Increasing its bet on offshore wind, the Biden administration announced Wednesday that it will auction six lease areas in the New York Bight on Feb. 23, enough to site at least 5.6 GW of generation.

The six leases in the Bureau of Ocean Energy Management’s (BOEM) sale notice are the most ever offered in a single auction, totaling 480,000 acres. BOEM had solicited commercial interest for 1.7 million acres in the Bight but excluded 72% of the area to reduce environmental impacts and avoid conflicts with the commercial fishing industry and other ocean users. BOEM issued its final environmental assessment on the lease areas in December. (See BOEM Issues Final Environmental Review of NY Bight.)

Interior Secretary Deb Haaland, who announced the auction in a press conference Wednesday with New York Gov. Kathy Hochul and New Jersey Gov. Phil Murphy, said the leases will include stipulations to encourage the use of union labor, building of a domestic supply chain and “planned” transmission.

The announcement of the new leases came the same day the Department of Energy issued a report identifying five strategic priorities for maximizing the value and reducing the costs of offshore wind. The Biden administration has set a goal of 30 GW of offshore wind by 2030; with states on the East Coast already committed to a pipeline of 39 GW by 2040, DOE said the country could deploy 110 GW by 2050 — equal to 6% of current demand.

Murphy said the Biden administration’s enthusiastic support for OSW was a marked change from the Trump administration. “I think the most charitable word I can use is [the Trump administration] slowed whatever progress we were making; [I] wouldn’t necessarily say they stood in the way,” Murphy said. “They started out [wanting] to drill for oil and gas offshore. … So this is just night and day.”

Supply Chain, Labor

Like state officials, the Biden administration has promoted the new generation as economic development projects.

BOEM said it will require lessees to describe their plans for contributing to development of a domestic supply chain and will offer a 50% reduction in the “fee rate” for five years for lessees that “meaningfully and substantially” assemble or manufacture major components in the U.S. That would reduce the fee rate from 2% to 1%.

The operating fee will be based on a proxy for the wholesale market value of the power generated from each project. The proxy will assume a 40% capacity factor for the first six full years of commercial operations, with potential adjustments based on actual generation in future years. BOEM will use the simple hourly average of the spot price for NYISO’s Zone J in New York City. At a wholesale power price of $40/MWh, the annual 2% fee for a 1,028-MW facility, would be $2.9 million.

New York, which has targeted 9 GW of OSW by 2035, will base procurement of offshore wind renewable energy credits (ORECs) in part on economic benefits provided by the projects, including domestic supply chain and port infrastructure investments, benefits to disadvantaged communities and creation of jobs and workforce training programs.

New Jersey, with a goal of 7.5 GW, has approved $350 million in tax credits tied to capital investments in offshore wind-specific facilities in the state.

Officials from BOEM and the two states have created a supply chain working group that will meet quarterly to coordinate their efforts.

“We are now going to have a very significant regional cluster between New York and New Jersey that will make it very compelling … for folks to not just install, but build the stuff here,” Murphy said.

“This opportunity we’re presented with today is absolutely transformative, not just for New York and New Jersey, but for our nation,” said Hochul.

BOEM also will require lessees to “make every reasonable effort” to sign contracts with labor unions for construction.

“We’ve been laser focused on offshore wind for several years because we think that this can be the sector that is the shining example of how the clean energy economy can create high-road, high-quality jobs,” said Liz Shuler, president of the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO), who also took part in the press conference. “… I can speak from the perspective of workers in the energy industry. They’ve been skeptical of the transition, because [they] have not seen the same quality, stable careers in clean energy that they have in the industries that they’ve worked in in the past. And there hasn’t been a commitment historically to high-quality jobs in the clean energy economy. But it doesn’t have to be that way.”

Transmission Planning

BOEM’s sale notice urged strategic planning of transmission, saying the agency is considering “the use of cable corridors, regional transmission systems, meshed systems, and other mechanisms.” It said it may condition approval of construction and operations plans “on the incorporation of such methods where appropriate.”

The DOE report said “strong near-term efforts” are needed to plan transmission to incorporate OSW “without long delays or lost opportunities.

“There is a lack of sufficient onshore transmission capacity to transmit power from the strongest offshore wind resources to load centers,” DOE said. “…Creating incentives to plan and share transmission across multiple offshore wind projects, states, and transmission planning regions can encourage collaboration in infrastructure planning, cost allocation, and transmission system development that can benefit all states within and across regions.”

Sites

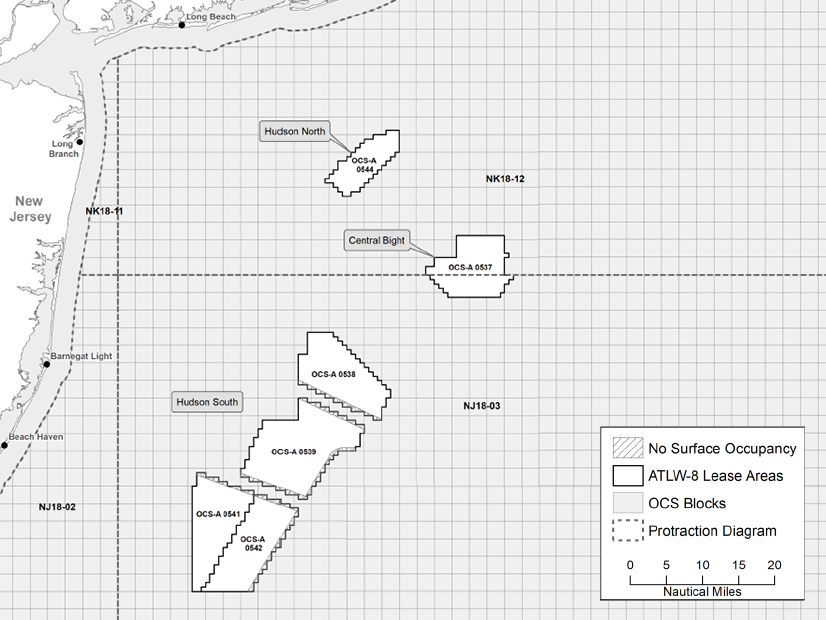

The sites to be leased will be 20-69 nautical miles from New York and 27 to 53 miles from New Jersey, with minimum depths of 31 to 50 meters and maximum depths of 46 to 63 meters. BOEM has established a minimum bid of $100 per acre for the leases, which the agency said could produce 5.6 GW based on 3 MW per square kilometer.

BOEM listed 25 companies eligible to bid in the auction, each of which posted a $5 million deposit. BOEM said it would limit each company to only one lease to maximize competition in future procurements and limit consolidation of the offshore wind market.

Before the auction, BOEM will hold its fifth and final meeting with the fisheries community on Jan. 19 to describe how it decided on the final lease areas.

The final sale notice reduced the area by 22% from the preliminary notice, reflecting concerns by the fishing industry, the U.S. Coast Guard, the National Marine Fisheries Service and the Department of Defense (DOD).

It excluded lease area OCS-A 0543 in response to issues raised by the fishing industry and DOD and to make room for the siting of a “fairway” proposed by the Coast Guard to accommodate traffic travelling across the NY Bight from the Delaware Bay area to east of Montauk.

It also eliminated several areas that overlap with both fishing activity and seafloor features sensitive to impacts from construction. No leases were offered within 2.5 nautical miles of the Mid-Atlantic Scallop Access Area. BOEM also removed areas to the west of OCS-A 0539 that are used by the Atlantic surf clam fishery.

DOE Priorities

In addition to calling for planned transmission, the DOE report listed four other priorities for the nation’s OSW plans:

- Expanded federal incentives to increase demand for offshore wind energy and grow the domestic supply chain;

- Technology innovation and adaptations to reduce costs. “New system designs are required for U.S. operating conditions, such as deep water in the Pacific, hurricanes in the Gulf of Mexico, and ice formation in the Great Lakes,” DOE said. “Accessing wind resources in deep-water areas (~60% of the U.S. offshore wind resource) will be key to reaching long-term deployment goals. The deployment of floating offshore wind platforms … will be critical to development in the Pacific, Gulf of Maine and other regions with deep waters.”

- Increase the transparency and predictability of regulatory processes and auction new lease areas. “The number of lease areas will need to grow significantly over the next decade to meet state and federal deployment goals,” DOE said.

- Invest in supply chain development, including customized offshore wind ports and vessels. “Building a domestic supply chain and growing the industry will require dozens of port upgrades, numerous Jones-Act compliant vessels, and new factories for component manufacturing and assembly,” DOE said.

Interest in Gulf of Mexico

In comments posted by BOEM on Jan. 11, Ørsted and Shell New Energies U.S. (NYSE:RDS.A) expressed interest in bidding for potential OSW leases in the Gulf of Mexico.

ClearView Energy Partners said BOEM could offer leases in the Gulf as early as the first half of 2023.

“While existing energy infrastructure and supply chains in [Gulf of Mexico] coastal states may attract offshore wind project developers (indeed, commenters note that offshore wind generation could facilitate green hydrogen production), we emphasize other factors could dampen interest in comparison to the East Coast, including lower electricity prices, the lack of strong state-led decarbonization policies in the GOM area and higher risks of severe hurricanes,” ClearView said in a note to clients.