TAC Members Look for Direction on Governance Structure, Stakeholder Process

ERCOT market participants again expressed their concerns last week with potential changes to the stakeholder process following discussions during last month’s Board of Directors meeting.

The newly reconstituted board reviewed the grid operator’s corporate governance structure and project portfolio and discussed bylaw revisions and other changes. The directors also pressed staff on the many system projects they are working on. (See “Board Discussions,” Texas PUC Pushes ERCOT on Market Changes.)

It followed a tense Technical Advisory Committee meeting in July, when members pushed back against interim CEO Brad Jones’ proposal to convert the committee into one “comprised of senior-level members from each ERCOT member organization.” An August workshop to discuss TAC’s future membership and its interaction with the incoming board was canceled. (See “Members Push Back Against Revamped TAC Structure, Conservative Ops,” ERCOT Technical Advisory Committee Briefs: July 28, 2021.)

TAC currently has 30 members comprising primarily subject-matter experts representing six different market segments. Some members argued last summer that adding officer-level representatives would only slow the committee’s work down.

Morgan Stanley’s Clayton Greer, representing the independent power marketer segment, asked during TAC’s Jan. 31 meeting whether the board, which met in lengthy executive sessions during the two-day meeting, had given any direction to “reformat” ERCOT’s stakeholder process.

“It sounded like they wanted some change, but there was no direction,” Greer said.

South Texas Electric Cooperative’s Clif Lange, TAC’s chair, attended the board meeting. He told Greer that what he heard was more informational for the board and intended to give the directors comparisons between ERCOT’s and other grid operators’ governance structures.

“Nothing I heard that day gave us any direction for us to do anything at this point,” Lange said. “It’s certainly within the purview of the board to determine how they want to establish their committees and subcommittees. I didn’t get the feeling from the room that there was any immediate move to want to do that.

“Whether board members are discussing that offline, something we’re not privy to, that could be ongoing,” he added.

Greer noted the “pile of stuff that we go through as stakeholders” and asked again whether there was a plan to create a better process or methodology for managing change requests.

“The work that gets done … it can be managed any number of ways,” he said. “We selected [the current process] … because for the most part, it’s been effective. It gives a fair hearing to everything and gives everybody a chance to vote on these things. Without a problem statement or understanding what we’re doing wrong, I don’t get how we can get to a better spot without direction.”

Lange allowed that ERCOT’s stakeholders are “keenly interested” in any decisions the board may make on the stakeholder process’ future, telling RTO Insider that he is optimistic the board “still finds value in the collaborative efforts of stakeholders, ERCOT and the” Public Utility Commission of Texas.

“It would be a shame if the stakeholder process was abandoned or significantly diminished, since extraordinary work products have come forth from that collaborative process over the last 20 to 25 years, including the nodal market design and implementation, real-time co-optimization, and ancillary services redesign,” Lange said. “That all occurred while meeting the challenges of tightening reserve margins and with the unmatched integration of significant renewable and storage assets.

“ERCOT does a great job in identifying reliability and market flaws and in defining the objectives that they want to target to address those findings, but they don’t always have the in-house capability to understand the full ramifications of their objectives,” he said. “Stakeholders collectively see the full range of impacts, including financing, development and construction; wires and generator operation; the retail markets; and ultimately the impact to consumers. It is this expertise, combined with the expertise and policy direction provided by ERCOT and the PUCT, that helps to provide a more comprehensive solution. I strongly hope the new board finds value in the stakeholder process and the debate that has allowed for some very good and comprehensive solutions to be developed.”

ERCOT has already responded to the board discussion by creating a Technology Working Group that provides a forum to share information; review, analyze and develop best practices; and improve market participants’ and the grid operator’s information and operational technology systems and software applications.

The group will be independent of the TAC subcommittee structure, similar to the Regional Planning Group and the Gas Electric Working Group. It’s scheduled to hold its first meeting Thursday.

Staff Rushes Firm-fuel Product

ERCOT staff have drafted a nodal protocol revision request (NPRR1120) that creates a firm-fuel reliability product as directed by state legislation last year and the PUC.

The commission’s first phase in redesigning the ERCOT market calls for a standalone, auction-based product that is procured similar to ERCOT’s black start program. The PUC sees the firm-fuel product compensating dispatchable generation resources that meet a higher standard of “firm” winter-weather resilience and reliability and serving as a stopgap should weatherization not be incorporated into a load-serving entity obligation. (See PUC Forges Ahead with ERCOT Market Redesign.)

Kenan Ögelman, ERCOT’s vice president of commercial operations, told TAC that in order to deliver the service by next winter, staff are focusing on the “long pole in the tent,” which is completing the settlement and billing system’s changes. He said additional requirements will be reflected in a request for proposals that will quickly follow the NPRR’s approval.

“We’re going to take more time to develop and will put those parameters into the RFP to procure the service, Ögelman said. “The commission has asked for more time to weigh in on those parameters.”

Greer pointed out that TAC would be expected to pass the NPRR’s language regardless of its accuracy. “I don’t know how you create a straightforward RFP unless you have on-site storage capacity,” he said, adding that coal piles and nuclear rods should also be considered.

“There is an interest is going beyond on-site fuel oil. We want to leave that possibility open, but that would require another RFP and potential protocol language,” Ögelman said. “There are going to be gaps in the RFP that will make the RFP pretty not standard and non-substantial. There are a lot of requirements for the resources that will have to be in the RFP to get this NPRR through.”

Members and staff agreed to set up a workshop to hash out further details on the NPRR and RFP. In the meantime, the Protocol Revision Subcommittee is scheduled to vote on the NPRR during its Wednesday meeting. Staff hope to have the board consider the measure during its March 7-8 meeting.

RUC Usage Skyrockets

ERCOT’s heavy use of reliability unit commitments (RUCs) last year as part of its conservative operations approach resulted in 4,052 instructed resource-hours and 3,853.1 effective resource-hours, an 18-fold increase from 2020. The bulk of those hours (3,361, or 87%) came to meet capacity needs during the latter half of the year, when the grid operator began deploying more resources sooner to improve the system’s reserve margin following last February’s disastrous winter storm.

The difference between “instructed” and “effective” values is because of resources starting up, shutting down, partial hour instructions or otherwise not being dispatched.

ERCOT only called for 224 RUC instructed resource hours in 2020, resulting in 220.1 effective hours.

“Compared with previous years, the size of resources getting RUC’ed has not changed much,” ERCOT’s Dave Maggio said.

Last year, ERCOT issued approximately $5.3 million in make-whole payments, almost exclusively covered through capacity-short charges. The total RUC claw-back charge was about $3.1 million.

The Independent Market Monitor is sponsoring NPRR1092, currently before the Protocol Revision Subcommittee. The measure would reduce the $1,500/MWh RUC offer floor, designed for a market construct where RUCs were expected to be self-committed.

Texas PUC Chairman Peter Lake supports the NPRR and has filed a memo siding with its $75/MWh offer floor. He said that will still allow resources to increase offers in accounting for higher fuel prices and will be consistent with non-spinning reserves’ price floor.

“We expect to expect to see improved performance of self-committed resources,” IMM Executive Director Carrie Bivens said.

Stakeholders Eye Load Resources

TAC and staff agreed to work together in creating a task force and scheduling a workshop to address load resource issues as Texas becomes a haven for cryptocurrency miners and other loads that can add energy to the grid. Several stakeholder groups have discussed load resource issues, including how to price them and whether or they are controllable resources.

Texas Gov. Greg Abbott and U.S. Sen. Ted Cruz (R) have led the charge in encouraging Bitcoin miners to set up shop in the state, where their ability to shut down quickly can help the grid during scarce conditions. The Texas Blockchain Council lobbying group says there are already more than two dozen crypto miners in the state.

“Clearly, when the governor and a U.S. senator invite cryptos to come to town, we need to figure out quickly how we can get them reliably connected to the grid,” energy consultant Bob Wittmeyer said. “This issue is much bigger than crypto, which can potentially add hundreds of megawatts to the grid in a period of months. We need to move pretty expeditiously here. We’ve got [transmission and distribution] issues, different metering configurations, co-location issues and issues with resources that choose not to be controllable load resources. We really need to talk about this from multiple levels.”

Several stakeholder groups have already discussed issues surrounding load resources and floated a scope document for the task force. Staff said they need time to better understand the issues before hosting a “meaningful” workshop.

“We need a basics-type of discussion on what these loads are,” Greer said. “It sounds like a lot of these business plans for these guys involve co-locating with either energy storage or generation, or both.”

Greer noted that passage of NPRR945 in 2020 also introduced bypass issues that need to be discussed. The measure defined electric configurations that are eligible for net metering. (See ERCOT Technical Advisory Committee Briefs: Oct. 28, 2020.)

TAC agreed with Lange’s proposal to have stakeholders and staff begin laying out ideas and bring them back for the committee’s Feb. 23 meeting. The workshop will be held at the TAC meeting, and the task force could be established in March.

Staff Work to Improve Communications

ERCOT staff worked to ease members’ concerns as last week’s winter storm approached, telling them that internal and external communications have both been improved.

“Right now, everything is business as usual at ERCOT,” Chris Schein, interim communications leader, said in providing TAC an update on the grid operator’s efforts.

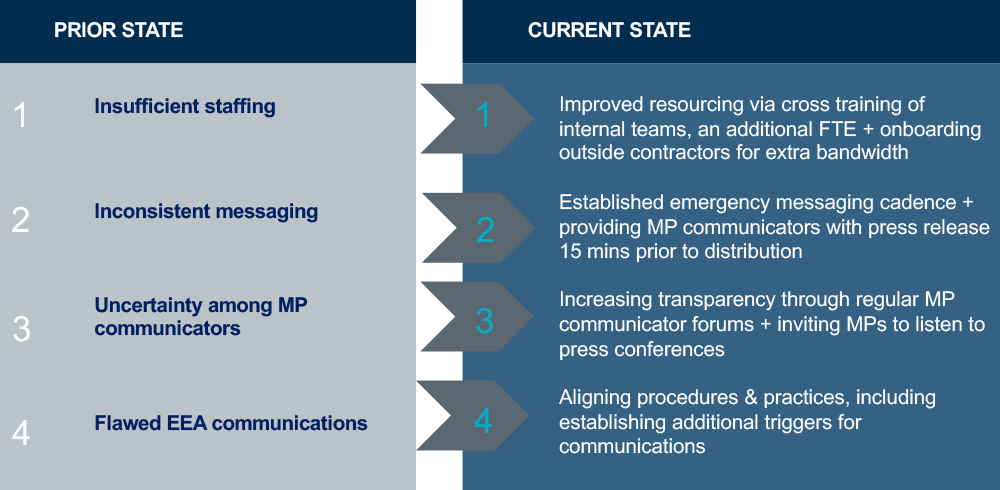

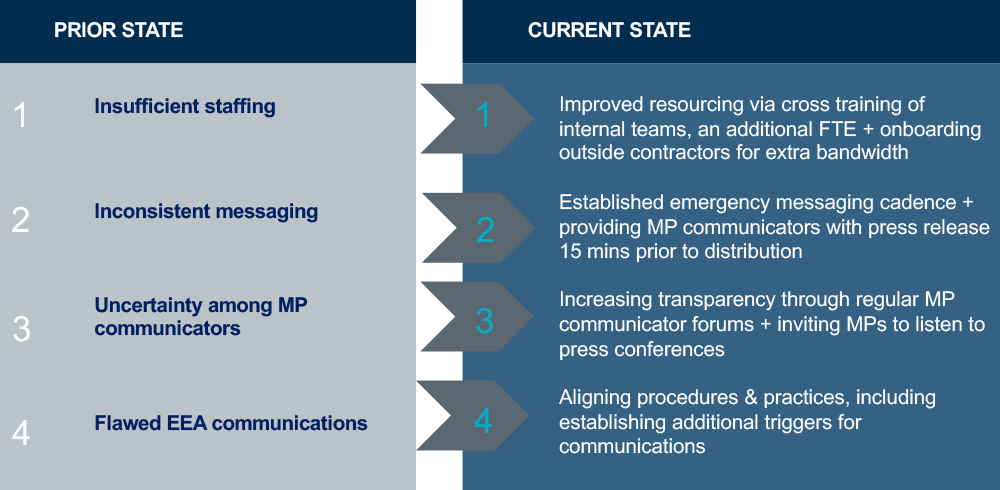

Schein said ERCOT now conducts daily calls with market participants’ communicators; it has set up a regular cadence for external messages; and it has completed internal and external audits of its communications practices. The internal audit looked back at ERCOT’s communications during the storm, and the external audit looked forward at best practices to address insufficient staffing, inconsistent messaging, uncertainty among the market’s communicators and flawed energy emergency alert (EEA) communications.

The grid operator had fewer than two staffers devoted to media communications during last year’s storm, “insufficient for an organization the size of ERCOT,” Schein said. Outside contractors will help it “dial up or dial down” communications as needed, he said.

ERCOT has made changes to improve its communications. | ERCOT

ERCOT has made changes to improve its communications. | ERCOT

“Frankly, ERCOT, under the leadership of Brad Jones, has clearly communicated that we are going to be aggressive in calling for conservation alerts,” Schein said. “It’s an effective tool for ERCOT to use. We’ve been working very hard the last seven months with the news media so they understand conservation alerts do not mean EEAs.”

Mark Dreyfus, who represents several cities in the commercial consumer segment and who requested the update, said communication is a two-way street and that many of his constituents need to trust the messages they’re receiving from ERCOT during an emergency.

“I just don’t think we’re there because of the dramatic loss of trust in the community that occurred [last year] with the storm,” Dreyfus said. “We have to engage with those groups to ensure ERCOT is a trustworthy source of information.”

Indeed, a recent University of Houston survey found that if there are more power outages because of cold weather, 70% would hold the grid operator responsible.

Schein agreed ERCOT lost trust during last year’s winter storm. “I’m not making any judgments as to whether it was worthy or not, but it happened,” he said.

“Building trust takes years; losing trust takes seconds. We are in the process of rebuilding trust. It will take time,” Schein said. “We’re at a phase now where it’s trust and verify. We not only have to say things; we have to live up to things so these various audiences will look at us and say, ‘Yes, they did what they said they were going to do.’”

Lange Re-elected TAC Chair

Committee members re-elected Lange and Just Energy’s Eric Blakey to serve once again as their chair and vice chair, respectively, this year.

ENGIE’s Bob Helton, who nominated Lange and Blakey, said he did so because their leadership during a “very difficult year … got us to some places we needed to go.” Helton, who has served as both chair and vice chair, said he looked forward to working with them to finish up ERCOT’s market designs and other issues.

“We have a lot of ground to cover, particularly with the ongoing market-reform issues and anything else that pops up that is unforeseen now,” Lange said. “We’re looking forward to another great year, and a challenging year, for sure.”

Members also confirmed TAC’s subcommittee chairs and vice chairs for 2022:

-

- Protocol Revision Subcommittee: Martha Henson, Oncor, and Melissa Trevino, Occidental Chemical.

- Retail Market Subcommittee: John Schatz, Luminant Generation, and Deborah McKeever, Oncor.

- Reliability and Operations Subcommittee: Chase Smith, Southern Power, and Katie Rich, Golden Spread Electric Cooperative.

- Wholesale Market Subcommittee: Resmi Surendran, Shell Energy, and Ivan Velasquez, Oncor.

HCAP, ORDC Fixes Comply with PUC

TAC unanimously approved its combo ballot, which included two other binding document revision requests (OBDRRs) related to recent PUC orders to reduce the high systemwide offer cap (HCAP) from $9,000/MWh to $5,000/MWh and to raise the operating reserve demand curve’s (ORDC) minimum contingency level from 2,000 MW to 3,000. Both changes were effective Jan. 1. (See PUC Forges Ahead with ERCOT Market Redesign.)

OBDRR037 caps the power balance penalty curve at $5,001/MWh (the HCAP plus $1/MWh), effectively setting the curve’s price at its maximum value when violations are above 100 MW. The measure also reduces the generic transmission constraint shadow-price cap for base case voltage violations from $9,251/MW to $5,251/MW. Gray box language describes how the curve will work with the new HCAP upon real-time co-optimization’s implementation.

OBDRR038 updates the ORDC’s minimum contingency level to 3,000 MW within the relevant methodology document.

The combo ballot also included seven NPRRs, two Nodal Operating Guide revision requests (NOGRRs), an additional OBDRR, two modifications to the Retail Market Guide (RMGRRs), three system change requests (SCRs), and single changes to the Planning Guide (PGRR) and the Verifiable Cost Manual (VCMRR).

-

- NPRR1095: contains revisions that the Texas Standard Electronic Transaction (Texas SET) Working Group has determined are necessary to support the Texas SET V5.0 improvement list.

- NPRR1098: establishes reactive power capability requirements for new DC ties interconnecting to the ERCOT system and existing DC ties replaced after Jan. 1.

- NPRR1099: grants ERCOT greater authority to move a resource node in the network operations model when deemed necessary to properly reflect point-of-interconnection (POI) changes or resource retirements.

- NPRR1102: allows ERCOT to adjust back-casted non-interval data recorder load profiles.

- NPRR1111: expands the use of the security-constrained economic dispatch (SCED) base point below the high dispatch limit flag to signify that ERCOT has instructed an intermittent renewable resource (IRR) or DC-coupled resources not to exceed its base point.

- NPRR1113: adjusts the real-time ancillary service imbalance payment/charge’s definitions to prohibit double-counting of the regulation-up schedule when calculating capacity in the imbalance settlement for controllable load resources available to SCED.

- NPRR1114: establishes processes to assess and collect securitization uplift charges to qualified scheduling entities representing LSEs pursuant to one of the PUC’s two debt obligation orders (52322).

- NOGRR234: revises the guide to be consistent with NPRR1098’s reactive power capability requirements for DC ties, specifying DC tie operator responsibilities related to real-time operational voltage control.

- NOGRR235: corrects blackline and gray box language associated with NOGRR210 and NOGRR227.

- OBDRR034: allows ERCOT to move network operations model resource nodes for POI changes or resource retirements.

- PGRR099: provides that an entity will not be eligible to begin or maintain a generator interconnection or modification (GIM) if it or any other owner of the project meets any of the company ownership (including affiliations) or headquarters criteria listed in the state’s Lone Star Infrastructure Protection Act. Any entity that seeks to initiate a GIM will be required to submit an attestation confirming that it does not meet the statutory criteria.

- RMGRR166: revises the timing for retail electric providers to access the daily switch hold files that are posted by the transmission and/or distribution service providers.

- RMGRR169: updates the Texas SET’s continuous service agreement (CSA) bypass validations at ERCOT; allows for rejection of move out (MVO) transactions if the CSA owner and MVO competitive retailer (CR) do not match; allows ERCOT to issue a move in transaction for the appropriate CSA CR when an MVO is submitted; and revises the inadvertent gain process to align with SCR817’s proposed MarkeTrak enhancements.

- SCR816: unlocks congestion revenue right bid credit on the same day auction results are posted.

- SCR817: adds validations/requirements to existing MarkeTrak subtypes, revises existing workflows and suggests new subtypes to align with current market practices for more efficient issue resolution.

- SCR819: improves dispatch of base points to resources to account for the ramping of un-curtailed IRRs.

- VCMRR032: clarifies that the average run time per start is calculated by dividing the total running hours by the total number of starts during the 20-consecutive-day period. It ensures that at a minimum, one start will be used in the calculation of the average run time per start when the resource is operating on the first interval of the first day of the 20-consecutive-day period.