MISO convened a special meeting of its Planning Advisory Committee Wednesday to underscore the urgency for $10 billion in long-range transmission projects in its Midwestern region.

Jarred Miland, the RTO’s senior manager of transmission planning coordination, stressed the grid operator’s pressure to build transmission as members’ generation portfolios transition to cleaner resources.

“The resource portfolio has been changing rapidly over the past 10 years and reliability will become increasingly difficult as renewable energy increases across the footprint,” Miland told stakeholders.

He said the long-range transmission portfolio (LRTP) seeks to “provide an orderly and timely transmission expansion effort that supports key goals,” including keeping system performance reliable in greater supply volatility and accessing lower-cost and cleaner energy.

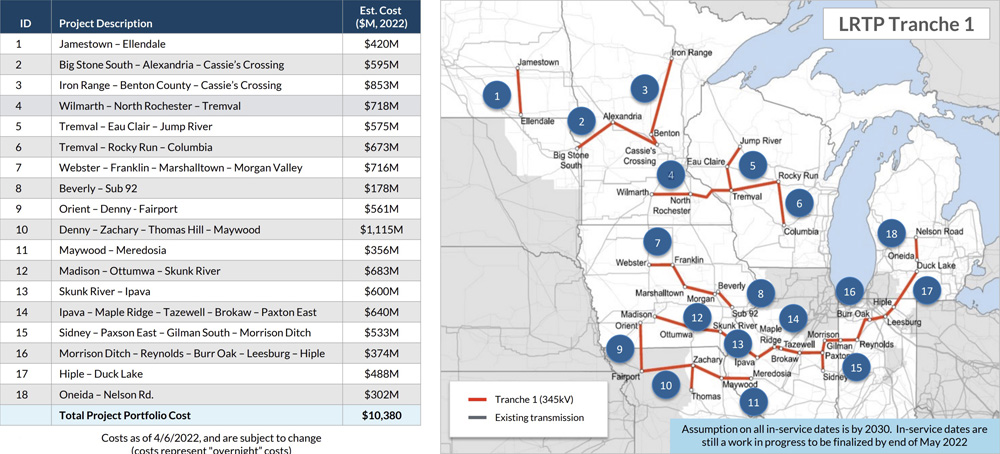

MISO’s first set of long-range projects could be the largest portfolio of regional projects ever proposed in the U.S. The grid operator has projected that the $10.4 billion package will yield anywhere from $23 billion to $52 billion in financial benefits over the projects’ 20- to 40-year lifespans, resulting in a 2.6:1 overall benefit-to-cost ratio. (See MISO Updates Stakeholders on $10B Long-range Tx Package.)

The LRTP is broken down into six groupings of 18 line segments. Staff assumes all projects will be built by 2030.

Projects under the first cycle of MISO’s long-range transmission plan | MISO

Projects under the first cycle of MISO’s long-range transmission plan | MISO

Miland said “work is still ongoing” to determine whether some segments will be open to competitive bidding. MISO plans to post a draft list of the portfolio’s competitive facilities by June 1.

Staff calculated the portfolio’s benefits by quantifying transmission’s ability to solve reliability issues, reduce congestion and fuel costs, avoid new generation and other transmission investments, trim reserve margins, avert loss-of-load events and meet utility and state decarbonization goals.

MISO adviser Joe Reddoch said the RTO played it conservatively when approximating the projects’ benefits and did not overstate savings. He said although the level of benefits will differ between Midwestern transmission pricing zones, they all stand to receive benefits.

While WEC Energy Group’s Chris Plante worried aloud that the LRTP’s benefits were too optimistic, Sustainable FERC Project attorney Lauren Azar said the identified list of benefits was probably “too narrow.”

Clean Grid Alliance said the projects can enable the additional 52.7 GW of renewable power projected in the most conservative of the three planning scenarios. That would power about 12 million homes and support 213,000 jobs, the group said.

Stakeholders asked whether MISO has accounted for the spiking costs of building materials and labor.

Aubrey Johnson, vice president of system planning, said staff will update cost estimates over the next month, but that he doesn’t expect the figures to change much. He said MISO was cautious from the start when estimating project costs and said he only expects “fine-tuning around the margins.”

The Planning Advisory Committee will vote on whether to recommend the portfolio to the Board of Directors during a May 27 meeting. The board will vote on the portfolio on July 25.

Determining LRTP’s Effect on the Interconnection Queue

MISO is determining how long-range projects will interact with its generator interconnection queue.

During a Monday Interconnection Process Working Group, MISO’s Jesse Phillips said staff is planning to monitor when new generation projects making their way through the queue are affected by a long-range transmission project.

Phillips said if a project is found to resolve a constraint found in network upgrade studies and is approved by the board within a year of an interconnection customer striking a generator interconnection agreement, the customer will not be financially responsible for transmission upgrades. He said the generation project will then be contingent upon the transmission project instead of a network upgrade.

Generation projects that entered the queue as early as 2017 could be affected by the new considerations, Phillips said

Stakeholders expressed doubts that the long-range projects will be built in time to support new generation projects advancing through the queue. Several pointed out that the transmission projects don’t have specific in-service dates yet.

Some also asked whether MISO would consider reinstating projects to the queue that were previously priced out by high network upgrades. Before staff embarked on their long-range planning, some stakeholders criticized the RTO for placing the system expansion’s financial burden on generation developers.

Phillips said staff is in the early stages of analyzing how they should treat projects affected by the LRTP. He said MISO is accepting written opinions through April 29 on how to integrate long-range projects into interconnection studies.

The discussion came as generation projects are experiencing multiple delays in the interconnection queue’s definitive planning phase. MISO is also trying to get a feel for how many developers are lining up to enter the queue this year. Staff are asking developers for a heads up on whether they plan on submit projects by the Sept. 15 deadline.

MISO said the submittals will be used for resource forecasting and won’t supplant the need for a queue application. It also said the information developers share will be non-binding and confidential.

In March, the queue contained 848 projects totaling 133 GW of installed capacity. Solar projects accounted for 62% of the capacity, with wind, storage and hybrid formats each responsible for 11%.