SPP’s plan to develop an electricity market to compete with CAISO’s Western Energy Imbalance Market is getting another boost from the region’s industry players, this time from a key group of utilities and energy customers in the Pacific Northwest.

The support came in the form of an open letter issued May 5 by the Public Power Council (PPC), which represents 85 “preference” customers of the Bonneville Power Administration that account for 70% of the federal power marketing agency’s $3.9 billion in revenues. The group’s members include Seattle City Light, Tacoma Power, Eugene Water & Electric Board, Port of Seattle and Grant County (Wash.) PUD, among many others.

In the letter, PPC announced its members were throwing their weight behind an initiative by Western utilities that said last month that they will help develop SPP’s Markets+ platform as a way to evaluate the effort against CAISO’s proposed extended day-ahead market (EDAM) for the WEIM. (See Western Utilities to Support SPP Market Development.)

“The deployment of an integrated real-time and day-ahead market is a very significant undertaking,” the PPC said. “Any market alternative must be carefully considered to ensure all design objectives are properly met without undue adverse effects. The ability to evaluate two fully-formed day-ahead market options, where both the market design and market governance have been developed, will ensure that entities are able to make an informed decision on the option that provides the best step forward for their customers.”

The 15 original utilities, a handful of which are PPC members, said they would be “dedicating key staff” to participate in the Markets+ initiative over the next year and “working collaboratively with SPP and other stakeholders towards the design of a governance framework and conceptual market design proposal,” expected to be completed by the end of the year.

PPC said it has already committed “significant staff resources” to CAISO’s EDAM effort and would continue to do so, while also contributing to the SPP effort.

“PPC members are committing to having productive discussions with other stakeholders to develop the best possible market opportunities. Sharing this commitment along with PPC members’ collective objectives is an initial step in that discussion,” Lauren Tenney Denison, PPC director of market policy and grid strategy, told RTO Insider in an email.

Among those objectives is a long-term solution that “maximizes” the group’s three priorities, according to the letter:

- a reduction in future costs for preference customers “by reducing net power supply costs and providing just compensation for all relevant attributes of the federal system;”

- a market that maximizes “efficient operation” of the federal transmission system and enables its expansion; and

- ease of integration of carbon-free resources.

“At the same time, an acceptable market must operate within several parameters,” the PPC said. “First, it must maintain or enhance grid reliability. Second, it must preserve our statutory rights to cost-based federal service. And finally, it must have a strong and effective independent governance structure that does not unduly discriminate in favor of or against specific market participants.”

Asked to clarify how an organized market could aid in expanding the federal transmission network in the Northwest, Tenney Denison said: “The potential that a market could send additional price signals on where BPA could most effectively invest in transmission could be helpful to encourage that responsible expansion. If larger conversations develop on a potential Regional Transmission Organization, this will create additional opportunity and potentially additional risk for the preference customers, given the comparatively low cost of BPA transmission today.”

Critical Role for BPA

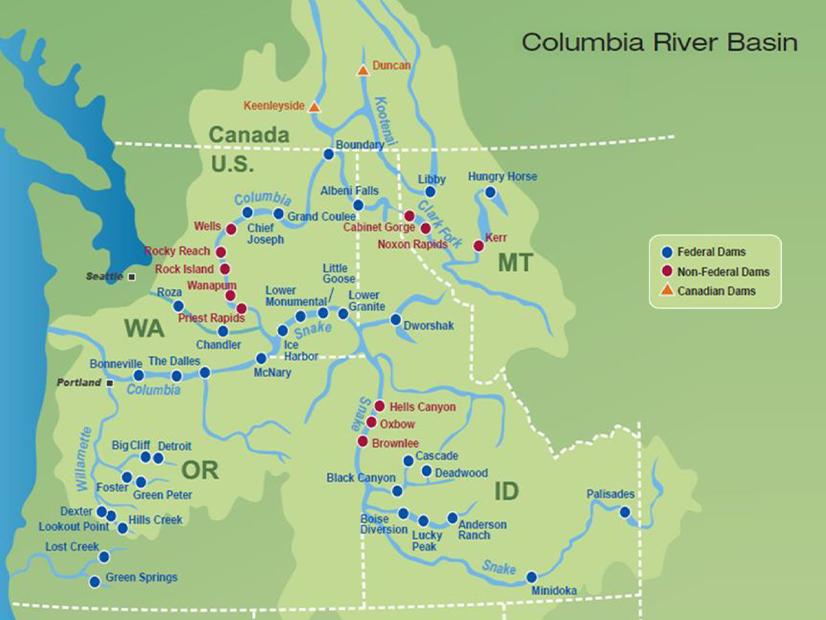

The PPC’s letter also shed light on other specific issues compelling its members to explore market development, not least of which is the looming termination of their 20-year cost-based power contracts with BPA in 2028, which will soon be subject to renegotiation. Under federal law, the Northwest’s publicly owned utilities are entitled to electricity generated by the Federal Columbia River Power System (FCRPS), but they are not guaranteed specific rates for that electricity, which can vary based on how BPA meets its own revenue requirement. Higher sales of surplus power or transmission capacity can translate into lower rates for the agency’s preference customers.

“We remain committed to exploring organized market options that develop in the West to assess whether an option exists that appropriately values the attributes of the FCRPS and provides net benefits to BPA customers,” the group said.

The PPC encouraged other Western stakeholders — and “especially BPA” — to participate in the market exploration effort. Tenney Denison said BPA’s role as operator of the “backbone” of the Northwest grid means “the agency’s ability to facilitate an integrated market across the Northwest will be critical to that market’s success.”

BPA began trading in CAISO’s Western EIM just last week, the culmination of a nearly four-year stakeholder effort to reach a decision on membership and prepare the agency’s customers for market participation. (See BPA, Tucson Electric Power Enter Western EIM.)

Tenney Denison said that with BPA now participating in the EIM, PPC will “continue to work with the agency to understand the impacts that participation is having on the preference customers, including the cost and reliability of the services that they receive from BPA. PPC worked with BPA to develop metrics which the agency will use to report on its participation in the EIM and we plan to continue to engage with agency staff in the coming months to better understand the agency’s performance in the EIM, as well as any lessons learned which may be applicable for a day-ahead market.”