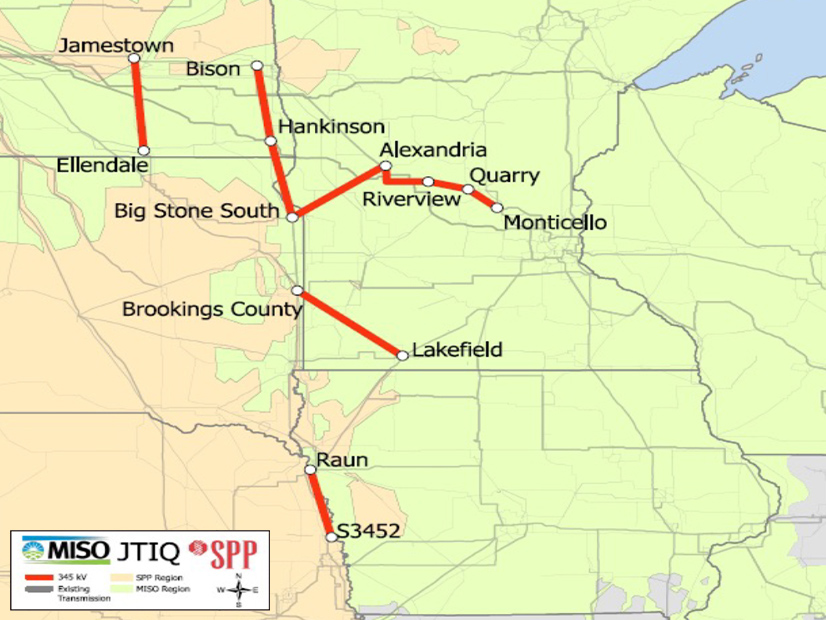

MISO and SPP said Friday they plan to ditch their current affected systems study process for more interregional transmission analyses like their joint targeted interconnection queue (JTIQ) transmission effort.

The RTOs announced the transition to more transmission planning at the seams to allow generation interconnections during a conference call Friday.

“Essentially, we’re proposing a framework … whereby we believe the JTIQ and subsequent studies could serve as a replacement for the affected system studies,” SPP Director of Seams and Tariff Services David Kelley told stakeholders.

Kelley said for the current $1.65 billion JTIQ portfolio and other transmission studies to replace affected system studies, the new studies should occur at least every two years. He also said the grid operators’ proposal is proactive when considering FERC’s advanced notice of proposed rulemaking to improve transmission planning, cost allocation and generator interconnections (RM21-17). (See FERC Issues 1st Proposal out of Transmission Proceeding.)

“We’ve been listening to stakeholders over the last several months,” Kelley said. “MISO and SPP have reflected on these comments and concerns. … The affected system study process (AFS) is problematic, even from our perspective of administering these studies.”

Kelley said MISO and SPP have come to regard the AFS process as “a separate layer of inefficiency.”

“We need to design a more optimized transmission system around these seams,” he said.

While conducting the JTIQ study, Kelley said, MISO and SPP have noticed several similarities to the AFS: they detect the same constraints, seek to bring more generation online through transmission construction and dole out cost assignments for system upgrades to interconnecting generation.

The RTOs are attempting to distribute JTIQ portfolio costs based on the projects’ beneficiaries, including their respective loads, and a share to interconnection customers on either side of the seam whose generation will flow between the footprints. They have also said they might assign costs based on added benefits like increased flows or more economic dispatch. (See Now, the Hard Part: MISO, SPP Tackle JTIQ Cost Allocation.)

The grid operators have kicked around using a per-megawatt charge to allocate costs based on the interconnecting generation distribution factor’s effect on the JTIQ portfolio.

MISO and SPP intend to replace the AFS’ upgrade costs with the predetermined cost per megawatt

Kelley said, “more generation can afford to interconnect” under the new flat fee because it “eliminates unknown cost exposure from other RTOs.”

SPP’s Neil Robertson said the RTOs will determine the per megawatt charge for new generation based on the first JTIQ portfolio and refresh the amount in subsequent interregional transmission planning cycles.

“I just don’t want to see a situation where the charge escalates until load ends up holding the bag,” Adam McKinnie, chief regulatory economist for the Missouri Public Service Commission, said of the fluctuating charge.

Stakeholders appeared to approve replacing the AFS, even though the RTO staffs admitted they still must work through several details.

“At a high level, I think this is a good step … and needs to happen to produce higher levels of certainty early on at the beginning of the process instead of the end,” Advanced Power Alliance’s Steve Gaw said.

“It’s a creative proposal, and I think it has the potential to introduce more timing certainty and cost certainty,” Clean Grid Alliance’s Natalie McIntire said.

But multiple stakeholders pointed out that the JTIQ study and cost-allocation design remains untested and unproven.

EDF Renewables’ Arash Ghodsian said he is worried that MISO and SPP might not be able to adhere to a biennial schedule.

“It is concerning that MISO and SPP spent two years evaluating this portfolio,” Ghodsian said.

Robertson said the RTOs envision the JTIQ becoming “a more enduring process” that’s conducted on a regular basis.

Under the proposal, the grid operators said they will likely create a “JTIQ affected system zone,” where they identify new transmission facilities near their seams that are likely to be impacted by their neighbor’s generation-interconnection requests. Nearby interconnecting generators will be assigned the per-megawatt charge based on their zonal impact. Staff said the zonal charge will be adjusted prospectively based on successive JTIQ studies.

Gaw said assigning costs to generators based on their zone seems like “rough justice.”

Kelley said the zonal method would eliminate individual developers depending on other higher-queued interconnection customers’ upgrades to get their own projects online.

Rafik Halim of National Grid Renewables asked how the RTOs will transition existing projects working their way through the respective queues to the new JTIQ charge. He said he was particularly concerned about the projects cycles that entered the MISO queue in 2018 and 2019 and have yet to receive AFS results from SPP.

“We have projects that are effectively being held hostage by an affected system study process,” he said.

Kelley said MISO and SPP have yet to work through a transition plan, but he said they will continue processing their queues until the new system can take effect.

“What MISO and SPP can’t afford to do is to put on hold any of our current study processes,” Kelley said.

The RTOs promised more meetings on the proposal beginning next month.

MISO Director of Resource Utilization Andy Witmeier asked stakeholders to provide their input on the proposal

“We want to really see if this new avenue is worthwhile,” he said.