CAISO’s Western Energy Imbalance Market closed 2021 with yearly economic benefits that were more than double those of any prior year, bringing the market’s cumulative savings for its participants close to $2 billion since it launched in 2014.

“The Western EIM’s outstanding performance last year provides further tangible evidence of the value of broad regional market coordination,” CAISO CEO Elliot Mainzer said in a statement announcing the results.

The record figures were a product of extreme weather in the West, high natural gas prices and more entities joining the EIM, CAISO said.

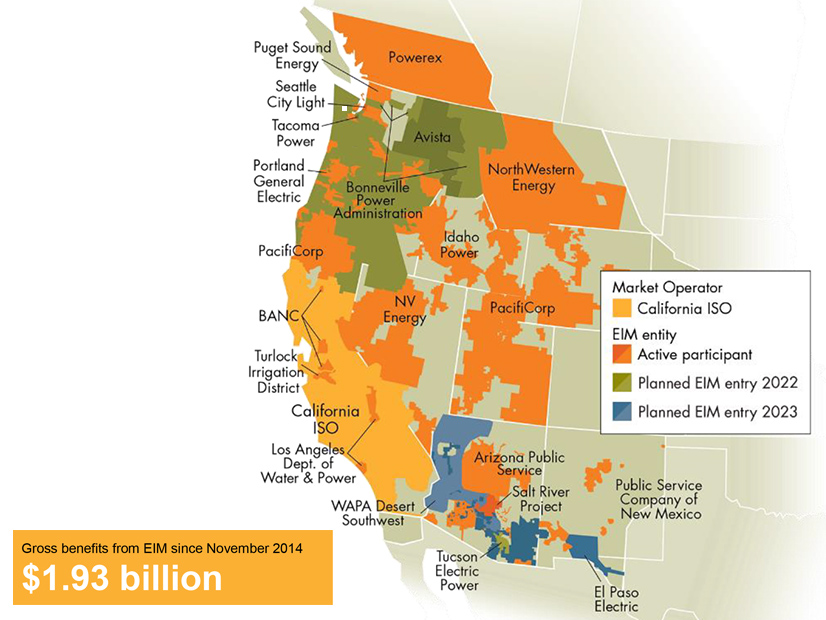

The fourth-quarter results announced this week showed benefits of $204 million for the WEIM’s 15 participants, which span much of the Western Interconnection. That brought last year’s annual benefits to $739 million, far exceeding 2020’s previous record of $325 million. The record year swelled the market’s total benefits to $1.93 billion.

Much of last year’s benefits came in the third quarter, which by itself exceeded the total annual benefits of $297 million in 2019 and came close to 2020’s annual figure. The unprecedented savings of $301 million in Q3 2021 resulted from summer heat waves in California, the Desert Southwest and the Pacific Northwest that triggered high demand amid tight supply, pushing electricity prices higher.

Transfers between WEIM balancing authority areas (BAA) provide access to lower-cost supply in the 15-minute and real-time markets, saving many participants millions of dollars per quarter. The Balancing Authority of Northern California (BANC), for instance, accumulated $72.5 million in benefits in Q3, while CAISO saved $54 million.

Q4’s winners included CAISO, with $55.5 million in benefits, and PacifiCorp, which saw nearly $40 million in benefits.

The WEIM provides a market for excess renewable resources such as wind and solar that would otherwise be curtailed.

The market saw its largest yearly expansion in 2021. New members that joined included the Los Angeles Department of Water and Power, Public Service Company of New Mexico, NorthWestern Energy, Turlock Irrigation District and BANC members Modesto Irrigation District, City of Redding and Western Area Power Administration-Sierra Nevada Region.

The expansion boosted benefits for all participants, the ISO said.

“The quarterly benefits have grown over time as a result of the participation of new BAAs, which results in benefits for both the individual BAA but also compounds the benefits to adjacent BAAs through additional transfers,” it said in its fourth-quarter report.

Defections, Delays

This week’s upbeat news for CAISO arrived days after three more Colorado utilities — Xcel Energy’s Public Service Company of Colorado, Platte River Power Authority and Black Hills Colorado Electric — said they had decided not to join the WEIM as previously planned and would instead join SPP’s Western Energy Imbalance Service, a smaller but growing competitor. (See Colorado Utilities Choose WEIS over WEIM.)

Colorado Springs Utility had announced last May it would join the WEIS instead of the WEIM. A month later, the other Colorado utilities paused their plans to join the WEIM to explore other options. The decision made Colorado the only state in the Western Interconnection without any active or planned WEIM participants.

The Bonneville Power Authority, which was scheduled to go live in the WEIM on March 2, said last week it would postpone joining until May 3 to address technical and training issues among its large base of generation and transmission customers, most of which are publicly owned utilities. (See BPA Postpones Western EIM Entry by 2 Months.)

Two other Pacific Northwest utilities, Avista and Tacoma Power, said BPA’s decision would not delay their market entry on March 2. Tucson Electric Power is also scheduled to join the WEIM this year. Next year’s planned entrants are Avangrid, El Paso Electric and the Western Area Power Administration’s Desert Southwest Region.

By next year, WEIM participants are expected to represent nearly 80% of load in the Western Interconnection.

CAISO is going through a stakeholder process to see if it can create an extended day-ahead market for the WEIM, further expanding the capabilities of the market.