Fresh from closing the sale of its fossil generating plants, Public Service Enterprise Group (NYSE:PEG) executives told investors during the utility’s fourth-quarter earnings call Thursday that they are looking at further investment in offshore wind projects and seeking a longer-term subsidy flow for their South Jersey nuclear plants.

The company on Wednesday completed the sale of its fossil plants in New York and Connecticut to a fund controlled by ArcLight Capital Partners, according to a company release, the last of its 6,750-MW portfolio of 13 fossil generating units, according to the company’s earnings presentation.

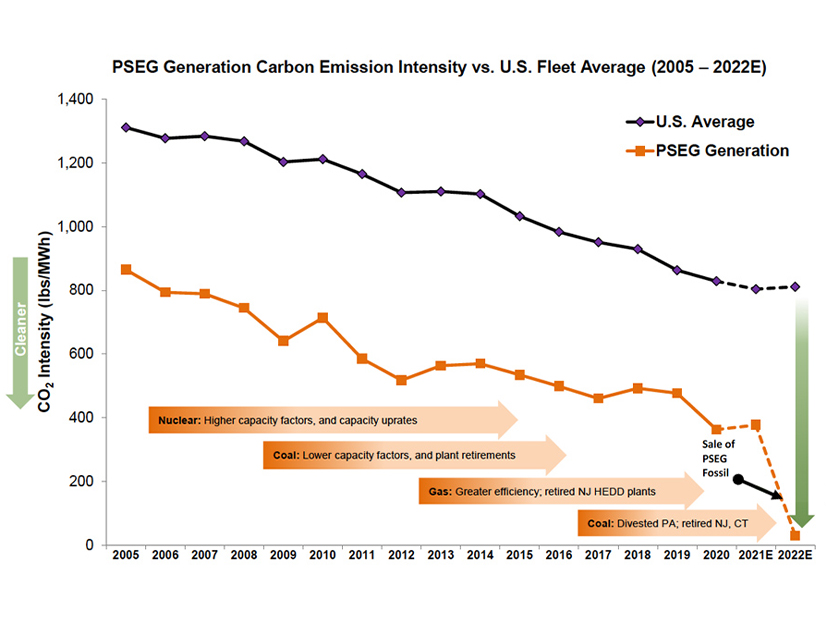

PSEG CEO Ralph Izzo said the sale will free up the utility to pursue a “robust set of regulated and contracted opportunities” that will enhance its “already compelling environmental, social and governance profile.” The company is looking at clean energy and infrastructure investments “to drive regulated utility growth, with the vision toward powering a future where people use less energy, and it’s cleaner, safer and delivered more reliably than ever,” he said.

The sale of the fossil units capped a year of “significant accomplishments,” Izzo said. Among the highlights: the sale of the company’s 467-MW portfolio of 25 solar plants in 14 states; the acquisition of a 25% share of the Ocean Wind offshore wind project under development on the New Jersey coast by Denmark-based Ørsted; and the announcement of a new goal to reach net-zero emissions by 2030, 20 years earlier than its previous target. The company also submitted nine proposals into the joint solicitation by the New Jersey Board of Public Utilities and PJM for transmission project proposals that will facilitate offshore wind projects.

Longer-term Subsidies

Izzo said he is looking to avoid the demands of applying every three years for subsidies to support the three nuclear generating plants — Hope Creek nuclear power plant and Salem 1 and Salem 2 — operated by PSEG in South Jersey, under the zero-emission certificate (ZEC) program. The approval in April of subsidies worth $300 million, the second three-year subsidy awarded to PSEG under the program, triggered sharp criticism from the New Jersey Division of Rate Counsel, the state’s consumer advocate, and environmental activists, who questioned whether the utility needed the funds to keep the generators operating. (See NJ Nukes Awarded $300 Million in ZECs.)

Izzo said he would like to see a “longer term” incentive program developed at the state level, and he is hoping for talks to resume at a federal level about awarding tax credits that would help support the operators of nuclear plants, such as PSEG.

“In the last four years, we had the creation of the legislation for the ZECs, and we had two rounds of ZECs,” he said, likening such a schedule to “sort of being masochists.”

“My sense from policy leaders — elected officials, regulators, key staff members — is we need these plants to run, at least until 2050,” he said. “The reality is, people have already expressed an interest in our nuclear plants. And they are outstanding assets. The issue is, how do you firm up the longer-term economic treatment beyond a three-year time frame?”

The U.S. Department of Energy last week invited public comment on the $6 billion Civil Nuclear Credit Program — funded under the Infrastructure Investment and Jobs Act — that will allow owners and operators of commercial nuclear reactors at risk of closure to competitively bid on credits to keep them in operation. (See DOE Launches $6B Nuke Credit Program.)

Izzo said the company also is in discussions that could lead to an increase in its offshore wind portfolio.

“We have a series of conversations underway that are related to Ocean Wind II, Skipjack [and] potential further upside of Ocean Wind I,” he said. The 1,148-MW Ocean Wind II project was one of two projects awarded leases in New Jersey’s second offshore wind solicitation in June. Ørsted, the project developer, also is developing two projects under the Skipjack name off the Maryland and Delaware coast. (See NJ Awards Two Offshore Wind Projects.)

Izzo said the company’s “initial early caution” about investing in offshore wind projects has diminished, in part because of increased understanding of the “commitment of other states in the development of supply chain [and] some of the regulatory hurdles that have been eased by virtue of some state actions and some federal actions.”

PSEG subsidiary PSEG Renewables is one of 25 companies eligible to bid in the auction underway this week for six leases in the New York Bight in a solicitation held by the U.S. Bureau of Ocean Energy Management.

Earnings

PSEG reported a net loss of $648 million (‑$1.29/share) for 2021, compared to net income of $1.905 billion ($3.76/share) for 2020. Non-GAAP operating earnings for 2021 were $1.853 billion ($3.65/share), compared to $1.741 million ($3.43/share) for 2020.

The loss in 2021 was from a pre-tax impairment charge of about $2.7 billion that stemmed from the sale of the fossil plants, the company said.

The company reported net income for the fourth-quarter of $445 million ($0.88/share), compared to net income of $431 million ($0.85/share) in 2020’s fourth quarter. Non-GAAP earnings for the quarter were $352 million ($0.69/share), compared to fourth-quarter non-GAAP earnings of $392 million ($0.65/share).