p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 11.0px ‘Helvetica Neue’; color: #000000}

SACRAMENTO — Four bills intended to help speed the construction of transmission to deliver renewable energy to CAISO’s grid cleared the Senate and Assembly and are moving forward in the legislative process, including two measures that propose studying public ownership and financing of transmission projects in California.

The measures seek to bolster the state’s efforts to supply end-use customers with 60% renewable resources by 2030 and 100% carbon-free energy by 2045, as required by Senate Bill 100.

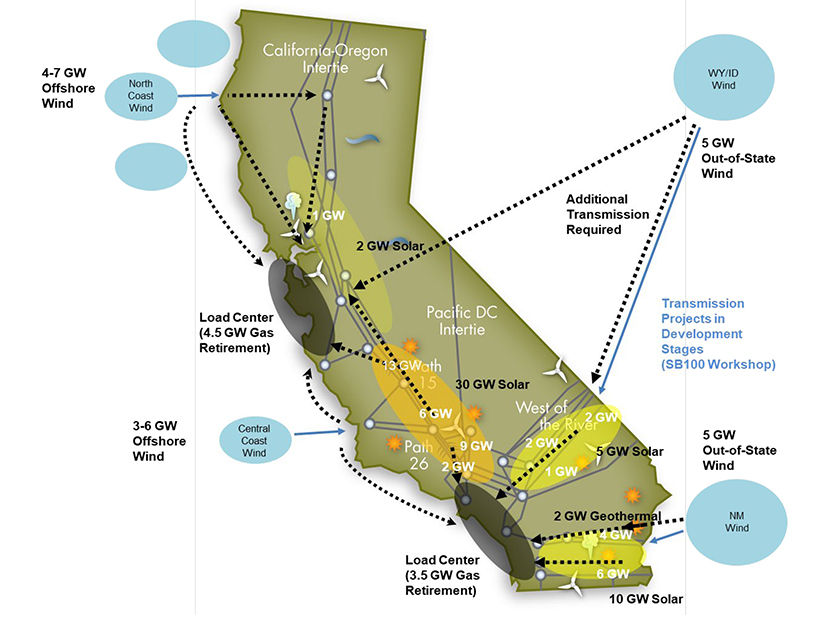

CAISO estimated in its first 20-year transmission outlook in February that meeting the state’s goals will require a $30.5 billion transmission buildout in California and across the West over the next two decades, mainly to carry wind and solar power from remote areas to urban load centers. (See CAISO Sees $30B Need for Tx Development.)

The assessment prompted lawmakers to introduce bills to accelerate the normally laborious process of transmission development. The measures include Senate Bill 1174, by Sen. Robert Hertzberg, a San Fernando Valley Democrat.

“California’s ambitious clean energy goals are nothing more than goals without the right infrastructure,” Hertzberg said in a statement following Senate passage of his bill, by a vote of 39-0, on May 25. “This bill connects the state’s bold plans for electrifying our economy with the modern infrastructure required to power a cleaner, greener California.”

SB 1174 is now before the Assembly Utilities and Energy Committee.

Transmission owners currently report annually to the California Public Utilities Commission on transmission upgrades needed to achieve their renewable portfolio standard procurement requirements, it notes.

Hertzberg’s bill would direct the CPUC to work with CAISO, the California Energy Commission (CEC) and the state Air Resources Board to “identify all interconnection or transmission projects necessary to achieve” the goals of SB 100 and to prioritize approval of the projects.

That includes the connection of offshore wind resources to CAISO’s grid.

The federal Bureau of Ocean Energy Management intends to hold the West Coast’s first wind auctions later this year for two areas off the California coast, one of which, the Humboldt Wind Energy Area in Northern California, lacks onshore transmission connections.

Completing the project and delivering its estimated 1.6 GW of capacity will require building transmission lines 100 miles across a mountainous landscape or laying an undersea cable more than 200 miles to the San Francisco Bay area, CAISO planners have said. (See West Coast Wind Faces Big Challenges.)

Such large-scale needs mean speeding transmission “may be one of the most important steps we can take to connect bold planning with common-sense policy,” Hertzberg said in his statement.

Faster, Cheaper and Possibly Public

Another bill, SB 887 by Sen. Josh Becker, a Democrat from the San Francisco Peninsula, says the state’s installed generating capacity could grow from 85 GW today to more than 300 GW by 2045 to meet SB 100’s targets. (CAISO’s estimates are less but still suggest the state may need to triple its in-state generating capacity in the next 23 years.)

“These build rates are not achievable without additional electrical transmission lines and facilities connecting new resources to consumers in the state’s load centers,” Becker’s measure says. “Given the scale of this challenge, there is an urgent need to prioritize and accelerate the substantial effort needed to build transmission projects with long development times.”

The measure would direct CAISO, the CPUC and the CEC to expand their generation and transmission planning horizons from the current 10-year process to “at least 15 years into the future to ensure adequate lead time for [CAISO] to analyze and approve transmission development, and for the permitting and construction of the approved facilities, to meet the projections.”

(CAISO’s 20-Year Transmission Outlook is “a long-term conceptual plan of the transmission grid in 20 years,” including out-of-state projects, that is intended to complement but not replace its normal 10-year transmission planning process, which concerns only projects in California.)

SB 887 would also require CAISO to identify “the highest priority transmission facilities that are needed to allow for reduced reliance on nonpreferred [fossil-fuel] resources in transmission-constrained urban areas by delivering renewable energy resources or zero-carbon resources that are expected to be developed by 2035 into those areas.”

A second Becker transmission bill, SB 1032, seeks “faster and cheaper transmission development,” the senator’s office said in a news release.

The bill would direct the CPUC to identify “proposals to accelerate the development of, and reduce the cost to ratepayers of expanding, the state’s electrical transmission grid as necessary to achieve the state’s goals [of reducing greenhouse gas emissions.]”

Measures to be studied would include public ownership of transmission facilities, public financing of transmission projects, and the use of non-ratepayer funds to cover part of the cost of transmission projects needed to achieve the state’s clean energy goals.

The bill also would direct the CPUC to examine state and private partnerships to support siting transmission projects and obtaining land-use rights, as well as “opportunities to reduce redundancy and streamline permitting processes related to transmission projects.”

Both Becker bills passed the Senate by large margins on May 23-24 and are now in the Assembly.

At about the same time, an Assembly measure dealing with transmission, AB 2696, crossed over to the Senate. It, too, seeks to lower the costs of transmission development, possibly through public ownership and financing.

The bill would instruct the CPUC — in consultation with CAISO, the California Infrastructure and Economic Development Bank and the Governor’s Office of Business and Economic Development — to study “potential lower cost ownership and alternative financing mechanisms for new transmission facilities needed to meet the state’s clean energy and climate targets” including public ownership, public financing and partnerships with federal agencies.

Under the measure, the CPUC would have to report its findings to the governor and legislature by September 2023.