FERC’s proposed transmission planning and cost allocation rulemaking Thursday was a welcome victory for Chairman Richard Glick (D), coming a month after having to walk back a controversial pipeline ruling, and two months before the end of his current term on the commission.

The Notice of Proposed Rulemaking was approved on a bipartisan 4-1 vote Thursday (RM21-17). (See related story, FERC Issues 1st Proposal out of Transmission Proceeding.)

“This is a big deal, a great step and one that is moving forward with bipartisan consensus,” tweeted former Commissioner Neil Chatterjee, a Republican who had frequently clashed with Glick. “Not easy to do on matters that are complex and contentious.”

The NOPR also won praise from groups including the American Council on Renewable Energy, Business Council for Sustainable Energy, Natural Resources Defense Council and Edison Electric Institute, which said it would get new wind and solar connected to the grid while adding resilience.

Glick “forged more consensus than people imagined possible on very tough and complex substance,” said Seth Kaplan, director of governmental and regulatory affairs at offshore wind developer Ocean Winds.

But the proposal also is a retreat from Order 1000’s drive to open transmission development to competition: It offers to give incumbent transmission owners a federal right of first refusal (ROFR) on regional projects on the condition that they partner with an unaffiliated company with a “meaningful level of participation and investment” in the project.

The commission said it was changing course because it feared that Order 1000’s removal of the federal ROFR may be “inadvertently discouraging investment” in regional transmission. Incumbent transmission providers “may be presented with perverse investment incentives” to instead engineer local transmission projects for which they retain development control, the commission said.

Regional transmission facilities subject to competitive procurements represent only a small portion of transmission investment in recent years, it said.

In Order 1000, the commission found that federal ROFRs create “a barrier to entry,” discouraging nonincumbent transmission developers from proposing alternative solutions that could be more efficient or cost-effective. But FERC’s order could not eliminate ROFRs authorized by state laws, and state legislatures in Iowa, Minnesota, North Dakota, Michigan, South Dakota and Texas have supported such protections for their utilities.

‘Practical Reality’

In regions with state ROFRs, “there’s not a practical opportunity for third-party transmission,” said Rob Gramlich, president of consulting firm Grid Strategies. “So, in some sense, I think the commission is just reflecting the practical reality.”

“Competitive transmission is like a 4.8-degree of difficulty in diving. Generation is way easier,” Gramlich continued. “There’s been a 40-year consensus on competitive generation. Not that we have it everywhere, but at least the economic policy is agreed to by every economist who looks at it. In transmission, it’s just harder and it hasn’t worked out well.”

Larry Gasteiger, executive director of WIRES, which represents utilities promoting grid investment, said the commission appeared to be prioritizing transmission development over competition.

“The bigger goal was getting the needed infrastructure built and put in place over other processes,” he said. “I think it’s an acknowledgement by the commission that competition — as it was set forth in Order 1000 and has been implemented for the last 10 years — really hasn’t been working in terms of getting needed transmission infrastructure built. … So we were pleased to see that there wasn’t a further expansion in that direction and, in essence, a doubling down on what wasn’t already working.”

Jeff Dennis, general counsel and managing director of Advanced Energy Economy, said the commission “is looking to build as many coalitions as possible that can move transmission forward.” AEE represents businesses favoring carbon-free energy and electrified transportation.

“Certainly, one could surmise that the commission is sort of offering this renewal of the federal right of first refusal in exchange for incumbents opening the opportunity to invest in transmission to more entities,” he added. “The commission … hasn’t made this kind of political calculation transparent, but one could imagine that is one thing they are trying to do.”

Ed Tatum, vice president of transmission for American Municipal Power (AMP), acknowledged Order 1000 had fallen short, but added, “I’m not sure if elimination of ROFR is the right solution.”

Instead, he said, FERC should adopt the planning process changes that AMP and others proposed in the PJM stakeholder process, which have been rejected by the commission. (See FERC Rejects Challenges to Decision on EOL Projects in PJM.)

AMP and its allies are pressing their case before the D.C. Circuit Court of Appeals. “I think we have a better solution,” Tatum said. “But it might take the courts to help FERC see that.”

Limited Regional Transmission Investments

In the NOPR, the commission indicated dismay that “despite increased investment in transmission facilities overall … recent transmission investment appears to be concentrated in local transmission facility development or regional transmission facilities subject to an exception from competitive transmission development processes, such as immediate-need reliability projects or upgrades to existing transmission facilities, as opposed to investment in regional transmission facilities.”

Although there has been wide acknowledgement that Order 1000’s efforts to open up competition have had only limited success, commenters in the docket were divided on how FERC should respond.

Some, including the California Public Utilities Commission, called for more competition. NRDC, Sierra Club and other public interest organizations said FERC should require transmission providers to plan for local transmission needs as part of the regional planning process. The National Association of Regulatory Utility Commissioners urged FERC to discourage overinvestment in local transmission facilities.

But EEI asked the commission to “remove the complex and costly competitive processes” that it said is delaying transmission development.

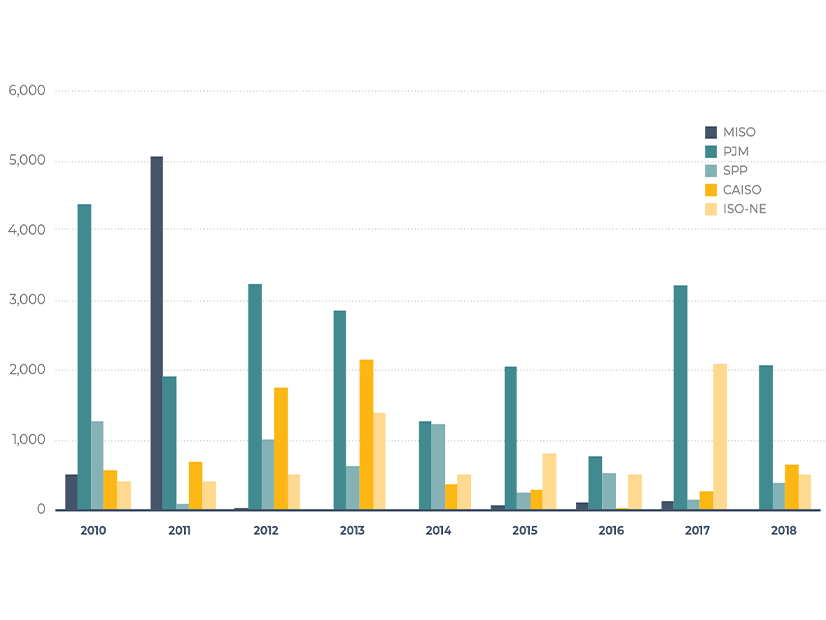

FERC noted investment in regionally planned transmission has declined in some regions, including PJM, which averaged $2.76 billion in annual spending on regional transmission from 2005 to 2013 and only $1.65 billion from 2014 to 2020.

Given the experience since the issuance of Order 1000 in 2011 and the comments it received in this docket, FERC said, it concluded that the order’s elimination of all federal ROFRs for new regional facilities “was overly broad,” resulting in “potentially flawed investment incentives that may be restraining otherwise more efficient or cost-effective regional transmission facility development.”

“Order No. 1000 failed to recognize that at least some of the most notable expected benefits from competitive transmission development processes (e.g., new transmission developer market entry, greater innovation in and potentially lower costs of transmission development) could be achieved or at least reasonably approximated through other means.”

Joint Ownership Proposal

ACEG’s Gramlich and others said they were intrigued by the proposal for joint ventures, a model they said has proven successful in MISO’s Multi-Value Projects and CapX2020, in which 11 transmission-owning utilities in Minnesota and surrounding states built nearly 800 miles of 345-kV and 230-kV transmission. In addition, LS Power Grid New York (formerly North America Transmission) teamed up with the New York Power Authority to win state approval for the New York AC project.

“The public power community has always advocated for more joint ownership,” Gramlich said.

AEE’s Dennis said enlarging the circle of those involved in planning and developing transmission “builds more and more support for determining that those projects are needed, brings in more sources of capital, including low-cost capital from not-for-profit, municipal entities and things like that. That helps move those projects forward.”

Dennis said there would likely be opposition, however, to a final rule that allowed “incumbent transmission owners being able to essentially ally with each other to exercise a right of first refusal.”

‘Right-sized’ End-of-life Replacements

While the commission’s retreat on the federal ROFR would be a win for incumbent TOs, the commission also proposed new procedures to increase transparency on the TOs’ local transmission upgrades.

The NOPR would require transmission providers to include in their long-term regional transmission planning an evaluation of TOs’ plans to replace aging transmission facilities of 230 kV and above to determine whether they “can be ‘right-sized’ to more efficiently or cost-effectively address regional transmission needs.”

It also expressed concern that local transmission planning processes may lack adequate transparency and stakeholder input, resulting in duplicative spending that increases costs for consumers. The commission noted that local transmission facilities are included in regional plans only as “inputs” for modeling of their reliability impacts, “with minimal opportunity for stakeholder review.”

“My initial read of it is it may not be a very dramatic change at all, in terms of how things are currently operating,” said WIRES’ Gasteiger. “Frankly, I think that’s pretty much being done in most regions right now.”

But Gramlich said it “could potentially be huge, particularly because we have so many transmission assets around the country that are well over 50 years old that will need to be replaced. And the practical limitations on developing new rights of way are so extreme that one of the best opportunities to expand capacity is to expand capacity over existing rights of way.”

Gramlich said there has been poor coordination between local and regional transmission upgrades.

“I’ve heard the heads of very large transmission owners in some of the RTOs say that it was working a lot better before Order 1000. Because it used to be that any upgrade they would identify on the local system, they would bring to the RTO, and the RTO would consider a more optimal regional solution,” he said. “And then Order 1000 came along with the requirement to competitively bid anything in the regional process, and that [coordination] largely shut down.”

Dennis said the change could be significant “if the transparency requirements are paired with accountability … meaning ultimately that there is a consequence to building more expensive, less-than-optimal options.”

AMP’s Tatum questioned the 230-kV cutoff. “There’s a whole lot in the [interconnection] queue I believe that is on transmission facilities below 230 kV,” he said.

Order 890 required that transmission providers’ local transmission planning comply with nine principles, including coordination, openness, transparency and information exchange. “However, implementation of these principles in local transmission planning processes appears to remain uneven,” FERC said.

The NOPR would require transmission providers hold at least three stakeholder meetings on each local transmission planning process: one on the criteria, assumptions and models used (Assumptions Meeting); a second on identified reliability criteria violations and other transmission needs (Needs Meeting); and last a review of potential solutions (Solutions Meeting).

Transmission providers would be required to evaluate whether any facilities rated at or above 230 kV that are planned for replacement during the next 10 years can be “right-sized” to more efficiently address regional transmission needs. “Right-sizing could include, for example, increasing the transmission facility’s voltage level, adding circuits to the towers (e.g., redesigning a single-circuit line as a double-circuit line), or incorporating advanced technologies (such as advanced conductor technologies),” FERC said.

Because the proposed rule would not change existing law allowing the incumbent TO to proceed with developing its planned in-kind replacement transmission facility without right-sizing, the commission said it would establish a ROFR for such facilities located within the utility’s retail distribution territory.

Only the incremental costs of right-sizing the transmission facility would be subject to regional cost allocation.

State Role

Dennis said he was pleasantly surprised by the commission’s effort to engage states in regional transmission planning and cost allocation. “I think that, paired with the requirements for much longer-term, multiple scenario-based planning, that [effort] really addresses the reality of what’s happening on the electric system and the resource mix changes that are occurring,” he said.

“By giving them that opportunity to engage up front, they are also giving the states the ability to really shape what regional transmission plans look like and to really say upfront, ‘These are things that we think will benefit our customers’ … instead of just having transmission be something that happens to them.”

The NOPR’s proposed requirement to seek state agreement on cost allocation “was a clear concession to Commissioner [Mark] Christie [R], as part of getting him on board,” Gasteiger said.

Gasteiger, who served in senior roles at FERC under Chairs Joseph T. Kelliher and Norman Bay, said it was essential that Glick won bipartisan support for such a sweeping rulemaking.

“On something of such potentially great significance … the commission [must] act on a bipartisan, if not unanimous, basis, and certainly not on a partisan basis, a 3-2 vote,” Gasteiger said. “And you don’t need to look any further than the pipeline certificate policy statement to see why that’s important.” (See FERC Backtracks on Gas Policy Updates.)

“I was glad to see that the commission made a strong effort to produce a bipartisan decision on this,” he continued. “It always involves a lot of compromise, and nobody gets exactly what they want. But it provides a lot more certainty to the industry and a lot more durability to the commission’s actions.”

After having praised the consensus-building, however, Gasteiger expressed some concern over the state role that helped win Christie’s vote.

“Generally speaking, more process doesn’t lead to getting more transmission built in a timely basis,” he said. “So the devil will be the details and in the implementation of what they’ve put in place. But I do have a concern with elevating or expanding the role of states in the process, and creating more process. What will that mean for actually getting transmission infrastructure built?”