The U.S. solar industry could lose nearly half its workforce — about 100,000 jobs — and planned installations will decline dramatically if the U.S. Commerce Department concludes that solar panels imported from four Asian countries are actually Chinese goods, the Solar Energy Industries Association (SEIA) said Tuesday.

The impact of the probe into solar panels from Cambodia, Malaysia, Thailand and Vietnam could cut the volume of solar installations forecasted to take place in 2022 and 2023 by 46%, resulting in a reduction of 24 GW of planned power, according to SEIA’s analysis of the sector. The decline could cause the U.S. to emit an additional 364 million metric tons of carbon by 2035 and jeopardize the clean energy goals of the Biden administration, the organization said in a release, as it also published the latest results.

The analysis is based on a survey of more than 700 industry companies. It provided a fresh reminder of the impact of the Commerce Department’s decision to launch an investigation March 25 into the origin of crystalline silicon photovoltaic cells imported from the four countries. The probe is scrutinizing whether the solar panels and related equipment are actually Chinese products shipped through those four countries to avoid anti-dumping and countervailing duties that would otherwise have to be paid by Chinese manufacturers. (See Solar Sector Braces for Tariff Probe Impact.)

The bleak picture offered by SEIA is the latest step in the organization’s aggressive effort to counter the investigation. On Wednesday, the effort included putting more than 50 senior solar executives on Capitol Hill to lobby government officials, an SEIA official told POLITICO.

SEIA and some solar developers say that the start of the investigation prompted manufacturers in the four countries to immediately reduce the volume of goods sent to the U.S., diverting them to other countries, out of fear that they would face retroactive U.S. tariff increases if the department concludes that circumvention took place. That has resulted in equipment shortages and delays, and price hikes, developers say.

NextEra Energy (NYSE:NEE), a major investor in wind and solar projects, told investors on an April 21 earnings call that 2.1 to 2.8 GW of the company’s solar and storage projects could be delayed until 2023 because suppliers are not shipping panels while they wait for the Commerce Department’s decision. After the statement, the company lost about 10% of its market value. (See NextEra Shares Tumble on Solar Supply Woes.)

CFO Kirk Crews said the company believes it will be “difficult” for the Commerce Department to conclude that solar panels from the four countries are circumventing tariffs, based on the department’s past analysis of the sector. For this and other reasons, the company is “optimistic” that the department will rule “favorably” and will not impose additional tariffs, he said.

“However, given that a number of suppliers are not expected to ship panels to the U.S. until the Commerce Department makes a preliminary determination as late as August, we continue to expect some of our solar and storage projects may be adversely impacted by this delay,” he said, according to a transcript of the earnings call published by Seeking Alpha.

In an earnings call Wednesday morning, Entergy (NYSE:ETR) CEO Leo Denault spoke of near-term cost and schedule pressures. “Supply chain constraints [are being] further exacerbated by the [investigation], which we expect will lead to further delays and cost increases. We are continuing to work through these constraints and are executing on our solar expansion plan.”

Future Hard Times

SEIA based its conclusions on the potential industry impact on a scenario in which the Commerce Department concludes that circumvention took place and places new tariffs of 50 to 250% on imports from the four countries.

“This case is destroying clean energy and needlessly taking down American businesses and workers in its wake,” said SEIA CEO Abigail Ross Hopper, who called the predicted job reduction “a monumental loss.”

“The Commerce Department is on track to wipe out nearly half of all solar jobs and force a surrender on the president’s climate goals,” she said.

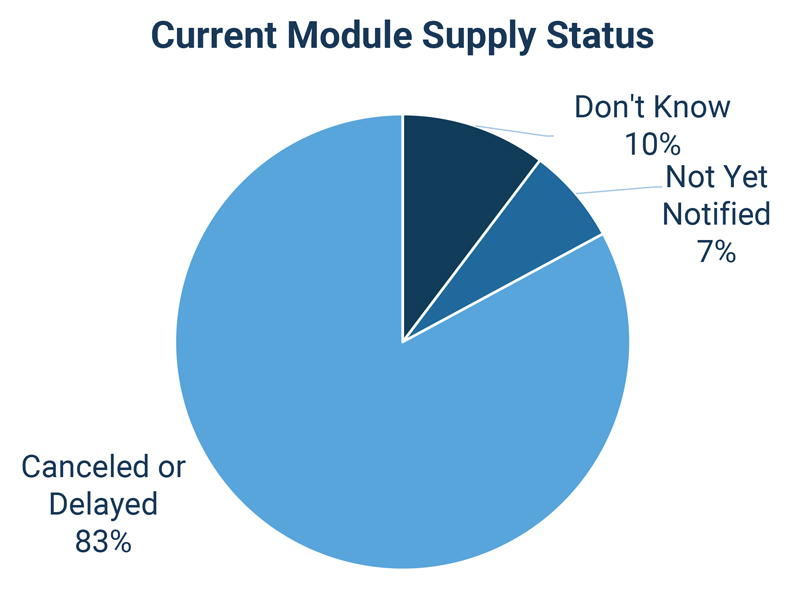

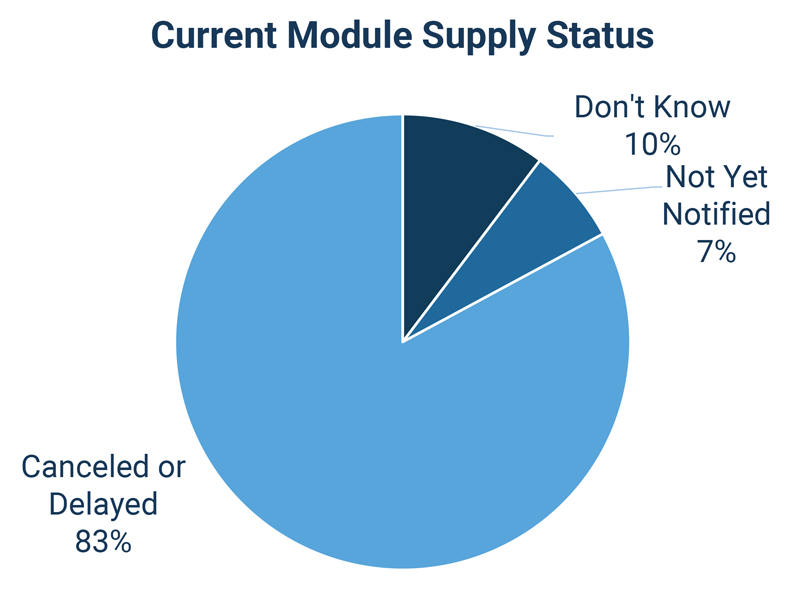

More than 4/5 of survey respondents reported canceled or delayed procurement of solar panels. | SEIA

More than 4/5 of survey respondents reported canceled or delayed procurement of solar panels. | SEIA

The survey found that 83% of respondents said that their “expected module supply has been delayed or canceled.” Slightly more than 50% of the respondents said they expect a “devastating negative impact” on their businesses from the investigation, and slightly less than 40% said they expect it to have a “severe negative impact.”

More than 200 respondents said that their “entire solar and storage workforce is at risk” because of the investigation, and 70% of respondents said that at least half of their solar and storage workforce was at risk. Eighty percent of respondents said that at least half of their current year solar pipeline is at risk.

SEIA said that even the domestic crystalline silicon module production sector had suffered from the investigation, because “nearly half of all cell imports came from the four target countries” in 2021. Cell imports have fallen since the probe began, the organization’s report said.