Grid Performs Well in July Heat Wave

The New York grid performed well in the summer’s first heat wave July 20 to 24, Aaron Markham, NYISO vice president of operations, told the Management Committee on Wednesday.

NYISO and transmission owners recalled facilities to service and rescheduled transmission and generation outages to prepare for the hot weather. That week’s peak load occurred on July 20, a Wednesday, at 30,505 MW, or just over 97% of the baseline forecast for the summer, Markham said.

July 20 zonal peak loads in the New York Control Area | NYISO

July 20 zonal peak loads in the New York Control Area | NYISO

“In general, generation performed well,” Markham said. “From a transmission perspective, the Neptune cable with PJM did return to full capability on Tuesday, [July 19,] so it was able to supply additional megawatts into Zone K [Long Island] from PJM.”

The Western New York public policy transmission project was also effective at reducing supply bottlenecking through the period, Markham said.

The ISO did activate emergency demand response and special-case resource (SCR) programs in Zone F [the Capital District] on both Tuesday and Wednesday in response to a forced outage at the 115-KV Greenbush substation in that area, which caused some supply bottling and added to transmission congestion into the region, he said.

“In summary, things went well, and we are watching the weather for next week,” Markham said. “It looks like it is warming up again, probably not to the level we experienced last week, but we will continue to monitor that and take actions as needed to be ready for it.”

June LBMPs Rise Slightly; Gas Prices Ease

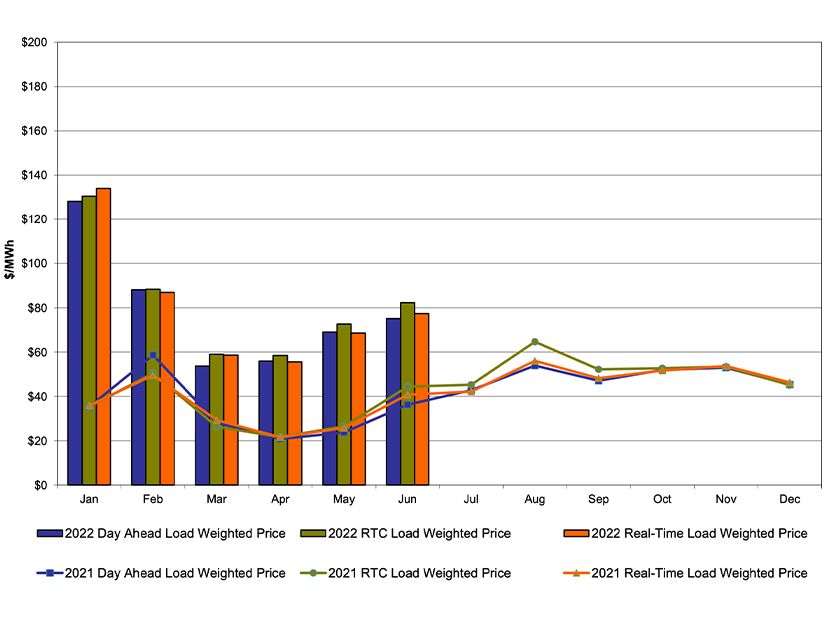

NYISO locational-based marginal prices averaged $76.72/MWh in June, up from $70.60/MWh the previous month, COO Rick Gonzales said in delivering the monthly operations report.

Day-ahead and real-time load-weighted LBMPs came in higher compared to May. Year-to-date monthly energy prices averaged $87.37/MWh, a 115% increase from $40.59/MWh in June last year.

June’s average sendout was 422 GWh/day, higher than the 372 GWh/day in May but lower than the 458 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $6.91/MMBtu for the month, down from $7.39/MMBtu in May and up 164.5% year-over-year.

Distillate prices were up 115.4% year-over-year but mixed compared to the previous month. Jet Kerosene Gulf Coast averaged $30.68/MMBtu, up from $29.17/MMBtu in May. Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $31.30/MMBtu, down from $32.97/MMBtu in May.

June uplift decreased to ‑61 cents/MWh from ‑5 cents/MWh the previous month, and total uplift costs, including NYISO’s cost of operations, came in lower than those in May. The ISO’s local reliability share dropped to 46 cents/MWh in June from 60 cents/MWh the previous month, while the statewide share decreased to ‑$1.07/MWh from ‑65 cents/MWh in May.

No RS1 Cost-of-service Study

The MC voted not to conduct a new Rate Schedule 1 cost-of-service study in 2022-2023. (See “RS1 Cost-of-service Study,” NYISO Management Committee Briefs: June 14, 2022.)

The last study, which considers the impact of the significant market design changes to be implemented, was done in 2011, and the tariff requires the committee to vote on whether to conduct one each year.

CEO Rich Dewey said NYISO will review the steps required to make a tariff change to remove the topic from requiring an annual vote. The ISO has plenty of work to do with the projects now underway, but next year it will come to the issue prepared with information on how much human resources would be needed to perform the cost-of-service study, he said.

“Then we’ll have better data in terms of how that intersects with other efforts within the project schedule, and market participants can be more informed about what that impact might be,” Dewey said.

Bad Debt Loss Methodology

The committee approved a recommendation from the Business Issues Committee to adopt a proposal from DC Energy to change the “look back” period in the tariff for determining each participant’s contribution to recover a bad debt loss, expanding the period from one month to three.

Bruce Bleiweis, director of market affairs for DC Energy, presented the change and said the company believes the goal of the payment default and bad debt loss allocation methodology is to spread the loss fairly based on NYISO stakeholders’ overall billing determinants. (See “Bad Debt Loss Methodology,” NYISO Business Issues Committee Briefs: June 22, 2022.)

One stakeholder asked whether the proposal had any risk of increasing market participants exposure to bad debts.

“This proposal does nothing to change the amount of credit or collateral that we have here,” said Sheri Prevratil, NYISO manager of corporate credit. “If a market participant defaults, we would always use that credit support first to cover any default before we declared a bad debt loss. … The ISO has no objection.”