[EDITOR’S NOTE: This story was updated on Friday, April 15, 2022, to include comments made by MISO officials and stakeholders during a teleconference that day.]

MISO’s 10th annual Planning Resource Auction (PRA) saw all its Midwestern zones clearing at the nearly $240/MW-day cost of new entry (CONE), signaling the prospect of temporary outages and a dire need for additional generation.

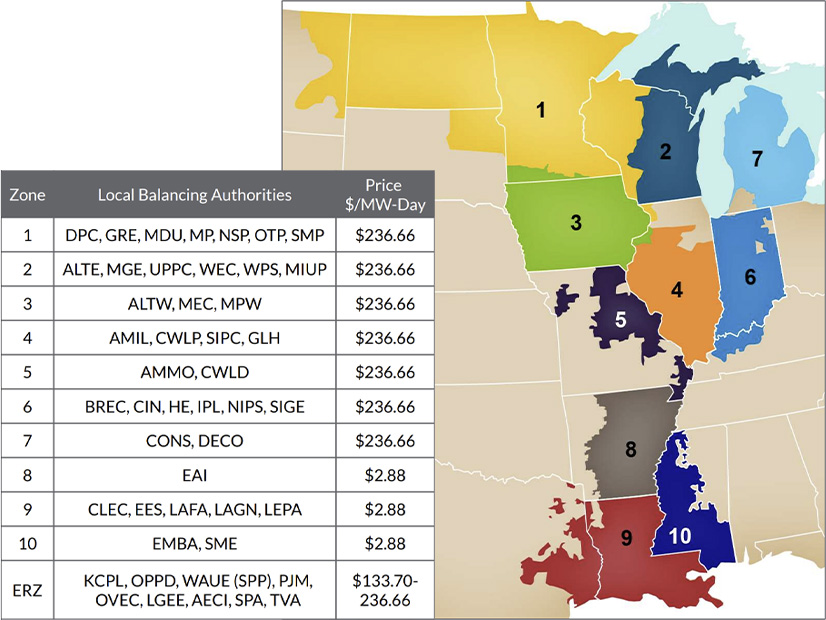

Zones 1 to 7 — which include the Dakotas, Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota, Missouri, Montana and Wisconsin — all cleared at $236.66/MW-day in the 2022/23 capacity auction, MISO announced Thursday. Zones 8 to 10 — Arkansas, Louisiana, Mississippi and Texas — did not feel the pinch and cleared at $2.88/MW-day.

MISO said that even with nearly 97 GW worth of offers, 1.3 GW of resource contributions external to MISO and 1.9 GW worth of imports from MISO South, MISO Midwest remained a little more than 1.2 GW short of its 101.2-GW planning reserve margin requirement.

The RTO said 8 GW in its North and Central regions were exposed to the CONE clearing price. MISO’s load-serving entities that don’t have enough contracted capacity to cover their load obligations use the PRA. During a teleconference with stakeholders on the results Friday, MISO Director of Resource Adequacy Coordination Zakaria Joundi said that only 8% of load participated in the auction this year. Participation in the PRA is voluntary.

Ahead of the 2022/23 planning year, MISO anticipated a 121-GW coincident systemwide peak, with 157 GW in total installed capacity and just short of 128 GW in total unforced capacity.

The grid operator attributed some of the shortfall to post-COVID load increases.

It also said that even though it has about 4 GW more worth of installed capacity footprint-wide than it did in 2018, it has about 8 GW less in accredited capacity, reflecting an uptick in intermittent generation and retiring thermal generation. Unless members build more capacity that can reliably generate, MISO said, “shortfalls such as those highlighted in this year’s auction will continue.”

Joundi said that although MISO is maintaining “decent amount of installed capacity,” accredited capacity “keeps going down.”

He said as generation retirements and suspensions were being replaced with lower-accredited renewable resources, MISO demand levels rebounded as the nation emerged from the worst of the pandemic.

“We couldn’t find enough capacity in the North-Central region,” Joundi said.

MISO’s South-to-Midwest transfer limit bound in the auction, limiting imports that could pass to the north, Joundi said. The South finished the auction with about 2 GW of surplus.

“This is an outcome we’ve been worried about for a decade,” MISO Independent Market Monitor David Patton said. He said the capacity auction’s vertical demand curve — which values reliability requirements over economics — doesn’t produce efficient enough economic signals and has caused generation that should be otherwise economic to retire. The Monitor has been a vocal proponent of a sloped demand curve for years.

“We obviously have been sounding the alarm for some time,” Michelle Bloodworth, CEO of coal trade organization America’s Power, said of thermal retirements. She said she foresees a worsening retirement crisis over the next decade.

In a press release, the RTO said it “remains committed to continue its work with members and state regulators to maintain grid reliability.”

“We have anticipated challenges due to the changing energy landscape and have communicated our concerns. … We have prepared for and projected resource fleet transformation, but these results underscore that more attention is required to offset the rate of acceleration,” MISO CEO John Bear said. “These results do not undermine our ability to meet the immediate needs of the system, but they do highlight the need for more capacity flexibility to reliably generate and manage uncertainty during this transition.”

MISO said zones 1 to 7 will head into the June 1 start of the planning year with a chance of temporary load shedding. Joundi told stakeholders to prepare for more frequent emergency procedures throughout the planning year. He also said MISO is evaluating the resource forecasting information it receives from members.

“The reality for the zones that do not have sufficient generation to cover their load plus their required reserves is that they will have increased risk of temporary, controlled outages to maintain system reliability,” MISO President and COO Clair Moeller said. “From a consumer perspective, those zones may also face higher costs to procure power when it is scarce.”

Patton has reviewed and certified the auction results.

Coalition of Midwest Power Producers representative Travis Stewart said the results were a bit of a head-scratcher, as the Midwest appeared to have sufficient capacity based on unforced capacity values heading into the auction. He said it seemed that more market participants are holding back supply up to MISO’s 50-MW withholding threshold, but Patton said he didn’t discover any withholding that would run afoul of MISO’s rule.

The price separation between MISO Midwest and South in previous auctions became even more pronounced this year. In the 2021/22 auction, zones 8 to 10 cleared at an all-time low of 1 cent/MW-day, while zones 1 to 7 cleared at $5/MW-day. (See MISO Capacity Auction Values South Capacity at a Penny.)

This is the second time CONE has made an appearance in the PRA. Zone 7, which covers MISO’s territory in Michigan, was MISO’s first local resource zone to clear at the then $257.53/MW-day CONE, in the 2020/21 auction.

The Organization of MISO States and MISO’s joint annual resource adequacy survey in 2020 warned of possible capacity shortfalls in the Midwest by 2022. However, by 2021, the survey had moved the risk into 2023. (See OMS-MISO Survey Sees Uncertain Supply Future and 2021 OMS-MISO Resource Adequacy Survey Shows Less Cause for Concern.)

“We didn’t necessarily expect this outcome to happen this year,” Joundi said. He reminded stakeholders that the OMS-MISO survey is a snapshot in time, and circumstances have changed since the last one. “Slight surpluses did erode.”

MISO said this year’s auction results show a need for market redefinition and more efforts to make resources more available. It could also be one of MISO’s last single annual capacity auctions. The grid operator has filed for FERC permission to conduct four seasonal auctions beginning in 2024. It has also asked to implement a minimum capacity requirement, in which LSEs must demonstrate that they’ve secured half of their load obligations prior to the auction. Last month, FERC issued MISO a deficiency notice for outstanding questions of the design. (See Deficiency Notices for MISO’s Seasonal Capacity Auctions Bid.)

At a Feb. 28 executive update with stakeholders, MISO General Counsel Andre Porter said the RTO’s seasonal auction and long-range transmission planning are meant to ensure it has adequate reserves amid changing resource portfolios and increasingly unstable weather.

“Even while we wait, volatility and uncertainty continue,” Porter said of FERC’s decision time on the seasonal auction. He said MISO is encouraging states to scrutinize their resource adequacy plans to make sure they’re appropriate for a changing landscape.

But Patton said that the long-range transmission plan will only help auction results if a project increases the transfer capability between Midwest and South. MISO doesn’t plan on addressing the constraint in the long-range transmission effort anytime soon.

Patton said the RTO should consider asking for greater flow capacity between the South and Midwest when it next refreshes the transmission use agreement it has with SPP and other parties. “That is something we should think about as that agreement gets renegotiated.”

Some stakeholders called for an operational analysis of adding transmission capability between the regions.