MISO focused on its first long-range transmission portfolio (LRTP) package twice last week, revealing an early price tag during its March Board Week and then holding a stakeholder workshop Friday to address cost-related questions.

The RTO has cut one long-range project from its final lineup, dropping one of two 345-kV lines in southern Minnesota. That reduced the portfolio’s cost to $10.4 billion, down from a previously announced $13 billion, while staff continues to refine cost estimates. (See MISO Delays $13B Long-range Portfolio’s Recommendation.)

Even as MISO pushed back the board’s consideration of the portfolio to July, it said it wants to move quickly in strengthening the grid with new lines. Its planners have said the seven 345-kV projects should relieve congestion that the Independent Market Monitor regularly warns of and tracks. (See MISO Says System Volatility Here to Stay.)

The grid operator doesn’t yet have estimated in-service dates for the projects.

Jarred Miland, senior manager of transmission planning coordination, said the LRTP is the most expensive package MISO has put forward. He also said it represents the most extensive planning work the RTO has ever performed.

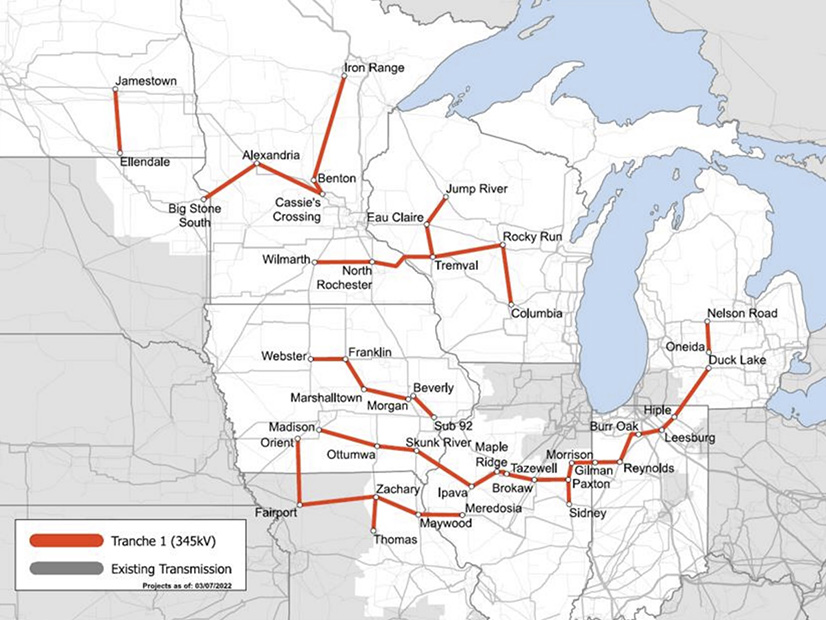

A final list of 345 kV projects from the first cycle of MISO’s long-range transmission planning | MISO

A final list of 345 kV projects from the first cycle of MISO’s long-range transmission planning | MISO

The projects will ease growing pains as MISO grapples with increasing renewable energy output and the loss of large, centralized power plants, Miland said. He pointed out that the interconnection queue contains almost 56 GW of solar projects alone.

“The LRTP is not a one-and-done. It’s a journey,” Miland said of the first cycle of projects.

MISO will begin work on a second cycle sometime during the third quarter, Miland said. The second portfolio will focus on MISO Midwest, as did the first. MISO South won’t enter the planning picture until the third and fourth iterations of long-range planning.

“It’s a big system. It’s a tremendous amount of work,” Miland said. “We do recognize that there is a lot more work to do. That’s why we’re moving into tranche two. It’s a big apple. We can’t eat it all at once.”

The seven groupings of 345-kV projects include:

- a $955 million line from Jamestown to Ellendale and Big Stone to Alexandria to Cassie’s Crossing in Western Minnesota and the Dakotas;

- a $1.2 billion line that crosses Minnesota into Wisconsin, hitting Wilmarth, North Rochester, Tremval, Eau Claire and Jump River;

- a $673 million line from Minnesota into Wisconsin that touches Tremval, Rocky Run and Columbia;

- an $853 million line in Western Minnesota and the Dakotas that intersects Iron Range, Benton and Cassie’s Crossing;

- an $894 million line in Iowa that passes over Webster, Franklin, Morgan Valley and then Beverly to Substation 92 near West Liberty;

- a $2 billion line situated mostly in Northern Missouri that includes Orient, Iowa, and extends into Meredosia, Ill.; and

- a sprawling, $3.4 billion line that links Iowa, Illinois, Indiana and Michigan.

The portfolio also provides for $350 million in lower voltage “under-build” projects necessary to accommodate the 345-kV transmission. MISO is still working to compile a list of the under-build projects.

“The under-build sort of represents … a high-end bogey as to where we’ll end up,” Miland said.

Miland said anytime MISO introduces new, large transmission projects, power system flows and contingencies could change and necessitate new equipment.

Indiana Utility Regulatory Commission staffer Dave Johnston asked whether the massive Iowa-to-Michigan project in the Central Region will be open to competitive bidding and whether it will be split up by jurisdiction into project segments.

MISO Executive Director of System Planning Aubrey Johnson said staff has yet to finalize those details.

“We have to think about some natural break points,” Johnson said, citing recent rights-of-first-refusal legislation in Michigan, Minnesota and Iowa. Wisconsin lawmakers are also considering ROFR laws.

MISO said its steady-state analysis of the Iowa-to-Michigan line show that it “can mitigate severe thermal issues in Michigan, Indiana, Illinois, Missouri and Iowa,” including reduced loading on 78 monitored facilities.

The grid operator is currently drafting an appendix to its 2021 Transmission Expansion Plan (MTEP 21) for the long-range projects. The portfolio will be part of MTEP 21, although its project approvals will take place about six months after the $3 billion MTEP 21 was approved.

MISO plans to divide costs of the long-range plan using a subregional, 100% postage stamp to load rate that is pending before FERC.