Planning Committee

Generator Deliverability Update

PJM is preparing to present stakeholders with study results that seek to explain any potential upgrade requirements stemming from the RTO’s generator deliverability proposal.

Jonathan Kern, PJM | © RTO Insider LLC

Jonathan Kern, PJM | © RTO Insider LLC

Jonathan Kern of PJM’s transmission planning department provided an update on the timeline for the development of a proposal to change the generator deliverability test at last week’s Planning Committee meeting.

Kern said PJM agreed to conduct two sets of studies on potential upgrade requirements. The first is on the baseline in the 2026 Regional Transmission Expansion Plan summer, winter and light-load assumptions; the second is on a hypothetical interconnection queue scenario using commercial probabilities to get an idea of the long-term implications of new rules.

PJM is performing some sensitivity analyses on the studies to distinguish between upgrades driven by higher wind and solar deliverability levels versus the other changes being proposed for the test. Besides the generator deliverability changes, Kern said, PJM has also discussed conducting several new tests that include a high wind and solar zonal test, an individual plant deliverability test and an extreme interchange variation test.

PJM’s work to provide transmission results and complete the studies is “customized,” Kern said, with staff developing power flow models and completing an “extensive” revision to the in-house generator deliverability code.

The RTO originally planned to provide a first read of the proposed generator deliverability changes at the February PC meeting, Kern said, but the work being done internally resulted in delays in the completion of the generator deliverability testing.

Kern said it will present additional information at a special PC session on capacity interconnection rights (CIR) for effective load-carrying capability (ELCC) resources on Feb. 15, including an educational workshop on the proposed generator deliverability changes.

PJM will hold a final special PC session on CIRs for ELCC resources on Feb. 23, Kern said, with the RTO targeting the meeting to provide stakeholders with a summary of the generator deliverability results and a discussion of the final proposals. Kern said PJM is expecting to complete the generator deliverability tests by the middle of the month.

Kern said PJM will conduct a first read of the generator deliverability proposal at the March 8 PC meeting.

Deactivation Process Timing

David Egan, manager of PJM’s system planning modeling and support department, reviewed the proposed generator deactivation process timing update, presenting a problem statement, issue charge and revisions to Manual 14D and the tariff.

Egan said the current tariff language providing 30 days to complete deactivation studies is acceptable when only a single deactivation notice is made in a period. But when multiple deactivation requests are received, the 30-day window is “insufficient” to determine any adverse impacts on reliability and can be “very challenging” to complete.

“We’re narrowly focused on targeting the current tariff timing for deactivations,” Egan said.

The current industry trends and state energy policies will increase the volume of deactivation notices in the future, Egan said, putting more pressure on PJM staff to complete deactivation studies. He said the short window puts “undue burden” on PJM’s planning and operations staff, along with the staff of transmission owners making deactivation requests, to make reliability evaluations and mitigation determinations.

Generation deactivations in PJM from 2018-2021 | PJM

Generation deactivations in PJM from 2018-2021 | PJM

PJM is an “outlier” in its deactivation process when compared to other RTOs and ISOs, Kern said, with a current advance notice of 90 days and 30 days to conduct a study.

MISO requires advanced notice of 26 weeks for a deactivation, and the studies include 75 days to identify issues and 26 weeks to complete the deactivation study. NYISO has an advanced notice of 365 days for deactivation, and studies are conducted in the subsequent quarter.

PJM’s proposed issue charge calls for tariff and manual changes that “provide more time to complete analyses, allow additional and improved studies and provide the ability for more efficient work control and consistency regarding timing of deactivation studies,” Egan said.

The proposed deactivation process includes quarterly study times for requests, with study periods beginning Jan. 1, April 1, July 1 and Oct. 1. PJM staff will study deactivations as a batch; the Jan. 1 study period would result in a reliability notifications at the end of February, for example.

To request a deactivation, a generation owner must submit a notice:

- between Jan. 1 and March 31 to deactivate July 1 or later;

- between April 1 and June 30 to deactivate Oct. 1 or later;

- between July 1 and Sept. 30 to deactivate Jan. 1 of the subsequent year or later; or

- between Oct. 1 and Dec. 31 to deactivate April 1 of the subsequent year or later.

Egan said the quarterly schedule will allow sufficient time for additional required seasonal, interim year and short-circuit analyses, scheduling upgrades and cost estimates. He said the new schedule would also allow PJM operations to identify additional needed operational measures.

PJM will seek endorsement of the issue charge at the March PC meeting.

Transmission Expansion Advisory Committee

NJ Offshore Wind

Aaron Berner, PJM

” data-credit=”© RTO Insider LLC” data-id=”3065″ style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Aaron Berner, PJM | © RTO Insider” data-uuid=”YTAtNTQzNTM=” align=”right”>Aaron Berner, PJM | © RTO Insider LLC

Aaron Berner, PJM manager of transmission planning, provided an update on the New Jersey offshore wind “state agreement approach” (SAA) proposal window at last week’s Transmission Expansion Advisory Committee meeting.

PJM and the New Jersey Board of Public Utilities asked FERC last month to approve the SAA plan to build the transmission necessary to deliver the state’s planned 7,500 MW of offshore wind. (See PJM, NJ Seek FERC OK for OSW Tx Process.)

Berner said PJM staff is currently conducting system reliability tests to determine how the different proposals may impact grid performance. The RTO has also performed internal reviews on the necessary construction of transmission, Berner said, while engaging with external consultants to look at the “viability” of the construction and potential cost and permitting issues.

“This is a much more complex set of projects than we have looked at in the past,” Berner said.

PJM is working with the New Jersey Department of Environmental Protection to “better understand” some of the environmental issues that need to be considered when building the new transmission, he said.

The RTO has completed a “good amount” of summer, light-load and winter deliverability testing associated with several proposals, Berner said, and has seen “small magnitude” violations with some of the proposals.

Berner said PJM has reviewed proposals for the options of upgrades on existing onshore transmission connection facilities and new facilities. In consultation with NJBPU, PJM identified an initial set of 6,400 MW of combinations to evaluate for offshore wind generation solicitations 2 through 5.

The NJBPU conducted its second offshore wind solicitation last June with a combined capacity of 2,658 MW. (See NJ Awards Two Offshore Wind Projects.) The fifth and final solicitation window is scheduled for the first quarter of 2027.

Berner said PJM is working with a consultant to analyze the cost of the proposals over the entire service life of the projects under different scenarios, including project cost increases and schedule delays. He said the RTO will also evaluate the cost containment provisions for the proposals.

Sharon Segner, vice president of LS Power, asked when the analytical and evaluation work being done by PJM staff and the consultant will be presented to stakeholders.

Berner said some of the work should be completed and presented at the TEAC by March, and more is expected within three months. He said it’s difficult to issue the analysis in a piecemeal fashion because of the complexity of the work to be completed.

“We need to come to a point where we have a more holistic view of some of the projects, which means rounding out more of the analysis,” Berner said.

Generation Deactivation

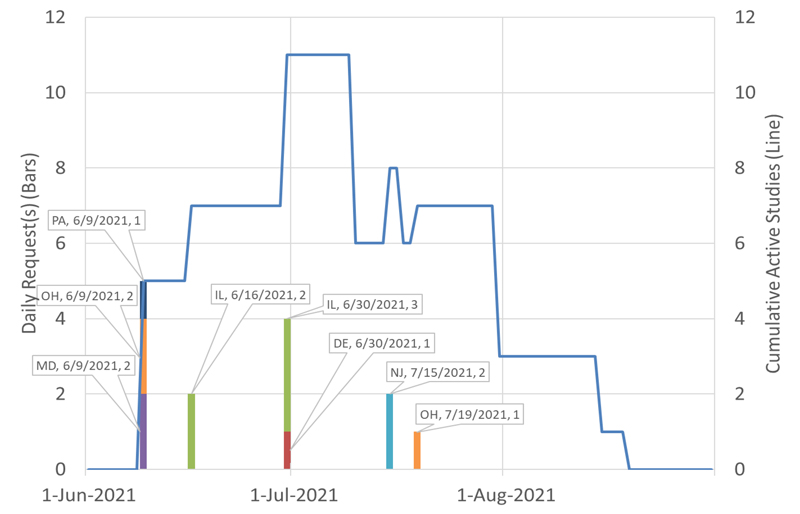

Phil Yum of PJM provided an update on recent generation deactivation notifications.

PJM generation deactivation requests from June-August 2021 | PJM

PJM generation deactivation requests from June-August 2021 | PJM

Yum highlighted the deactivation notifications of New Jersey’s last two remaining coal plants: the 219-MW Logan Generating Plant and the 240-MW Chambers Cogeneration, both owned by Starwood Energy and located in the Atlantic City Electric transmission zone. Starwood requested a deactivation date of April 1. PJM completed a reliability analysis of both plants and no reliability violations were identified.

The 9.3-MW Orchard Hills Landfill in the ComEd transmission zone in Illinois requested a deactivation date of March 31. Yum said a reliability analysis was completed and no reliability violations were identified.