NYISO’s first 20-year economic planning forecast paints a daunting picture of the challenge facing New York in meeting its climate goals: More than 95 GW of new zero-emission resources must be added to the grid by 2040, 20 GW within the next seven years.

“That is significant,” NYISO’s Jason Frasier said in presenting the inaugural System & Resource Outlook to the Business Issues Committee on Wednesday. The 2030 goal represents half of the ISO’s current 40-GW fleet.

Complicating matters, as fossil generation is eliminated, the state will need new clean energy generation technologies — potentially hydrogen, renewable natural gas and small modular nuclear reactors — which the report calls “dispatchable emission-free resources.”

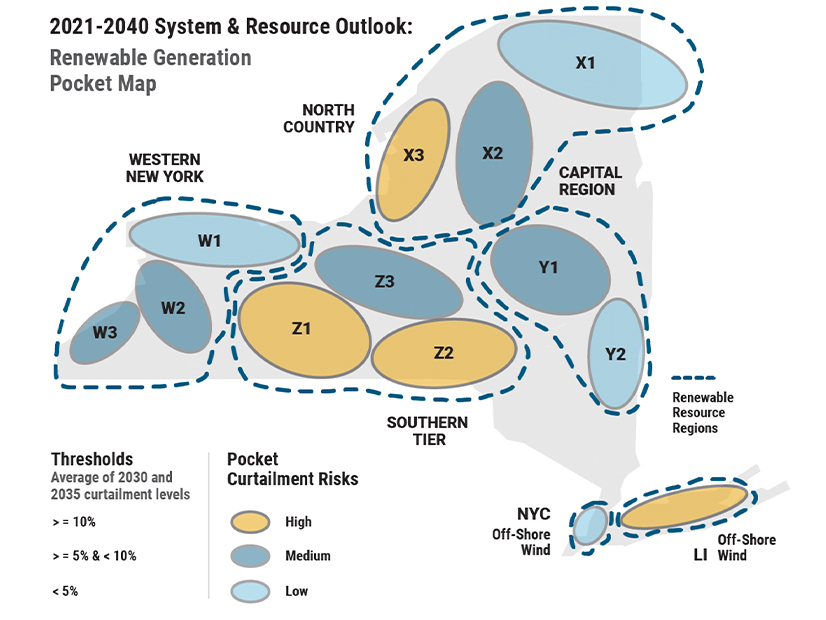

Also daunting: building the transmission needed to deliver that power. “The current New York transmission system, at both local and bulk levels, is inadequate to achieve currently required policy objectives,” the ISO says in the report. “Some renewable generation pockets throughout the state already face curtailments. More curtailments will be experienced in the future [absent transmission upgrades] as an increasing number of intermittent generation resources interconnect.”

The Need for Change

The outlook, which will be performed every two years, replaces Phase 1 of the Congestion Assessment and Resource Integration Study (CARIS).

The new planning process was prompted by the 2020 Accelerated Renewable Energy Growth and Community Benefit Act, which mandated a statewide transmission planning study to achieve the targets of the 2019 Climate Leadership and Community Protection Act (CLCPA): 70% renewable energy by 2030 (70×30) and 100% zero-emissions by 2040.

The “plan further supports the state’s mission by quantifying the evolving challenges in the electricity sector resulting from widespread beneficial electrification,” the ISO said.

NYISO won FERC’s approval for the new process last year, telling the commission in its transmittal letter that “no single NYISO planning study summarizes and evaluates the totality of New York state’s transmission system needs” (ER21-1074).

Cumulative contracted renewable capacity additions by online year | NYISO

Cumulative contracted renewable capacity additions by online year | NYISO

The ISO said the shift from CARIS’ 10-year horizon to a 20-year study period would “better capture trends in system congestion[,] the full benefits of potential transmission upgrades” and the long-term impacts of the CLCPA mandates. It also aligns with the 20-year study period that the ISO uses to evaluate proposed transmission solutions to address congestion in the Economic Transmission Project Evaluation (previously CARIS Phase 2).

The outlook assesses congestion statewide, in contrast with CARIS, which focused on only the top three congested transmission paths based on production costs — ignoring congested paths with lower production cost impacts but potentially higher benefit-to-cost ratios.

Under the previous process, NYISO also limited its transmission planning to the bulk power transmission facilities (BPTF) portion of the state’s transmission system (generally 230 kV and higher), leaving its transmission owners to plan their local systems. Under the outlook, the ISO will identify congestion throughout the transmission system, although its evaluation of proposed transmission solutions will remain limited to the BPTFs, supplemented by transmission owners’ local plans.

“Much of the transmission congestion identified in the 70×30 scenario resulted from local transmission constraints, which would likely not be identified in the top three most congested paths on the New York state transmission system,” the ISO said.

The ISO said the new process will improve its analysis of the benefits of interregional transmission. “Based on past CARIS studies, interregional congestion has not risen to the top three most congested paths in order for it to be analyzed,” it said.

Under the new process, the ISO will conduct its assessments of “generic” solutions (transmission, generation, demand response and energy efficiency) to the Requested Economic Planning Study (formerly the “Additional CARIS Study”) and the Economic Transmission Project Evaluation.

Unchanged is the ISO’s process for evaluating proposed economic transmission projects or identifying load-serving entities that benefit from projects. The 80% voting threshold required for LSEs to approve such projects also is unchanged.

Four Futures

The outlook considered four potential futures:

- The Baseline Case assumed little change from the status quo.

- The Contract Case includes nearly 9,500 MW of renewable capacity procured by the state (4,262 MW of solar, 899 MW of land-based wind and 4,316 MW of offshore wind).

- The Policy Case looks at two futures selected from dozens of preliminary scenarios that varied based on factors such as capital costs and demand forecasts. “Among all factors tested, the demand forecast demonstrated the largest impact on the resulting capacity expansion,” the ISO said.

- Scenario 1 envisions high demand (57,144 MW winter peak and 208,679 GWh energy demand in 2040) with fewer restrictions on renewable generation buildout options and land-based wind largely used to meet emission targets.

- Scenario 2 used assumptions consistent with the New York Climate Action Council’s Integration Analysis and sees a moderate peak but a higher overall energy demand (42,301 MW winter peak and 235,731 GWh energy demand in 2040) with a mix of land-based wind and solar.

DEFRs

The 20 GW of new generation needed in the next seven years dwarfs the 12.9 GW of generation developed since wholesale electricity markets began more than 20 years ago, the report notes. Over the past five years, 2.6 GW of renewable and fossil-fueled generation came into service — while 4.8 GW was deactivated.

NYISO’s two “Policy Case” scenarios use land-based wind (LBW), offshore wind (OSW), utility-scale solar (UPV), behind-the-meter solar (BTM-PV) and energy storage (ESR) to meet the state’s climate policy mandates through 2035. | NYISO

NYISO’s two “Policy Case” scenarios use land-based wind (LBW), offshore wind (OSW), utility-scale solar (UPV), behind-the-meter solar (BTM-PV) and energy storage (ESR) to meet the state’s climate policy mandates through 2035. | NYISOThe 9,500 MW of new contracted renewable resources projected would be a five-fold increase in the ISO’s current utility-scale renewable fleet. “Without any major transmission upgrades planned to specifically address this large influx of contracted renewables, transmission congestion increases. When the contracted renewable projects are added, several additional constraints appear, causing a 23% increase in congestion statewide by 2030.”

Most of the renewable projects are expected to be upstate solar or downstate offshore wind projects scheduled for installation before 2026. (In 2021, zero-emission resources made up 91% of upstate production, while fossil units dominated downstate (89%).)

The future will also mean an increase in dispatchable generator starts and stops and daily ramping to address the variability of wind and solar generation. While flexible units will be dispatched more frequently, they will operate for fewer hours within the year.

To achieve the CLCPA target, all fossil generation is assumed to be retired by 2040, replaced by “dispatchable emission-free resources” (DEFRs), “a proxy technology that will meet the flexibility and emissions-free energy needs of the future system but are not yet mature technologies that are commercially available.”

Scenario 1 assumes 45 GW of DEFR capacity by 2040 because of a 35% higher peak load forecast than Scenario 2, despite a 13% lower annual energy demand. The report notes that New York’s current fossil fleet is only 26 GW. Scenario 2 envisions 27 GW of DEFRs by 2040.

A scenario in which DEFRs are not available because of a lack of investments in research, development and commercialization “exhausts the amount of land-based wind built and results in the replacement of 45 GW of DEFR capacity in Scenario 1 with 30 GW of offshore wind and 40 GW of energy storage,” the outlook says.

That would also necessitate system reinforcements to address voltage support and dynamic stability problems that would arise without the fossil fleet or DEFRs.

Transmission Curtailments

New York is expected to see a major reduction in congestion on its Central East interface once the AC Transmission Public Policy projects in the Mohawk and Hudson Valleys are completed in 2024 and more than 10 GW of nuclear plant capacity in Ontario is retired or shut down for refurbishments by 2025. Nearly all of the economic energy exports to NYISO from the Ontario Independent Electric System Operator are delivered via the Central East interface.

But the reduced congestion will be short-lived as new renewables are connected upstream of the Central East interface, the outlook says.

A lack of sufficient transmission would result in increasing curtailments of both renewable and dispatchable generation, with renewable generators averaging 5 GWh per year in the Baseline Case, rising to 163 GWh in the Contract Case. Most of the curtailments affect offshore wind projects connected to Long Island, the report says.

The report predicts curtailment of at least 5 TWh of renewable energy in 2030 and 10 TWh in 2035 because of transmission limitations in renewable pockets. “This equates to roughly 5% less renewable energy that can be produced, and thus may not be counted toward the CLCPA targets.”

Generation Pockets

The report identifies four “generation pockets” that will need transmission expansions to avoid “persistent and significant limitations” to deliverability:

- Long Island offshore wind: NYISO is currently evaluating proposals submitted in response to the Long Island Offshore Wind Export Public Policy Transmission Need, which could reduce projected congestion “significantly,” according to the report. The solicitation seeks to deliver at least 3,000 MW of offshore wind by increasing the export capability of the LIPA-Con Edison interface connecting Zone K to Zones I and J and upgrading associated local transmission. “However, offshore wind resource additions of up to 20 GW that are under discussion may necessitate additional transmission to deliver offshore wind energy to New Yorkers,” the outlook says.

- The Watertown/Tug Hill Plateau renewable generation pocket (designated as X3 on the ISO’s map): The 115-kV network can’t deliver all of the already-contracted wind and solar generation in the area, and congestion will worsen with integration of more renewables.

- Southern Tier (Z1) and Finger Lakes (Z2) renewable generation pockets: The areas are attractive to wind and solar developers. “Transmission expansion from this pocket to the bulk grid would benefit New York consumers statewide,” the report says.

Comments

The outlook was generally well received by BIC members, who voted to recommend it to the Management Committee. That committee is scheduled to vote on it on Aug. 31, which will be followed by a vote by the ISO’s Board of Directors in late September. The ISO will then hold a public information session on the report.

Chris Hall, of the New York State Energy Research and Development Authority (NYSERDA), praised the report, although he said the authority “didn’t necessarily agree with every single modeling assumption” and will propose changes in the future. NYSERDA would have liked more time for the study, he said, “but we recognize pencils have to be put down at some point.”

Mark Younger of Hudson Energy Economics noted that while the outlook considered major changes in New York, it did not address the scale of changes occurring in neighboring regions. He argued that NYISO should not draw any conclusions about how it should address its interface with its neighbors without more analysis on the degree to which they can provide each other excess energy when it is needed.

Attorney Doreen Saia, of Greenberg Traurig, said she was concerned that the outlook’s executive summary focuses on changes needed as the state approaches 2040.

“There’s a very significant need now and in the near term. And I don’t want that to get muted,” she said. “We have to presume that there will be some subset of folks who only read the executive summary.”

Zach Smith, NYISO vice president of system and resource planning, said the ISO’s communications about the report will note the timing considerations at issue.

Next Steps

NYISO said data from the outlook will be used in the 2022 Reliability Needs Assessment (RNA) to identify commitment and dispatch trends and reliability impacts, as well as in the 2022 Grid in Transition study.

The ISO will open a 60-day comment period at the end of August or early September for its 2022-2023 Public Policy Transmission Planning cycle.

“The challenges identified in the outlook cannot be solved by any single entity,” the report says. “The full set of comprehensive electric system requirements will need participation among policymakers, generator owners, transmission owners and consumers. Communication and collaboration between stakeholders is essential to making progress toward achieving policy objectives while maintaining an efficient power market and reliable power grid.”