MISO members began an email vote last week on whether to recommend MISO’s $10 billion long-range transmission plan to the Board of Directors as staff made final pitches for the project portfolio.

The members’ advisory vote was originally slated to take place during a special Planning Advisory Committee (PAC) teleconference Friday, but some requested voting by email.

Voting will conclude June 6. The $10.3 billion, 345-kV package will then advance to the board’s System Planning Committee for its consideration. The full board will hold a final vote on the portfolio in July.

Presenting the long-range transmission plan’s (LRTP) business case to board members on Thursday, Vice President of System Planning Jennifer Curran said the plan is “critical” to MISO serving load as the footprint transitions to a new resource mix.

Curran called the initial search for long-range projects “one of the most if not the most complicated studies” MISO has ever undertaken. She said staff have been studying the transmission “in earnest” since 2020.

“That seems like a long time, but it’s really quick considering the amount of transmission analysis and the magnitude of it. … It’s been a lot in a short amount of time,” she said.

Curran said the package is MISO’s “least-regrets” assembly of projects based on a “conservative view” of members’ clean energy and decarbonization goals. She said staff will soon begin studying the LRTP’s second phase of possible projects “because the world continues to change aggressively.” That portfolio will contemplate a more rapid resource evolution and could yield projects with higher voltages than 345 kV.

MISO plans to continue monthly stakeholder workshops to discuss the second batch of LRTP solutions.

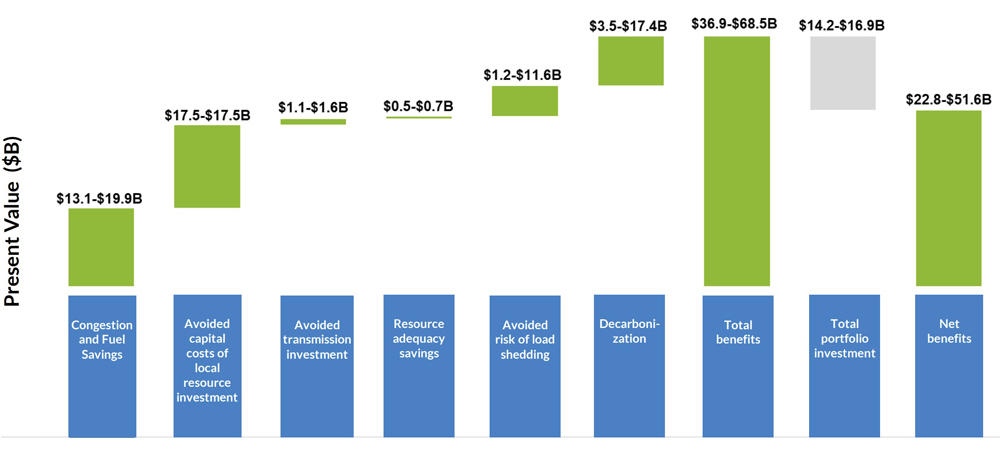

The RTO said its first portfolio will mitigate future excessive loading on existing lines and prevent possible voltage collapse across the Midwest. It anticipates the LRTP portfolio will yield anywhere from $23 billion to about $52 billion in financial benefits over 20 to 40 years of the projects, a 2.6:1 overall benefit-to-cost ratio. The grid operator estimates Midwestern cost-allocation zones will see cost-to-benefit ratios ranging from 2.1:1 to 3.2:1.

During the PAC teleconference, Clean Grid Alliance’s Natalie McIntire said MISO’s benefit estimates are cautious and said there are likely more unquantified benefits, especially reliability improvements.

The RTO has reduced the portfolio’s costs to $10.32 billion from $10.38 billion. It expects the 20- to 40-year present value of the projects’ total revenue requirement to range from $14.2 billion to $16.9 billion.

“Some of the projects increased in cost, some decreased in cost,” Jarred Miland, senior manager of transmission planning coordination, said. He said the portfolio is targeted to be in service by 2030, but that final in-service dates and costs are still subject to change.

MISO’s Joe Reddoch said staff will monitor long-term inflation trends and update cost projects if inflation materially affects construction costs.

Making Use of Existing Routes

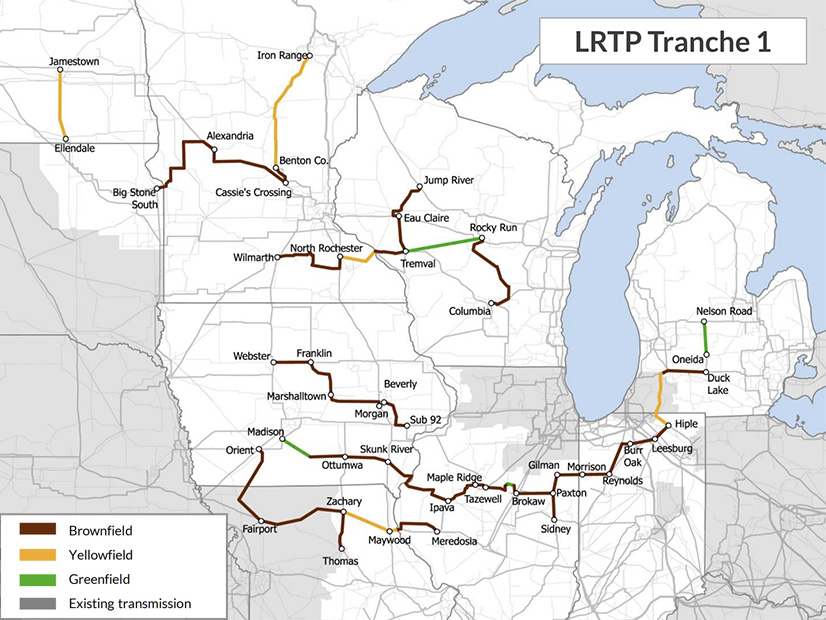

Aubrey Johnson, the grid operator’s vice president of system planning and competitive transmission, said about 90% of the first LRTP portfolio will use existing and adjacent rights of way, or “yellow fields.” He said the planning team paid careful attention to where transmission lines could use existing rights of way.

“We think this will be a significant contributor to the speed of the regulatory process,” he said.

Director Nancy Lange, a former Minnesota commissioner, asked whether MISO expects any of the projects to be delayed or rejected by state regulators.

Johnson said though all state regulatory processes are different, using existing transmission routes should maximize the projects’ prospects.

MISO President Clair Moeller said states realized that the grid operator’s last long-range transmission projects in 2011 worked as a portfolio and were “quite responsive” to the proposal. He acknowledged that the Cardinal-Hickory Creek line remains in legal limbo a decade later over a planned river crossing route in Wisconsin. (See Enviro Groups Push Wis. DNR to Scrutinize Cardinal-Hickory Creek Line.)

However, Minnesota Public Utilities Commission staffer Hwikwon Ham warned during an earlier Market Subcommittee meeting last week that the first LRTP portfolio could temporarily increase the already high congestion levels because construction will be carried out very close to existing lines in the footprint.

OMS Hears Different Benefits Perspective

The Organization of MISO States recently hired an engineering firm to conduct an independent review of the LRTP, which the firm called a “comprehensive assessment.”

RLC Engineering’s Rick Conant said during an April OMS board meeting that the first cycle of projects doesn’t resolve all of MISO’s overloading issues. He said more thermal fixes would likely arrive with the second cycle of long-range projects.

However, RLC said it arrived at a 1.4:1 B/C ratio for the first group of projects, smaller than MISO’s overall projection of 2.6:1. The firm’s Waine Whittier said despite the findings, the projects still are beneficial to pursue.

OMS has not made the RLC study public, though its members have discussed the results in open meetings.

Competitive Bidding Question Remains Open

MISO will release a draft list of long-range facilities that will be considered for competitive bidding by June 1. Johnson said staff are still analyzing “the competitive landscape.”

Also last week, the RTO made a FERC filing to change its competitive transmission process to exclude “short segments and conductor-only” work from competitive bidding eligibility (ER22-1955). Brian Pedersen, senior manager of competitive transmission administration, said some smaller projects will be necessary to accommodate the long-range projects and “are not best suited for competition.”

Some members said they were taken by surprise that MISO would file the tariff changes without first consulting the stakeholder community.