MISO’s financing options for transmission system upgrades on merchant HVDC lines are not on equal footing with those for interconnecting generators, and therefore not subject to the RTO’s self-fund order, FERC said last week in a ruling that could save transmission developers millions.

The April 29 ruling pertains to the commission’s 2019 decision that restored transmission owners’ option to unilaterally self-fund network upgrades before the interconnection customers are offered the chance to finance them. FERC said the initial funding option cannot be extended to upgrades needed for merchant HVDC lines because those developers aren’t offered the same array of financing options as generation developers under some circumstances. (ER22-477).

Commissioner James Danly dissented, claiming his fellow commissioners’ decision rested on a technicality.

Since the 2019 order, MISO has been revising past interconnection agreements for TOs who wanted to have first crack at initial funding of network upgrades. (See FERC Accepts Documents in MISO TOs’ Self-fund Selection.)

In late 2021, MISO filed to extend the self-fund option to transmission owners building upgrades to accommodate merchant HVDC lines. The RTO argued that “both types of connections result in upgrades on the MISO transmission system.”

MISO transmission owners agreed that merchant HVDC line-related upgrades should be treated comparably with generator interconnection-related network upgrades. The MISO TOs said they saw no meaningful difference between the two types of projects because both require TOs to install and maintain upgrades that would not be needed but for the projects.

Clean energy organizations, including American Clean Power Association and Clean Grid Alliance, banded together to protest the self-funding expansion. They said the filing “rests on an unproven assertion of comparability” between the two types of upgrades. They said facilities needed for merchant HVDC are developed under a different business model, and a TO self-funding option — which would subject HVDC developers to a TO rate of return rather than a market-based interest rate — could cause upgrade costs to balloon.

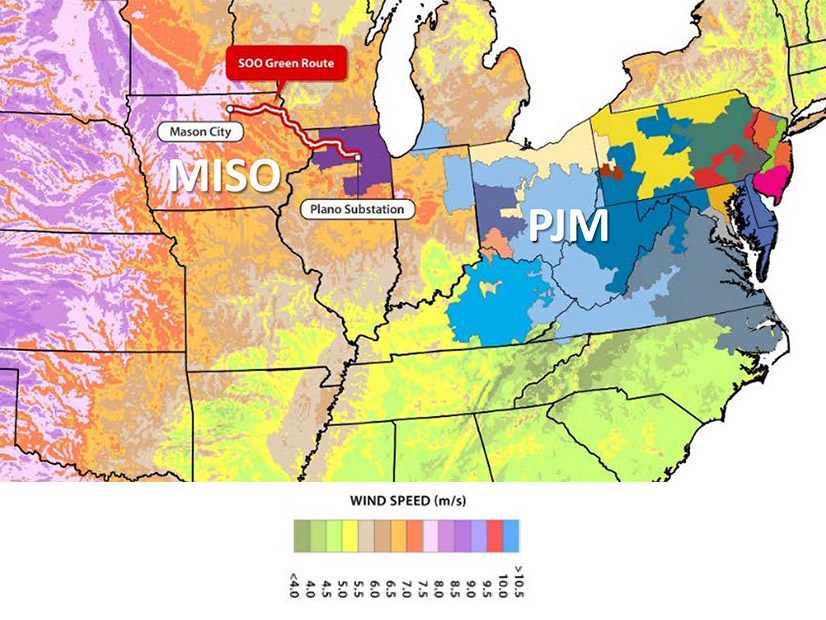

SOO Green HVDC Link, which is developing a 350-mile HVDC line running along corridors from Iowa to Illinois, contended TO financing could cause upgrade costs to increase by 30-40%, meaning a merchant developer with $100 million in upgrades could be charged tens of millions more at the higher rate of return.

The clean energy group also said MISO’s proposal would introduce discriminatory treatment between merchant HVDC-to-transmission owner interconnections and transmission owner-to-transmission owner interconnections “even though all such facilities will be operated as part of an integrated grid.”

FERC’s decision, however, rested on the differing financing option available for the two types of upgrades rather than material differences between the upgrades themselves.

MISO failed to show how the expansion of TOs’ self-funding option to merchant HVDC lines wasn’t discriminatory or preferential, the commission decided.

MISO could not insist that the upgrades are “functionally identical” when it doesn’t offer all available funding options to merchant HVDC developers when they haven’t secured injection rights, FERC said. MISO doesn’t include an option to build or liquidated damages provisions in transmission connection agreements for merchant HVDC developers without injection rights, or a pre-certification from MISO that its system can handle the capacity and energy the line plans to deliver. MISO allows merchant HVDC lines to connect to the system without injection rights, but those lines are considered non-firm and the upgrades to accommodate the line are classified as necessary upgrades instead of network upgrades. “MISO created the category of necessary upgrades because it believed that necessary upgrades would be necessary simply for a physical connection between the MHVDC transmission line and the MISO transmission system and thus would likely be limited in scope,” FERC explained.

MISO’s option-to-build safeguard allows interconnection customers to take over construction of network upgrades when a transmission provider cannot meet pre-negotiated milestones. The liquated damages provision lets an interconnection customer collect damages when a transmission provider lags in completing upgrades.

FERC also said while MISO characterized its filing as simple housekeeping related to the 2019 self-fund order, the grid operator was actually expanding TO initial funding “into new areas” of its tariff where the option hasn’t historically existed. The commission pointed out that its 2019 self-funding order did not address merchant HVDC upgrades.

In his dissent, Danly said the commission’s decision “denies the transmission owners’ right to receive a return on and of the capital costs of network upgrades, necessary upgrades, and transmission owner system protection facilities.”

Danly pointed out that FERC has accepted TO initial funding provisions for merchant HVDC upgrades in other areas of the country.

“…[A]bsent some evidence to the contrary, MISO’s proposed tariff revisions bear all the hallmarks of relatively minor improvements to a tariff already deemed just and reasonable,” Danly wrote.