In 2021, the U.S. pulled in $105 billion in capital investments in the clean energy transition, installed 37 GW of new wind and solar, along with 42 MW of battery storage, and put 657,000 new electric vehicles on the road, more than double the 325,000 EVs sold in 2020.

At the same time, according to the 2022 Sustainable Energy in America Factbook, U.S. greenhouse gas emissions rose 5.8% year over year, and climate disasters cost the country $145 billion in damages. Meanwhile, high natural gas prices opened the way for coal-fired generation to once again become competitive in wholesale power markets. Coal produced 22% of the nation’s electricity in 2021, the highest level in 14 years, the Factbook says.

A joint project of the Business Council for Sustainable Energy (BCSE) and BloombergNEF (BNEF), the 2022 Factbook was one of two major energy industry reports released Thursday, with each providing different and somewhat conflicting views of the U.S. energy transition.

The U.S. Energy Information Administration’s Annual Energy Outlook 2022 reported that fossil fuels will continue to dominate through the middle of the century even as renewables and electric vehicles ramp up.

“We don’t see liquid fuels and natural gas losing their place as the top two sources of energy in the United States through 2050,” said EIA acting administrator Stephen Nalley during an announcement webinar.

The 2022 Factbook provides a chart-packed, by-the-numbers look at a U.S. and global clean energy transition that has become unstoppable but still faces many uncertainties as to its speed, costs and evolving portfolio of technologies and fuel sources.

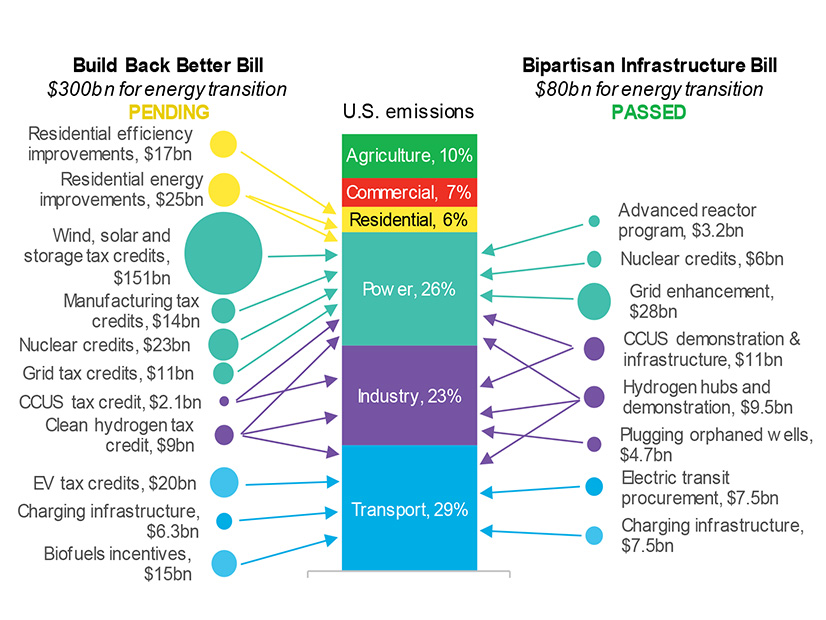

A key chart in the report compares the $80 billion in energy research and development funding — mostly for nuclear, hydrogen and carbon capture — in the Infrastructure Investment and Jobs Act with the $300 billion in incentives and tax credits for renewables, storage, transmission and manufacturing in the stalled Build Back Better Act.

“We need every technology that we can bring to bear, and we need them to be affordable, deployable and practical” to reach economy-wide decarbonization, BCSE President Lisa Jacobson said in an interview with RTO Insider. “Investments are needed in many innovative technologies, in addition to dramatically scaling up what we have readily available today.”

At a prerelease press briefing on Thursday, other energy industry officials spoke of the need to ramp up investments, deployments and the policies that will support them. Dan Whitten, vice president of public affairs at the Solar Energy Industries Association (SEIA), said solar deployments could drop in 2022 “if we don’t get this right.”

SEIA is particularly focused on the tax credits for manufacturing in Build Back Better, which he said are “critical, both in terms of investing in facilities and also in supporting production of everything from ingots to cells to wafers to panels themselves. We’ve got make that commitment.”

Records for Venture Capital

For Ethan Zindler, head of Americas for BNEF, one of the report’s biggest takeaways is the growth in investment and renewables deployment in 2021, which he called “a truly blockbuster of a year.”

“In the flows of capital, almost every type of asset class or way that money could get deployed into the sector, it did,” Zindler said. “We saw records for venture capital investment. It was everything from early-stage technologies to deployment of existing and commercially viable technologies … which reflected a lot of bullish sentiment on the part of investors.”

Renewables took the largest chunk of new U.S. investment, $47 billion (45%), followed by electric transportation at $35 billion (34%), he said. And investment in hydrogen doubled to $200 million.

Paralleling those investments, the solar industry added 24 GW of new power to the grid and wind added 13 GW, helping to push renewables’ contribution to U.S. power generation — including hydropower — to a new high of 21%.

Transmission also saw record-breaking investments from both utilities and independent developers, close to $28 billion, an 11% increase from 2020, according to the factbook. But, despite the hundreds of gigawatts of renewable energy projects in interconnection queues across the country, BNEF is predicting a slight downtick and plateau in coming years.

Transmission investments jumped 11% to $27.5 billion in 2021. | EEI

Transmission investments jumped 11% to $27.5 billion in 2021. | EEI

“I don’t think the issue is the lack of available capital,” Zindler said. “The challenge is lack of investible projects … [caused by] the incredible challenge it takes to get a transmission project permitted.”

Emily Duncan, director of federal government relations for National Grid and BCSE board chair, pointed to the indefinite hold on construction of the $1 billion Hydro-Quebec transmission line following a 2021 vote by Maine voters against the project.

“We’re living that right now,” Duncan said. The uncertain fate of the project “is a perfect example of just how important this transmission problem really is — the fact that we are going to have to run transmission through states that may not directly benefit from it. And how do we square that moving forward?”

Cost of Renewables Matters

Offering a more cautious view of the energy transition, EIA’s Annual Energy Outlook begins with the premise that meeting global demand for cheap power will keep fossil fuels a growth industry in the U.S. Oil and gas production will continue to boom, hanging on to their top spots as the two biggest sources of energy in the U.S. through 2050, despite increasingly high rates of renewable energy growth, the report says.

“We see the United States continuing to produce record amounts of crude oil, natural gas and natural gas plant liquids through 2050 under a wide variety of assumptions examined in the reference case and side cases,” Nalley said.

Driving that trend is a nearly 50% baseline increase in global energy consumption between now and 2050, bringing with it hefty international demand for oil and gas.

Corporate procurement of renewable energy is expected to add hundreds of terrawatt-hours of new renewable energy to the grid by 2030. | BloombergNEF, The Climate Group, company announcements

Corporate procurement of renewable energy is expected to add hundreds of terrawatt-hours of new renewable energy to the grid by 2030. | BloombergNEF, The Climate Group, company announcements

On the emissions front, the report’s look at a number of scenarios — a reference case and eight “side cases” — finding that the ongoing energy transition decreases emissions until 2037, but then they begin to gradually tick upward again. EIA assistant administrator Angelina LaRose said the upward trend reflects “an increase in overall energy usage as a result of increasing population and economic growth,” as well as assumptions about current laws and regulations holding in place.

The share of renewables in the U.S. electricity generation mix more than doubles from 2021 to 2050 according to the outlook, with wind leading the way in the next few years and solar taking over after 2024. By 2050, the EIA sees solar at 22% of electricity generation and wind at 14%.

“The cost of renewables matters,” LaRose said. In one of the agency’s side cases, with low renewable costs, gas and nuclear generation fall compared to the reference case. In another, with renewables remaining at today’s costs, solar and wind still grow but gas prices remain competitive, and all of the energy sources keep growing.

“In the absence of changes in policy, the market is primarily driven by cost,” LaRose said. “There’s the potential for much variation.”

A ramp-up in electric vehicle sales, from 340,000 in 2021 to 1.52 million in 2050, starts to put a dent in the share of gasoline-powered vehicles in the reference case, which fall from 92% of light-duty vehicles in 2021 to 79% in 2050.

“There are a number of factors, including declining battery costs,” said Erin Boedecker, EIA’s team leader for energy consumption and efficiency modeling. “Also, an increasing number of available models on the market, and that’s expected to continue. And there’s a growth in the consumer market for longer-ranged electric vehicles, particularly in light trucks, in our projection period.”