NYISO’s Market Monitoring Unit is recommending a new capacity market pricing structure that it says would lower costs and improve incentives for market participants making long-term investments.

Presenting highlights of the Monitor’s 2021 State of the Market Report to the Management Committee on Wednesday, Potomac Economics’ Pallas LeeVanSchaick said that the current processes for setting the installed reserve margin (IRM) and locational capacity requirement (LCR) “aren’t well coordinated with each other.”

“It is not possible for the NYISO to address the concerns discussed above in a piecemeal fashion,” the report says.

It proposes to institute an overhauled capacity market pricing structure, dubbed locational marginal pricing of capacity (C-LMP).

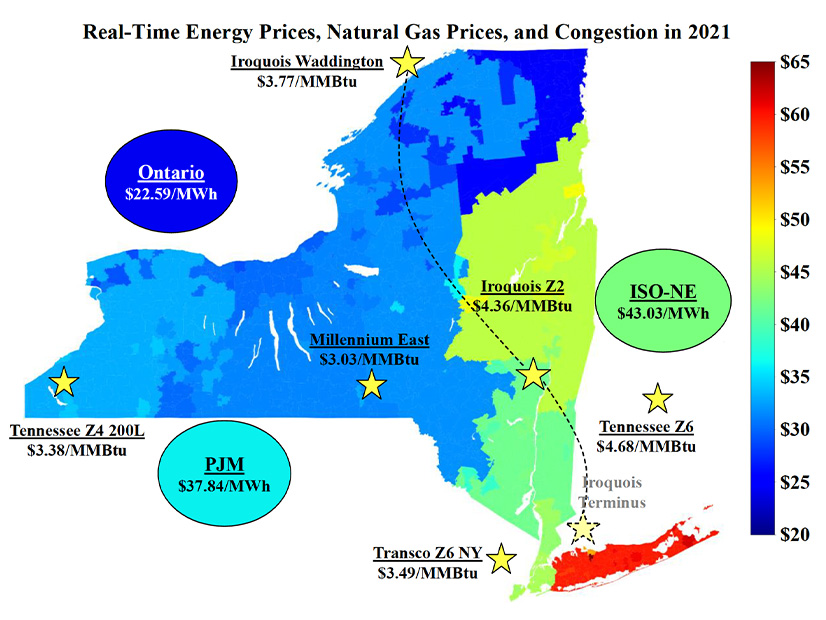

The market has just four fixed pricing regions, so when transmission constraints arise within one, it can lead to inefficient results. For example, in recent years the Monitor has observed bottlenecks going into Western New York capacity zones from Central New York zones, and from Staten Island into the rest of New York City, that are not represented by the current capacity zone configuration, the report said.

“We’ve seen that the lack of a treatment of constraints upstate has accentuated some of the fluctuations in the IRM and LCRs,” LeeVanSchaick said. In addition, “the LCR optimizer has a flawed objective function. … It’s not only that it doesn’t find an efficient solution; it’s also problematic because there are aspects of it [overly sensitive to small changes in inputs] that contribute to more volatility in the requirements.”

These constraints can be a barrier to entry for new resources, which are required to pay for transmission upgrades to receive capacity rights if they are not fully deliverable throughout their entire capacity region. Offshore wind and battery projects in Long Island were recently assigned costly deliverability upgrades that are not required of incumbents that are limited by the same constraints, the report said.

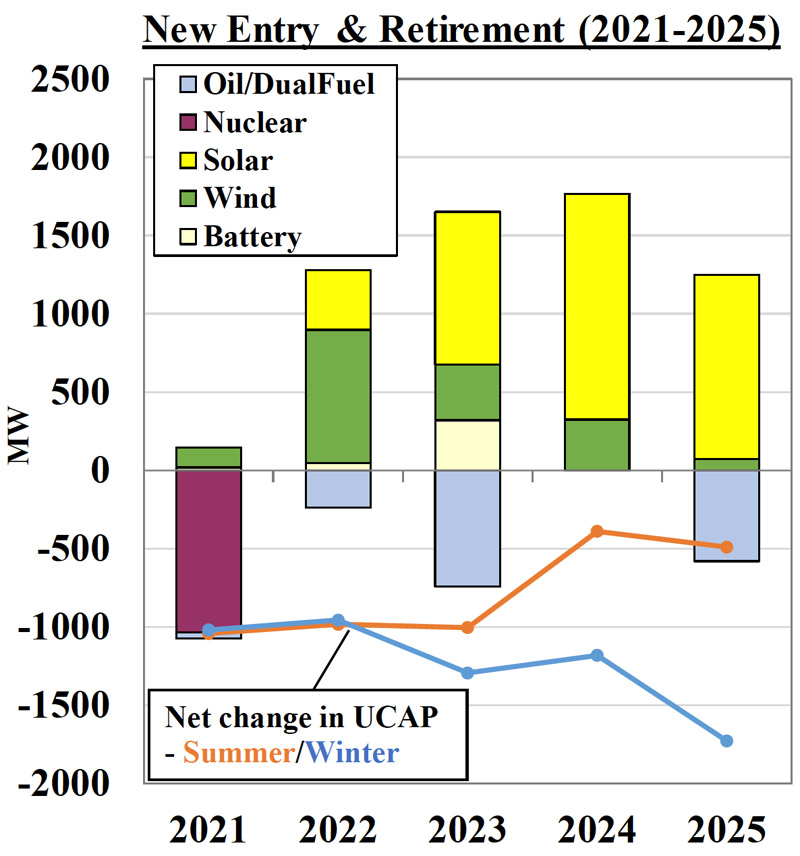

Potential new entries include intermittent renewables principally motivated by REC solicitations and potential retirements include a number of dual fuel peaking units leaving through 2025. | Potomac Economics

Potential new entries include intermittent renewables principally motivated by REC solicitations and potential retirements include a number of dual fuel peaking units leaving through 2025. | Potomac Economics

The report says C-LMP would:

- “produce more granular prices that are better aligned with NYISO’s planning criteria;

- be more adaptable to changes in resource mix and transmission flows;

- remove unnecessary barriers to new entry in the interconnection process;

- be less burdensome for the ISO to administer; and

- reduce the overall costs of maintaining reliability.”

“There are some emerging concerns that we see with potential new entry and retirements,” LeeVanSchaick said. “On the new entry side, of course, it’s a lot of intermittent renewables that are principally motivated by [renewable energy credit] solicitations, and on the potential retirement side you have of course Indian Point 3 in 2021. But then you’ve also got a number of dual-fuel peaking units leaving as well through 2025.”

Price Trends

All in price trends | Potomac Economics

All in price trends | Potomac Economics

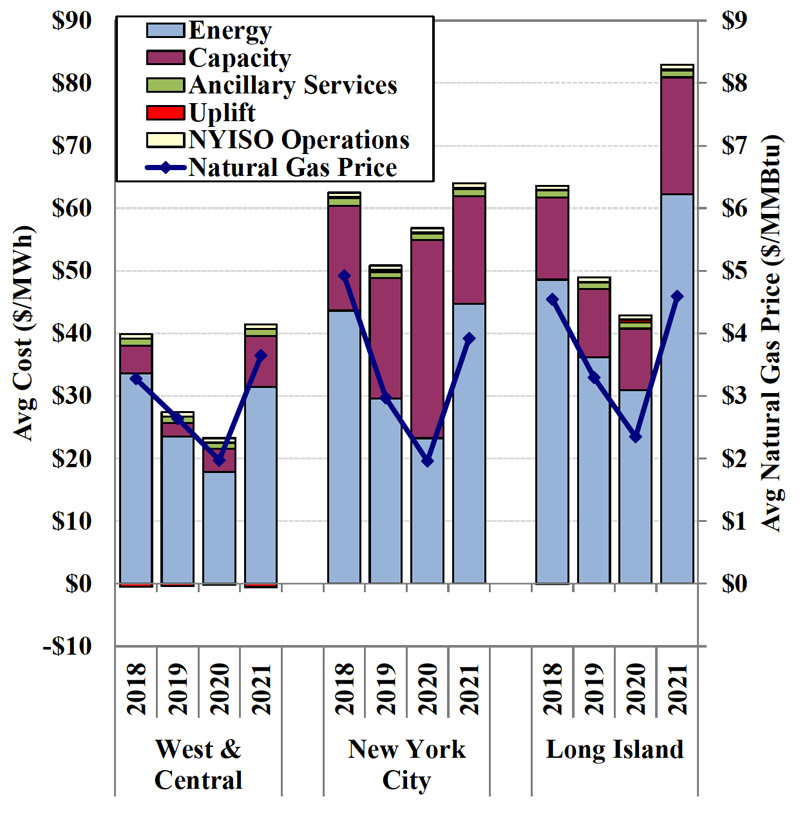

LeeVanSchaick also discussed pricing trends over the last few years. Gas prices are clearly driving energy prices, but they are not the single biggest factor, he said.

“We saw a big increase from 2020 to 2021, not only [because of] gas prices but certainly the Indian Point nuke retirements that are ongoing,” LeeVanSchaick said. “Between those two years it certainly is contributing to the higher prices in Eastern New York. We [also] saw more planned and forced transmission outages in 2021.” Last year also saw extra high levels of forced transmission outages into Long Island.

“Lastly we saw the return to normal consumption patterns, or more normal, in 2021 than they were in 2020 from COVID,” LeeVanSchaick said. “We saw higher gas prices, higher electric demand [and a] very large reduction in capacity prices in New York City.”

EAS Market Recommendations

The Monitor also recommended changes to the energy and ancillary services markets, including to compensate reserve providers that increase transfer capability by allowing use of higher line ratings; increase the reserve demand curve for statewide requirements to reduce out-of-market actions and reflect risk to load; eliminate offline fast-start pricing, which undermines incentives for flexible resources; and model transient voltage recovery (TVR) constraints on the East End of Long Island in the energy market.

Increased penetration of intermittent or variable generation will accentuate the need for these changes, the report says, and the evolving resource mix will increase the need for longer lead time reserves to address net load forecast uncertainty.

“This is potentially reserves that don’t have to be 10 or 30 minutes; they can be potentially just available in an hour, two hours, three hours or four hours; but it would be in a time frame that would allow the NYISO to meet what are going to be increasing requirements for reserves to deal with that load forecast uncertainty,” LeeVanSchaick said.