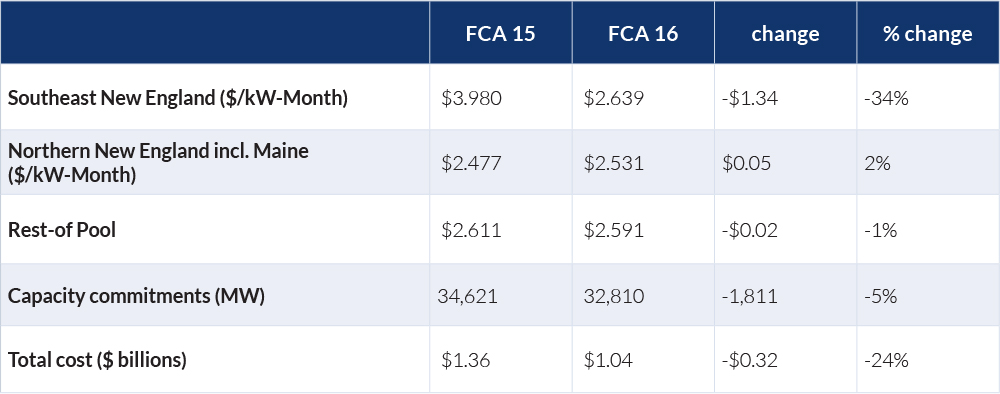

Capacity prices in Southeast New England fell to $2.639/kW-month in Forward Capacity Auction 16, a 34% decrease from last year’s auction, ISO-NE reported Wednesday. The total cost of the FCA 16 was $1.04 billion, a $320 million (24%) drop from 2021.

ISO-NE said the auction procured 32,810 MW of capacity for the 2025/26 period.

Prices were mostly flat outside of the Southeast zone, coming in at $2.531/kW-month in Northern New England and Maine, and $2.591/kW-month in Rest of Pool.

“New England’s clean energy transition is well underway, and the region’s wholesale markets are playing a vital role by sustaining a reliable power system, maintaining competitive prices and creating opportunities for the resources that will be the backbone of our clean energy future,” said Robert Ethier, ISO-NE’s vice president for system planning.

Nearly 5,000 MW of renewables, energy storage and demand resources cleared the auction, making up 15% of the total capacity, ISO-NE said. That includes more than 700 MW of energy storage, 500 MW of solar generation and 275 MW of existing wind generation.

Resources worth 256 MW submitted retirement bids, all of which cleared, and 1,540 MW worth of generation was delisted.

No Delist for Merrimack Power

The owner of New England’s last active coal plant, Merrimack Station, submitted a static delist bid, seeking to remove its two units from the capacity auction if prices dropped below a certain point (the dynamic delist bid threshold).

But the bid was rejected by ISO-NE’s Internal Market Monitor, which reviews delist requests, and subsequently withdrawn by the operator of the plant.

Resources successfully submitting retirement bids included Potter II, a 96-MW combined cycle plant owned by Braintree Electric Light Department; two units at Schiller Station in New Hampshire, which shuttered in 2020; and two units burning kerosene and gas at the West Springfield Generating Station.

Information about which individual resources cleared the auction will be published when ISO-NE sends its filing to FERC, expected to occur as early as next week.

A Disjointed Process

The results were delayed by several weeks because of the uncertainty over the Killingly Energy Center, which won a last-minute stay from the D.C. Circuit Court of Appeals allowing it to temporarily take part in the auction. (See Killingly Uncertainty Could Delay Capacity Auction Results Another Month.)

ISO-NE ended up tallying results both with and without Killingly participating, and when the Connecticut natural gas plant under development by NTE Energy ultimately lost its appeal at FERC and forfeited its financial assurance, the grid operator was able to confirm that it would be using the results without the plant.

Killingly’s exit from the market had an effect on the auction’s outcome, said Dan Dolan, president of the New England Power Generators Association.

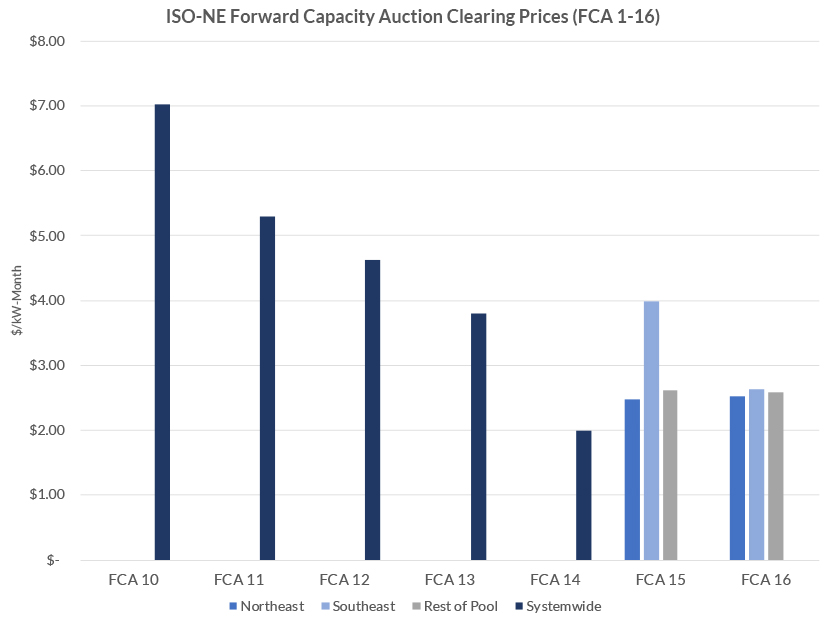

Prices dropped sharply in Southeastern New England in FCA 16 vs. FCA 15, pushing overall costs down by nearly one-quarter. | ISO-NE

Prices dropped sharply in Southeastern New England in FCA 16 vs. FCA 15, pushing overall costs down by nearly one-quarter. | ISO-NE

“We saw with the removal of Killingly less supply than the prior year’s, and when matched with the lower demand this year versus FCA 15, it led to relatively flat pricing overall,” Dolan said. “There are continued historically low capacity prices across the board.”

NEPGA’s members have been frustrated with the uncertainty created by the Killingly delay, Dolan said, but they are relieved that the results have been released and that the grid operator is working quickly to start the process for next year’s FCA 17.

“There is a feeling of ‘we can make this work.’ This is now a manageable timeline and process overall,” he said.