ERCOT’s regulators are pushing back against its plans to implement policy changes and new products in response to February’s devastating winter storm.

Asked by the Public Utility Commission in December to lay out an implementation plan for the first phase of what the commission labels a blueprint for ERCOT’s market redesign, staff last week filed a 10-page memo with timelines, budget requirements and key variables surrounding the work (52373).

The PUC’s response?

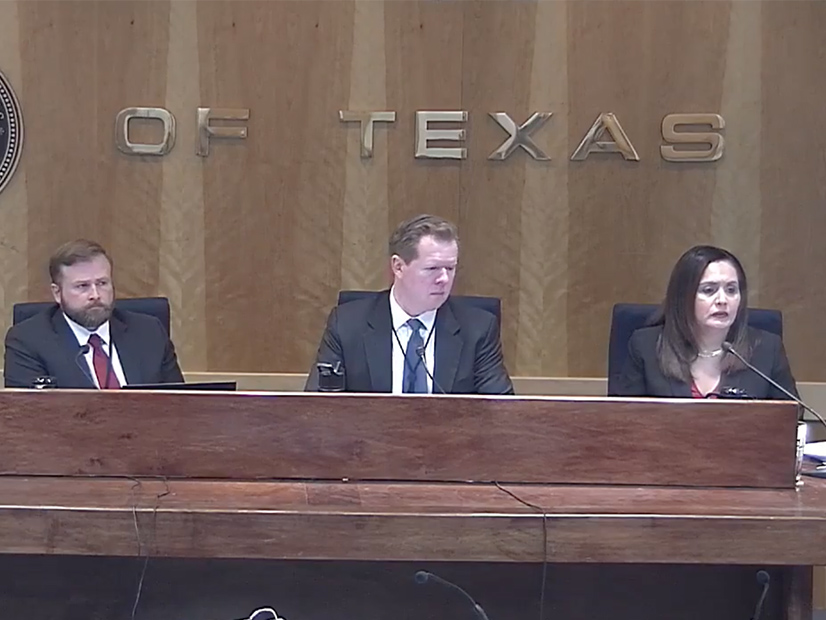

“I have a lot of concerns,” Commissioner Lori Cobos said during the Jan. 13 open meeting. “I have concerns with the long, projected timelines. … I know ERCOT may be setting expectations, but we have expectations too. We have expectations that these products will be put in the market as soon as possible.”

Cobos and the commission have been focused on ERCOT contingency reserve service (ECRS), a 10-minute ramping ancillary service product designed to address increasing renewable energy penetration. The market change was one of five ancillary services in the blueprint’s first phase. (See PUC Forges Ahead with ERCOT Market Redesign.)

Kenan Ögelman, ERCOT’s vice president of commercial operations, said in the memo that the grid operator has prioritized ECRS for delivery in early 2023. However, because of the product’s interaction with ERCOT’s major energy management system (EMS) upgrade, ECRS may have to wait until that is stabilized after its mid-2023 through mid-2024 implementation window.

“Two years is too long. It’s unacceptable,” Cobos said. “We’ve been working really hard to get these items on the blueprint implanted as soon as possible. I know ERCOT has resource constraints … that need to be evaluated by the leadership at ERCOT. ERCOT needs staff resources and contractors to ensure that ECRS is delivered on time and before the EMS upgrade.”

ERCOT also said it would take one or two years to implement a firm-fuel ancillary service product, another high-priority PUC directive. It asked for the commission’s input on eligibility qualifications, procurement processes, quantity of procurements and performance requirements.

Ögelman said allocating firm fuel’s costs on a load-ratio-share basis, as is done now, would be quicker to implement than assigning costs to certain resources.

“ERCOT must ensure a firm-fuel product is in place by next winter,” Cobos said. “The legislature expects it; Senate Bill 3 requires it.”

Cobos also said the backstop reliability mechanism, a second-phase proposal, should be delivered as soon as possible in 2023. In his memo, Ögelman said that will be difficult to do given the “relative size and complexities of these efforts.”

“ERCOT cannot deliver three major projects simultaneously in next 18 months,” Ögelman wrote.

Commissioner Will McAdams acknowledged that ERCOT is facing a workforce squeeze and urged it to leverage its contractors to bring the near-term market designs online. He said the commission has received feedback from lawmakers that they expect to see several of the proposals “imposed” in the next two years.

“Given the complexity and massive effort we’re taking with the blueprint and we’re ordering ERCOT to take,” McAdams said, “we need to adhere, and must adhere, to the definitive points of the statute where possible. Be aware of that as you’re developing the mechanics.”

Ögelman said staff would begin drafting an urgent revision request on on-site fuel storage as part of the firm-fuel product, adding PUC feedback when they receive it. He told the commission that the grid currently has about 4.4 GW of on-site fuel storage, but he agreed to survey generators to see if there is additional storage capacity.

“We will start that today,” he said. Ögelman said staff will need to minimize revision request timelines and will work with stakeholders to move the change through.

“Funny enough, the [stakeholder approval] process is top of the list for [ERCOT’s new] board to address,” PUC Chair Peter Lake said. “It’s a problem and will be remedied.”

Board Discussions

On Monday and Tuesday, the new directors reviewed ERCOT’s corporate governance structure and project portfolio. An IT subcommittee was among several ideas floated as the board discussed bylaw revisions and other changes.

Staff engaged the board in a lengthy discussion of the many projects they are working on besides those directed by the PUC. The directors peppered the speakers with questions about the use of vendors for complex software systems and the frequent delays in project deliveries, asking how projects could be completed faster.

“It’s not like we have the source code for that system,” ERCOT CIO Jayapal Parakkuth said. “We are completely dependent on the vendor for that system to provide the solution. So, in this case, us adding staff around that product would not help us.”

Mandy Bauld, director of ERCOT’s Project Management Office, reminded the board that the office is working on the largest changes to the market since the nodal market went online in 2010.

“The most important next step is [to] let the new ERCOT board take a look at this and work with them to help chart a path forward,” Lake said. “By the next commission meeting, we’ll continue to put the pieces in place and move the implementation forward.”