MISO and SPP staff on Friday told stakeholders that this year’s coordinated system plan (CSP) study will focus on “potential solutions to historical, persistent congestion issues” on the RTOs’ seam.

The study, which is not dependent on other regional or interregional planning processes, will analyze historical market-to-market (M2M) congestion problems and look for transmission solutions that benefit both grid operators.

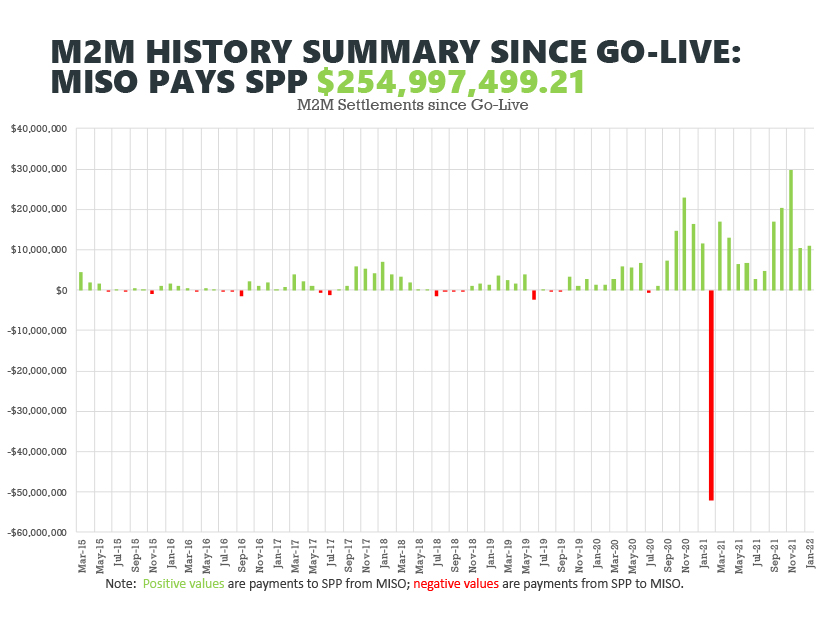

The M2M process has resulted in SPP accruing almost $255 million in settlements from MISO since the RTOs began it in March 2015. Under the process, the grid operators exchange settlements for redispatch based on the non-monitoring RTO’s market flow in relation to firm-flow entitlements.

“We’re looking at sort of near-term planning horizon,” MISO’s Ben Stearney told the Interregional Planning Stakeholder Advisory Committee (IPSAC). “We want to target solutions that can be implemented quickly. So really, we’re not looking for large expensive, greenfield projects. We’re targeting kind of a low-hanging-fruit, quick-hit type of projects.”

In their scope document, staff said they have been jointly exploring ways to address M2M congestion where a long-term planning horizon study “may not effectively capture certain existing day-ahead or real-time market conditions.” They raised the concept of a targeted market efficiency project, similar to that conducted by MISO and PJM, before formally agreeing to use the process in the CSP. (See MISO, SPP Take on 2nd Interregional Planning Effort.)

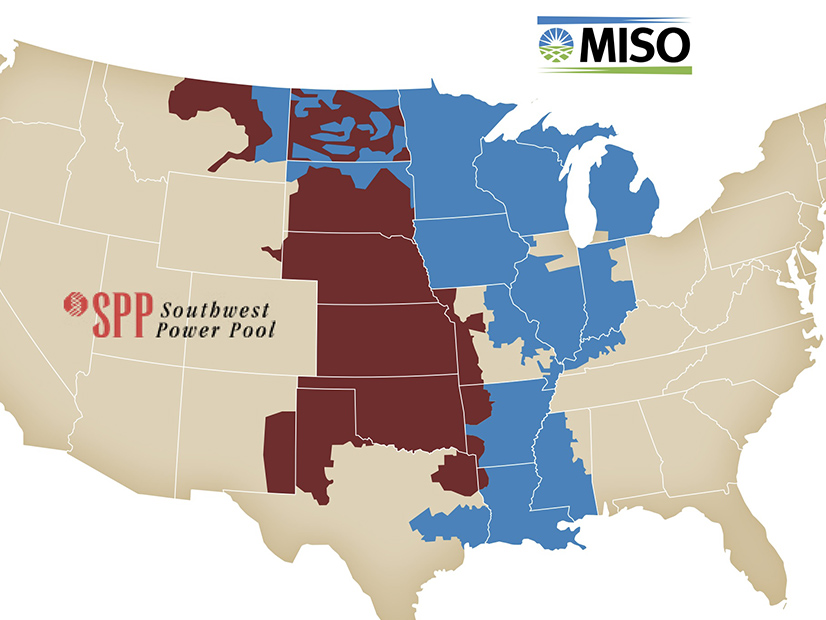

MISO and SPP seams | MISO and SPP

MISO and SPP seams | MISO and SPP

The RTOs’ staffs hope to develop a repeatable process to effectively study persistent congestion on the seam, including a set of appropriate project criteria for inclusion in their joint operating agreement’s (JOA) language. They also plan to recommend transmission upgrades using a yet-to-be-determined cost allocation methodology.

The grid operators’ JOA requires a CSP be conducted every couple of years to find interregional projects. However, previous, more comprehensive studies have come up empty over cost allocation issues. The MISO-SPP Joint Planning Committee, comprising representatives from each RTO, agreed in March to pursue the new study process.

Asked whether the CSP analysis might find projects that have already been identified by the RTOs’ long-term transmission planning efforts already underway, Stearney said those latter studies have longer lead times.

“I don’t see that as an issue,” he said.

WEC Energy Group’s Chris Plante offered his company’s support for the CSP study.

“I think when we look back at the process that MISO and PJM followed when evaluating targeted market efficiency projects, I think we found that to be a very successful process in terms of identifying extremely near-term, low-dollar cost upgrades that can address some of this congestion,” he said.

The RTOs are working to compile two years of historical M2M data and establish a list of candidate flowgates for consideration. They intend to develop the study process and complete the initial assessment this year. However, they pointed out, because the study will require JOA updates to formally recommend any resulting projects, the final tariff language and FERC filings are not expected to be completed until midway through 2023.

Staff will wait until next year to begin the always sticky development of regional cost allocation.

Future IPSAC meetings are scheduled for July 22 and Sept. 23. Additional meetings will be held as needed while the study progresses.