New Start-up Cost Offer Proposal

PJM presented an updated proposal addressing start-up cost offer development at last week’s Market Implementation Committee meeting after being sent back to a subcommittee for more work on the issue.

Tom Hauske, principal engineer in PJM’s performance compliance department, provided a first read of the revised PJM/Independent Market Monitor proposal to revise Manual 15 that emerged from the Cost Development Subcommittee (CDS).

The CDS initially brought two proposals for first reads to the October MIC meeting. (See “Start-up Cost Offer Development,” PJM MIC Briefs: Oct. 6, 2021.) But a vote on the proposals was postponed so more discussions could take place and have stakeholders reach a consensus on a single proposal.

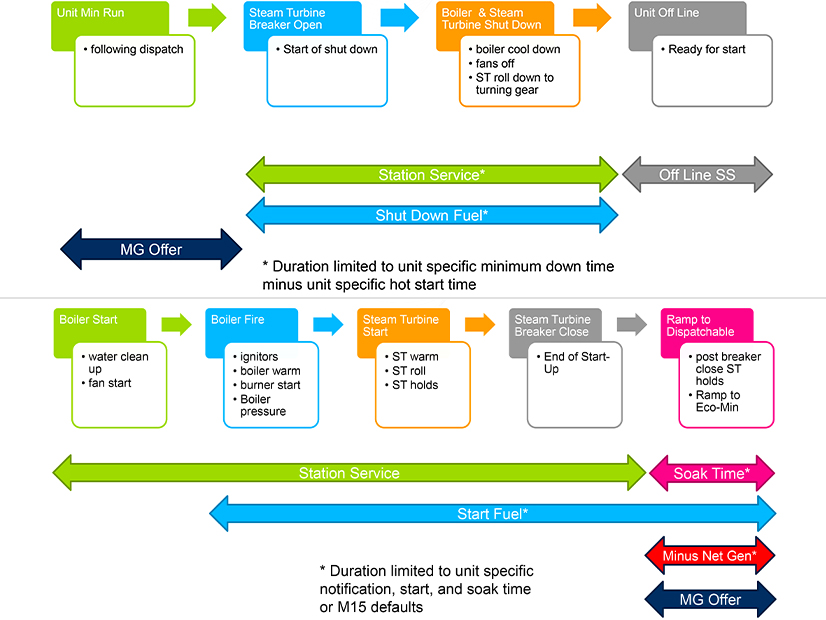

Manual 15 currently allows combined cycle units to include fuel costs after generator breaker closure and synchronization to the grid in their calculations of start-up costs that other unit types, like steam and nuclear units, cannot. The proposed revisions would align start-up cost for all units with a soak process, or units that use steam turbines.

Comparison of a 2×1 combined cycle unit with a pseudo-modeled 2×1 combined cycle unit when dispatched on a parameter-limited schedule | PJM

Comparison of a 2×1 combined cycle unit with a pseudo-modeled 2×1 combined cycle unit when dispatched on a parameter-limited schedule | PJM

For units with a soak process, including steam, combined cycle and nuclear units, some of the soak costs would be included in the start-up costs from PJM’s notification to the “dispatchable output” and from the last breaker open to the shutdown process.

Units that don’t have a soak process, like combustion turbines and reciprocating engines, would maintain the status quo, with start-up costs including costs from PJM notification to first breaker close and from last breaker open to the shutdown process.

The revised proposal features several other changes to Manual 15 to provide additional guidance and clarification, including equations to calculate start-up costs, station service calculations for units with and without a soak process, and unit-specific parameter limits on includable costs.

Hauske said PJM’s intent is to provide a six-month window for implementation to allow market sellers the opportunity to have their fuel costs or net generation used for the offset to be reviewed by the Monitor prior to the proposal going into effect.

“We’re trying to avoid the possibility of putting someone in a compliance trap where a unit today could wind up having a smaller start-up cost and then have a fuel-cost policy penalty,” Hauske said.

The committee will be asked to endorse the proposal at next month’s meeting.

Minimum Run Time Guidance Endorsed

Members unanimously endorsed PJM’s proposal addressing pseudo-modeled combined cycle minimum run time guidance after stakeholders asked for more time last month to analyze the changes.

Hauske reviewed the proposal that included adding language to Manual 11: Energy and Ancillary Services Market Operations that would require market sellers to update the minimum run time of any subsequent pseudo-modeled unit to remove the associated steam turbine start-up time included in the parameter limit when it’s dispatched.

Hauske said market sellers can model a combined cycle generation unit as multiple “pseudo units” that are made up of a single combustion turbine and a portion of a steam turbine. But he said the potential exists for one or more of the pseudo-modeled units to operate for a period beyond the minimum run time parameter limit compared to an identical non-pseudo-modeled combined cycle unit if the market units of a pseudo-modeled combined cycle unit are dispatched at different times because the steam turbine takes extra time to reach operative levels.

PJM would provide guidance developed in the initiative to any pseudo-modeled combined cycle unit requesting an adjustment during the review period, Hauske said, or to existing pseudo-modeled combined cycle units with an approved unit-specific minimum run time parameter.

The proposal will receive a final vote at the Markets and Reliability Committee meeting next week. Hauske said PJM wants to have a final endorsement at the next MRC meeting because the RTO’s unit-specific parameter adjustment process started Feb. 28, and PJM must provide a determination on the requests by April 15.

Manual 18 Revisions Endorsed

Stakeholders unanimously endorsed manual revisions conforming with several FERC orders related to PJM’s capacity market.

Jeff Bastian, PJM

” data-credit=”© RTO Insider LLC” data-id=”6180″ style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Bastian-Jeff-2019-03-06-RTO-Insider-FI” data-uuid=”YTAtNTUxNzU=” align=”right”>Jeff Bastian, PJM | © RTO Insider LLC

Jeff Bastian, senior consultant in PJM’s market operations department, reviewed several revisions to Manual 18: PJM Capacity Market, including:

- revisions to the application of the minimum offer price rule, which became effective by operation of law in September when the commission deadlocked (ER21-2582);

- an October compliance filing to amend several sections of Attachment DD of the tariff establishing a replacement market seller offer cap (EL19-47);

- restored tariff provisions reinstating the prior backward-looking energy and ancillary services (E&AS) offset for the 2023/24 Base Residual Auction and beyond (EL19-58); and

- the removal of the 10% cost adder for the reference resource used to establish the variable resource requirement curve (ER19-105).

Bastian said language in section 3.3.2 was updated to reflect that the net E&AS of the reference resource combustion turbine will be calculated using the forward-looking methodology with the application of the 10% adder for only the 2022/23 delivery year. The net E&AS will be determined using the historical approach and without the application of the 10% adder for all other delivery years.

The revisions also delete language in section 5.4.5.2 describing the consequences of accepting a state subsidy after electing the competitive exemption or certifying that a resource is not state-subsidized.

Members will vote on the manual changes at next week’s MRC meeting for final endorsement.

Critical Gas Infrastructure Approved

Stakeholders unanimously approved an issue charge to address critical gas infrastructure recommendations for demand response.

Jack O’Neill of PJM’s demand response department reviewed the problem statement and issue charge addressing the recommendation for DR participation found in the FERC and NERC report on last February’s winter storm in Texas and other parts of the South.

The report included a recommendation “to require balancing authorities’ operating plans (for contingency reserves and to mitigate capacity and energy emergencies) to prohibit use of critical natural gas infrastructure loads for demand response.”

Natural gas infrastructure in PJM | PJM

Natural gas infrastructure in PJM | PJM

PJM began discussions with curtailment service providers (CSPs) through the Demand Response Subcommittee (DRS) to identify impacted loads for the 2021/22 winter season, O’Neill said, and the committee developed a preliminary definition of critical gas infrastructure loads.

O’Neill said CSPs have cooperated with PJM to identify impacted loads in the RTO’s DR Hub application so dispatchers have “operational awareness.” PJM estimates about 20 facilities of critical gas infrastructure load participate as DR in the RTO’s wholesale markets, amounting to about 95 MW of winter capability and 190 MW of summer capability.

The key work activities of the issue charge include defining critical gas infrastructure loads and PJM market participation rules in compliance with FERC/NERC recommendations and developing a transition mechanism if new participation rules impact member’s capacity commitment.

Work on the issue is assigned to the DRS and is expected to last 12 months. O’Neill said the goal is to file any necessary tariff changes with FERC in the first quarter of 2023.

Operating Reserve Clarification Endorsed

Stakeholders unanimously approved an issue charge to address clarifications and potential enhancements to the rules for paying operating reserve credits to resources running when requested by PJM.

Phil D’Antonio, PJM | © RTO Insider LLC

Phil D’Antonio, PJM | © RTO Insider LLC

Phil D’Antonio of PJM’s energy market operations department reviewed the problem statement and issue charge developed by the RTO to find opportunities to strengthen incentives for supply resources to operate consistent with PJM’s directions.

PJM pays energy uplift to market participants under specified conditions to guarantee that competitive market outcomes “do not require efficient resources to operate for the PJM system at a loss,” D’Antonio said. Uplift payments are one of the incentives for generation owners to offer energy for dispatch based on short-run marginal costs and to operate units through the direction of the RTO’s operators.

D’Antonio said PJM wants to clarify the definition of “operating as requested by PJM” in both the tariff and manuals because it “lacks the type of systematic approach” found in the definition of “following dispatch,” which is used in assessing balancing operating reserve deviation charges. He said PJM and the Monitor have debated the meaning of the definition and want to clear it up.

Key work activities in the issue charge include determining a definition of “operating as requested by PJM” as it relates to payment of operating reserve credits. It also seeks to establish alternative rules addressing the megawatt level to which balancing operating reserve credits should be paid to resources found not to be closely following PJM’s commitment and dispatch instructions.

D’Antonio said stakeholder discussions led to an additional key work activity to determine how intermittent resources are treated under the definition of “operating as requested by PJM” with respect to dispatch megawatts and/or forecast megawatts.

Stakeholders will work on the issue at the MIC beginning in April, D’Antonio said, with the potential for scheduling of special MIC meetings as needed. Work on the issue is expected to last around nine months.