SPP staff said last week they are conducting internal discussions on how they manage MISO constraints in their RTO’s day-ahead market as part of their market-to-market (M2M) process.

Clint Savoy, SPP senior interregional coordinator, told the Seam Advisory Group on Friday that the MISO Independent Market Monitor’s recent comments on SPP’s M2M management has caused staff to review their processes.

“We’re doing an assessment on the impacts of changing our process and evaluating the impacts on price convergence of market-to-market settlements … the impact on uplifts and virtual payments,” he said. “We want to understand the impact of the changes before we make those changes.”

Savoy said members should expect more detailed presentations on the issue coming to the group and SPP’s Market Working Group.

MISO Monitor David Patton said last month that SPP is not properly recognizing M2M flowgate constraints with its seam neighbor in its day-ahead market. Patton told a MISO stakeholder group that the oversight must be costing SPP members several million dollars in balancing congestion. (See MISO and SPP Announce New Interregional Stakeholder Meetings.)

SPP has said that it does model MISO’s system and constraints in the day-ahead market and that it believes the market should best reflect expected real-time operating conditions and not necessarily create day-ahead congestion based on calculated firm flow entitlement (FFE) values.

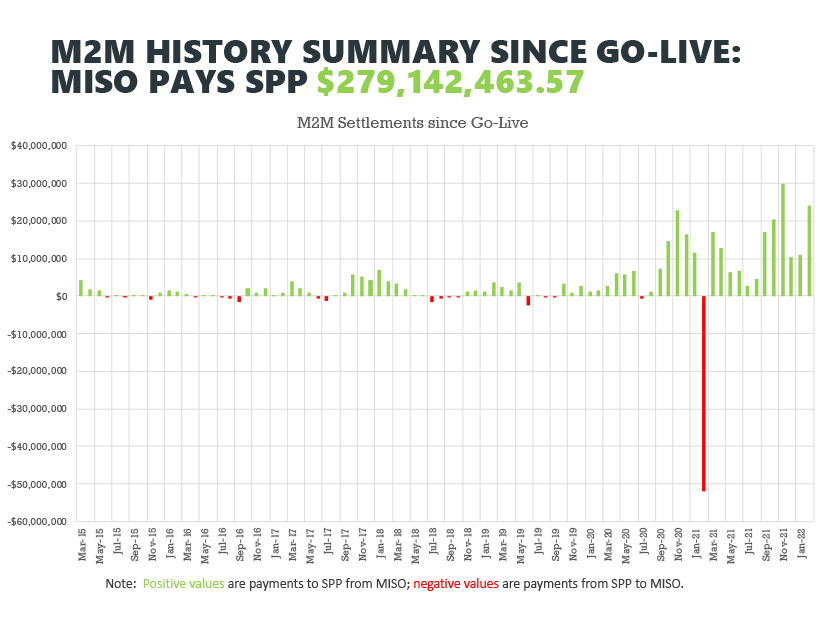

The discussion came as SPP accrued another $24.1 million in M2M settlements from MISO during February, its second-highest monthly total since the process began in March 2015. That pushed the amount MISO owes its neighbor for congestion to $279.1 million.

Temporary flowgates accounted for $18.4 million in settlements during the month, binding for 2,064 hours. The two grid operators exchange settlements for redispatch based on the non-monitoring RTO’s market flow in relation to FFEs.

It was the 12th straight month M2M settlements have accrued in SPP’s favor and the 27th time in the last 29 months. SPP has piled up nearly $180 million in settlements since September 2020, despite more than $50 million in settlements to MISO during the severe winter storm in February 2021.

New Members Welcomed

The SAG welcomed three new members: ITC Holdings’ Raju Brahmandhabheri, Arkansas Electric Cooperative Corp.’s Rick Running and the American Clean Power Association’s Daniel Hall, a former member of the Missouri Public Service Commission.

American Electric Power’s Jim Jacoby, the group’s chair, welcomed the diversity the new members bring in representing their companies’ differing interests.

“I think it brings a different perspective to some of the issues that we’re dealing with,” he said, “So, thank you for putting your name into the hat and being part of the team.”

Staff gave the new members an overview of the different initiatives SPP and MISO are currently working on together. The newly created Common Seams Initiative met today, and the RTOs’ staffs this Friday plan to share a “very substantive” cost allocation proposal for their Joint Targeted Interconnection Queue study.