The developers of a transmission line intended to carry Wyoming wind power to California have asked to join CAISO, a move that could extend the ISO’s reach more than 700 miles across the West and help the state meet its 100% clean energy mandate by 2045.

But the ISO’s plan to adopt a new participating transmission owner (PTO) model for the line and others like it has raised concerns.

The planned TransWest Express line “intends to place under the CAISO’s operational control all of [its] project transmission lines and associated facilities … that will connect to the existing bulk power system in Wyoming and Utah as well as directly to the [CAISO]-controlled grid in Nevada,” the company said in its application to become a PTO.

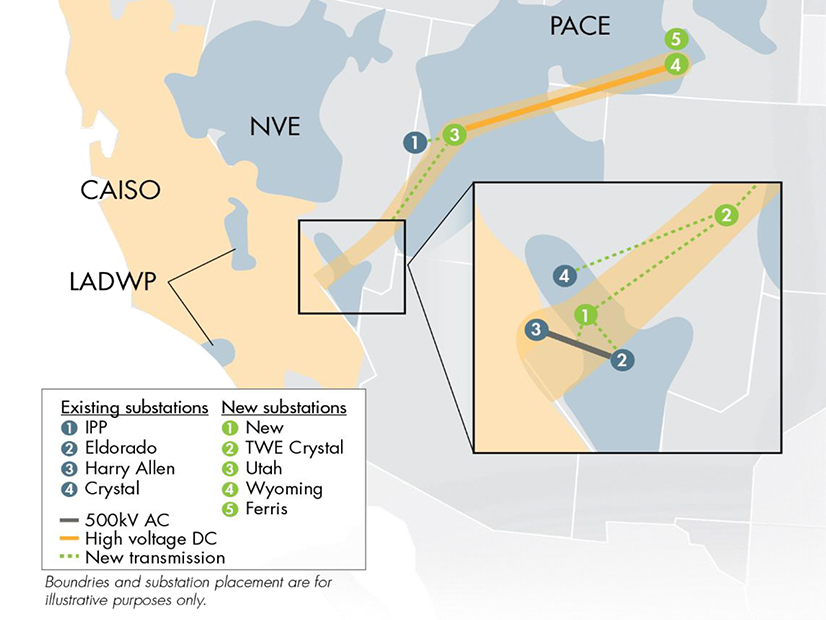

TransWest would consist of 732 miles of transmission lines in three linked segments: a 405-mile, 3,000-MW HVDC system between Wyoming and Utah; a 278-mile, 1,500-MW HVAC line between Utah and Nevada; and a 49-mile, 1,500-MW HVAC transmission line in Nevada. It will connect in Utah to lines serving the Los Angeles Department of Water and Power (LADWP) and in Nevada to CAISO’s grid and balancing authority area.

The project is an “advanced stage of development, focused on pre-construction matters including tower design and testing; interconnections; contracting with engineering, procurement and construction contractors; and financing,” the application says. “All major permits have been acquired, and 100% of the easements/authorizations to build on private lands have been secured.” Major parts of the project could be in service by 2026, it says.

Subscriber Model

TransWest would be CAISO’s first subscriber participating transmission owner (SPTO), a new model that would give the ISO operational control of the lines without increasing its transmission access charge (TAC), currently more than $16/MWh.

Last year, TransWest conducted a FERC-approved open-solicitation process that offered firm, long-term transmission service to California via Utah and Nevada. It decided to allocate 100% of its capacity to Power Company of Wyoming, owner of a 3,000-MW wind farm in the south-central part of the state. FERC approved the arrangement in February.

Both TransWest and Power Company are wholly owned affiliates of The Anschutz Corp., a privately held company based in Denver controlled by billionaire Phillip Anschutz, a conservative who made much of his fortune from oil and natural gas. Anschutz has sought to profit from California’s clean-energy mandate under Senate Bill 100.

To meet the 2045 goal, the state will need to import as much as 10 GW of out-of-state wind by 2040, at least half of it from Wyoming, according to projections by the California Public Utilities Commission and the California Energy Commission.

CAISO’s recent 20-year transmission outlook examined new transmission needed for the undertaking, predicting overall costs of $30 billion that includes $12 billion to carry wind from the Great Plains and Rocky Mountain states. (See CAISO Sees $30B Need for Tx Development.)

Stakeholder Meeting

In an Aug. 1 presentation and stakeholder question-and-answer session, Deb Le Vine, CAISO director of infrastructure contracts and management, described the TransWest project and how the new SPTO model would work.

“In trying to implement a new type of participating TO, there are a number of things to consider,” Le Vine said. “The intent was to go ahead and come up with a model that allows a remote transmission facility to become part of the ISO grid but to have subscribers that would pay for the transmission.”

Most of the transmission capacity for TransWest is subscribed in at least one direction and would not rely on ISO for funding, Le Vine said in her presentation.

Subscriber rights to the line will be treated as encumbrances, similar to existing contracts on transmission lines joining CAISO, she said. An SPTO could recover incremental charges from CAISO market participants using the lines, for instance, if non-subscribers send capacity from south to north on TransWest, she said.

“We’re looking to go ahead and support this concept by an amendment to [CAISO’s] Transmission Control Agreement” (TCA) without tariff changes, she said.

Need More Info?

Some stakeholders felt CAISO needed to provide more information that spells out the details of how the new subscriber model would work and to engage in a stakeholder process, making tariff changes.

Chris Devon, director of market intelligence in the West for advisory firm Customized Energy Solutions and a former CAISO senior policy developer, asked De Vine if the subscriber model would be detailed in a paper or only through slide decks like the one that she used in her presentation.

De Vine said it would be presented through slide decks because the new model does not require changes to CAISO’s tariff, only to its TCA.

Devon said he thought the changes should be vetted in a stakeholder process and made through tariff changes, not through the TCA. He expressed concern with CAISO using an abbreviated process to adopt a complex, untested TO model that diverges from current market practices.

The subscriber model resembles processes being discussed in the ISO’s transmission service and market scheduling priorities stakeholder initiative, Devon said. That initiative is meant to develop a “long-term, holistic framework for establishing scheduling priorities,” the ISO says.

The new model could impact the CAISO market and stakeholders, Devon said. “It just seems to me like this is actually creating a new type of policy as opposed to just being something that should be done through this change to the TCA, so I think it should be stakeholder-ed.”

The subscriber model’s potential costs to ratepayers remains unclear.

Asked to comment, the CPUC, which has been trying to control rising ratepayer bills for the state’s increasingly expensive electric system, said in an email that it is “actively participating on behalf of ratepayers in the CAISO’s stakeholder processes related to the newly proposed subscriber participating transmission owner model concept related to TransWest Express.”

“As such, we are unable to provide a specific comment on the TransWest Express transmission line at this time as we continue to develop our analysis.”

Comments on the Aug. 1 presentation are due Aug. 15. Stakeholders have until Sept. 19 to comment on the TransWest application.