — this winter, ISO-NE CEO Gordon van Welie told reporters Monday.

ISO-NE CEO Gordon van Welie | ISO-NE

ISO-NE CEO Gordon van Welie | ISO-NEThe RTO anticipates having adequate capacity to meet forecast peak demand of 19,710 MW during average winter weather conditions of 10 degrees Fahrenheit and 20,349 MW if temperatures reach below-average conditions of 5 F, with both projections about 2% lower than last year’s forecasts.

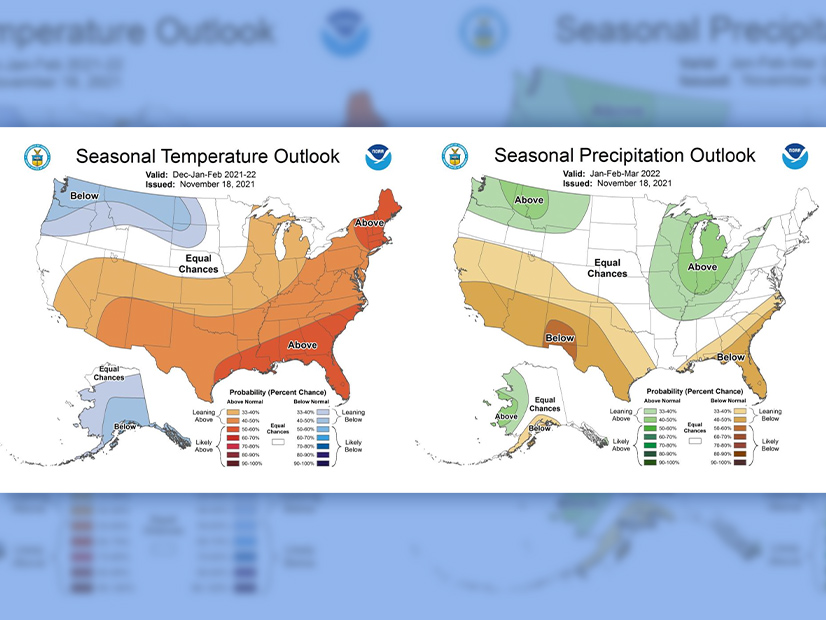

The National Oceanic and Atmospheric Administration this year is projecting a warmer than average winter in New England. “If this forecast holds true, and we hope it does, the ISO expects to have the resources needed to meet consumer demand throughout the winter season,” van Welie said during a press briefing.

But he said uncertainty over fuel supplies “could put the region in a more precarious position than past winters and force the ISO to take emergency actions up to and including controlled power outages. These controlled power outages would be a last-resort action to prevent a regionwide blackout, which would take many days or weeks to restore.”

Risk Factors

Van Welie said three variables will impact the RTO’s ability to provide adequate electricity: natural gas supplies, always tight in winter because of competing heating demand; the availability of oil and LNG; and “weather events becoming more frequent and more extreme.”

He noted that current storage levels of oil and LNG are lower than in recent winters and that European and Asian LNG prices are now as much as double those in New England.

“If you were a supplier of LNG, where would you send your cargoes? To Europe or Asia or New England? I mean, I think the answer is pretty obvious,” he said. “In past winters, we’ve had the reputation of being the highest-priced gas market in the world, and so there was a really strong financial incentive to send LNG cargoes to New England. That dynamic has flipped for this winter.”

Need to Communicate with Public

Peter Brandien, vice president of system operations and market administration, said the RTO is planning for the winter based on what it learned from the cold spell of 2017/18 — when all major cities in New England had average temperatures below normal for at least 13 consecutive days, despite the forecast of a mild season — and the recent load sheds in California and Texas.

Brandien noted that CAISO had to shed load during a heat wave because it ran out of energy as the renewables “ramped out.”

“After they shed load, and then communicated the tight situation that they were in, they ended up getting about 3,000 MW of additional capacity that they did not realize was available to them. When people really understood the situation, they got a lot better conservation than they had leading into the event,” he said. “So part of what we’re trying to do here is really educate everybody on where we are and understand that when we do go out for conservation, we’re going out for conservation to try to keep everybody with electricity and try to head off” load sheds.

Van Welie said there were also lessons from the outages in Texas during the February winter storm, although he emphasized “our system is better winterized, meaning the power plants, transmission lines and other equipment needed to produce and deliver electricity can better withstand cold temperatures.” (See FERC, NERC Release Final Texas Storm Report.)

“Watching what played out in Texas, and realizing that most people in this region don’t understand how vulnerable we are when it gets cold, we thought that it’s time for us to start communicating more openly about these risks,” he said. “We’re not trying to panic anyone; we’re not trying to cause undue alarm. We need people to understand how vulnerable it can be under the wrong set of conditions, and that this region hasn’t yet solved this problem.”

The New England region depends on natural gas as the balancing energy source, using gas to produce 50 to 60% of its electrical energy today.

“And yet we know we have this constraint in the winter, so we turned to burning imported gas, essentially LNG, or imported oil, so the question is how do you start displacing that?” he said.

Siting Woes, EE

Van Welie said some technological solutions, such as small modular nuclear reactors, would be unlikely to win siting permission in New England.

The region also has not yet taken other mitigating measures such as increasing the imports of hydroelectricity from Quebec. Van Welie said he was “disappointed” with the inability to complete the New England Clean Energy Connect (NECEC) transmission line, which would deliver hydropower from the province to Massachusetts.

The project’s developer last month halted line construction, and Maine regulators suspended its environmental permit after Gov. Janet Mills certified a negative referendum vote and asked the company to stop work. (See NECEC Halts Tx Line Construction, Regulators Suspend Env. Permit.)

“If it doesn’t go ahead, I think we’ll find other paths,” van Welie said.

The region is going to have to spend more in order to get transmission landlines sited because people don’t want to see such lines, but burying them incurs a much higher cost, he said.

New England is spending more than $1 billion a year on energy efficiency, which has dramatically clipped the growth in electricity usage in the region. But the wave of electrification coming will add more demand to the grid, he said.

“I think we will continue to need to do both energy efficiency as well as look to solve for the supply side of the equation,” he said.

Van Welie said the region may need to consider adopting something like the two-week energy reserve he’s seen in the Nordic countries.

“I think that’s a discussion to be had,” van Welie said. “It’s probably some combination of the LNG, imports from Hydro-Quebec, [and] in-region storage of LNG and oil. Then the big question will be how do we get off the fossil fuels? What do we replace the fossil fuels with? Because it cannot be the answer in the long run.”