FERC on Monday conditionally approved Duke Energy Progress’ (NYSE:DUK) proposed changes to its supply contract with the North Carolina Eastern Municipal Power Agency (NCEMPA) but ordered the two parties to negotiate over how the pact should be changed to reflect the latter’s use of batteries to shave its demand charges (ER22-682).

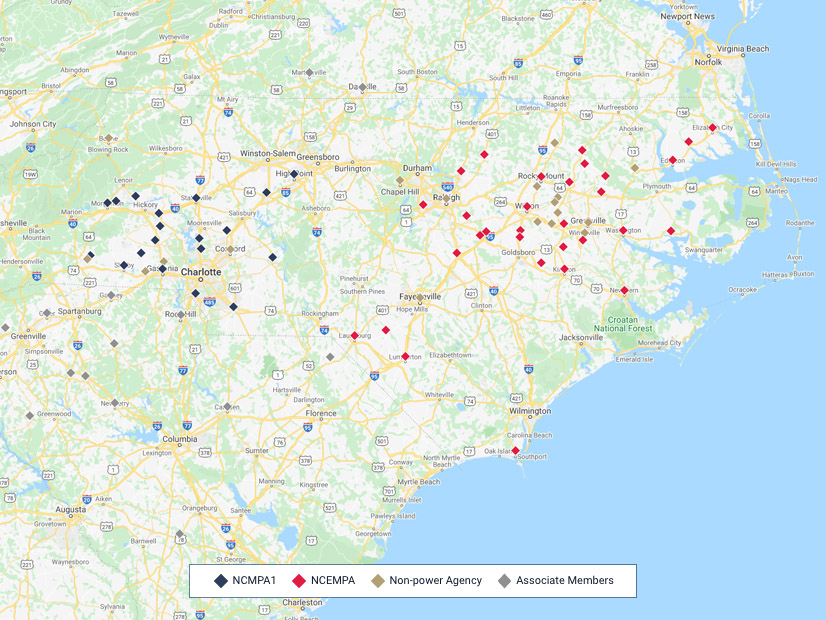

NCEMPA, which serves 32 cities and towns with municipal electric distribution systems, asked FERC in 2019 to issue an order declaring that its “full requirements” power purchase agreement with Duke permitted it to use battery storage to reduce the munis’ load during the peak hour each month that is used to determine capacity charges. FERC granted NCEMPA’s request in September 2020 (EL20-15), a ruling that was upheld by the D.C. Circuit Court of Appeals in January. (See DC Circuit Upholds FERC on Duke-Muni Battery Dispute.)

The capacity charge — based on NCEMPA’s pro rata share of the demand on Duke’s system during the one-hour coincident peak (CP) — is intended to cover Duke’s fixed costs and provide a return on its infrastructure investments.

New Contract Sought

DEP responded to the commission’s 2020 order by seeking to reopen the PPA, telling FERC that a revised rate design was needed because of statements by NCEMPA members announcing their intention to procure enough storage to reduce or eliminate their capacity charges “by superficially reducing or eliminating their demand only during the single CP hour of the month.” Since December 2020, NCEMPA and its members have issued solicitations for almost 150 MW of battery storage, DEP said.

The company said NCEMPA’s peak shaving was shifting capacity costs to four other wholesale requirements customers and that DEP’s retail customers also could be harmed because they pay a portion of the fixed costs.

DEP’s revised PPA would replace the current 12-CP methodology with a process that compares NCEMPA’s CP demand with its monthly non-coincident peak (NCP). In any month in which NCEMPA’s NCP exceeds its CP by 200 MW or more, the difference between the CP and the NCP minus 200 MW would be added back to the CP for setting demand charges.

The company told FERC the amended PPA is needed because “DEP’s system planning can no longer merely assume that the monthly coincident peak is the appropriate proxy for each customer’s use of the system.

“DEP’s limited visibility into NCEMPA’s intended time and magnitude of load management and demand cost mitigation measures creates real-time operational problems in so far as DEP must ramp (expensive and carbon-intensive) generation to meet NCEMPA’s anticipated load only to have NCEMPA members deploy demand cost mitigation measures, creating temporary and artificial load reductions to which DEP must quickly respond in real time,” it said, adding that the operational challenges will increase as it integrates more solar onto its system.

The company also proposed to change the nearly one-year notice period for proposed changes to the PPA. It currently gives the parties 60 days to reach an agreement on an amendment; if they are unable to agree, a 240-day informal dispute resolution process follows. DEP proposed shortening the notice and negotiation period from 300 days to 60 days, saying the current contract allows one party to “effectively hold the change hostage for almost a full year.”

NCEMPA protested, saying Duke’s proposal would penalize the development of distributed energy resources and that it violates cost-causation principles because the 200-MW threshold is arbitrary. It also complained that DEP would apply a cost allocation method that deviates from the conventional 12-CP method only to NCEMPA.

Ruling

FERC voted 4-1 to conditionally approve the revised PPA, effective March 1 and subject to refund pending settlement judge procedures.

The commission noted it has “previously accepted modification to a 12-CP methodology where the applicant sought to address cost shifting due to load-control measures.”

“Here, DEP has presented arguments that its current demand allocation method may fail to appropriately align costs with beneficiaries given the changing operational conditions on DEP’s system,” FERC said. “We find these arguments persuasive.”

The commission also dismissed NCEMPA’s argument that the revised PPA is unduly discriminatory, saying, “DEP’s departure from the 12-CP methodology … is not novel.

“Each of DEP’s wholesale customers has negotiated unique terms in their respective agreements based on their individual circumstances,” it said.

But the commission said it wasn’t convinced that DEP’s adjusted capacity charge calculation and 200-MW threshold are just and reasonable. It also said DEP’s proposal to modify its notice provisions from 300 to 60 days is “not adequately supported.” NCEMPA said it would consider some reduction in the duration of the informal process but that 60 days was too short for it to secure the necessary governing board consideration and approval.

Dissent from Clements

Dissenting was Commissioner Allison Clements, who said the commission should have rejected DEP’s proposal without prejudice and that the majority’s order “sets too low a bar for the filing party’s proposed rate to become effective as the hearing process moves forward.”

Clements said DEP failed to demonstrate how its rate proposal reflects its transmission planning. She also questioned why DEP doesn’t use NCP demands in allocating costs for all DEP customers.

“At minimum, a five-month suspension period is warranted in this case,” she said. “To the extent that the hearing process stretches beyond the 15-month refund period, NCEMPA risks being subjected to unjust and unreasonable or unduly discriminatory charges without any recourse.”