A long-simmering dispute over PJM’s capacity accreditation of renewable resources is threatening to boil over, with some stakeholders calling for FERC intervention.

At issue is PJM’s grant of capacity rights to wind and solar resources at levels that some stakeholders say have not been proven deliverable under peak conditions. The stakeholders say the practice is a reliability risk and is suppressing capacity prices. Fixing the problem could require transmission upgrades costing load up to $2 billion or more.

At a special Planning Committee meeting on capacity interconnection rights (CIRs) for effective load-carrying capability (ELCC) resources Aug. 23, stakeholders accused PJM of improperly attempting to engineer a solution in favor of lower capacity prices, while RTO officials insisted they were only trying to offer “transparency” on the impact of potential rule changes.

Economist Paul Sotkiewicz, of E-Cubed Associates, cited PJM’s presentation at the meeting that summarized the solution proposals that had resulted from 18 prior meetings. “Some packages can delay availability of higher accreditation, which causes increased capacity costs borne by load,” PJM said.

“PJM taking a market position for lower capacity costs is inappropriate at best. At worst it’s begging a referral to the FERC [Enforcement] Hotline,” said Sotkiewicz, who formerly served as PJM’s chief economist.

“This is not a PJM position,” PJM attorney Pauline Foley responded. “It’s simply a statement of fact.”

Vice President of Planning Ken Seiler said the RTO is “squeezed.”

“We’re trying to be as transparent as possible about the potential impact” of proposed changes, he said. “We get accused of not being transparent, and we get accused of taking a position.

“We don’t care what capacity prices are,” he insisted. “We care about the reliability of the system. We’re not taking a position on capacity prices at all.”

Seiler opened the meeting — the first by the special committee in two months — by saying the RTO had decided to “recalibrate and reset where we are” in response to stakeholder feedback in prior meetings and is not currently endorsing any package. “We as an organization are not married to any one particular package,” he said.

Marji Philips of LS Power said stakeholders are frustrated that PJM has insisted there is no over-accreditation problem even as it proposes spending billions to fix it. The RTO’s position “reminds me of George Orwell,” she said. “I’m trying to be respectful, but that was the weirdest explanation and disinformation I’ve heard in a while.”

But Gregory Carmean, executive director of the Organization of PJM States Inc. (OPSI), said PJM had done nothing wrong.

“It’s perfectly appropriate in a cost-benefit analysis for PJM to reflect” the impact on capacity prices, he said.

Sotkiewicz told Seiler that stakeholders were reacting to PJM staff taking “very definitive position [at a] very ugly meeting” June 24. “So what I think you’re hearing is that blowback,” he said.

That blowback has included at least one referral to the FERC hotline, according to a stakeholder who asked not to be identified. The stakeholder said two other stakeholders have also contacted the commission about what they see as tariff violations.

Problem Statement

PJM initiated the special meetings in early 2021 with a problem statement calling for discussions on: “the appropriate amount of capacity interconnection rights required for existing and planned generation capacity resources; the interrelationship between CIRs and the amount of capacity offered into the capacity market; the role CIRs should play in resource adequacy considerations; and CIR retention policies that strike a proper balance between continuing to support the reliable output of the resource while not resulting in unnecessary baseline upgrades.”

The initiative was proposed while PJM awaited FERC’s response to its proposed ELCC construct, which the commission approved on July 30, 2021 (ER21-2043). (See FERC Accepts PJM ELCC Tariff Revisions.) PJM uses probabilistic modeling to evaluate the contribution that ELCC resources — those such as wind and solar that are unable to maintain a stated output continuously without interruption — make to meeting PJM’s loss-of-load expectation (LOLE) standard of one day in 10 years.

Letters to Board

Economist Roy Shanker, who has represented LS Power during the committee sessions, says PJM has knowingly violated its tariff, the Reliability Assurance Agreement (RAA) and its interconnection service agreements (ISAs) by allowing renewables to sell capacity at levels above those for which they’ve qualified as deliverable.

The ISAs state that any output above an ELCC resource’s CIRs — determined by the amount that can be delivered during peak conditions — is considered an energy resource and not eligible as capacity, Shanker and others say.

But they say PJM has knowingly allowed energy output to be sold as capacity by accrediting based on units’ maximum output.

In February 2022, after a dozen meetings of the special PC committee, the PJM Power Providers Group (P3) sent a letter to the Board of Managers alleging the RTO was “knowingly allowing resources that cannot deliver all of their accredited capacity to acquire a capacity obligation greater than what is deliverable” at peak times.

P3 President Glen Thomas said the RTO could fix the problem by enforcing the RAA requirements with no need for a FERC filing. Instead, Thomas said, PJM proposed in the stakeholder process building transmission upgrades to increase the deliverability of the resources and to socialize the costs of the improvements.

‘Extreme and Unjustified Intervention’

Renewable supporters, including the Solar Energy Industries Association and American Clean Power Association, responded that P3 was seeking an “extreme and unjustified intervention in the market” that would “circumvent the stakeholder process” based on “unproven assertions about the deliverability impact of changes in PJM’s process that were made long after those resources were interconnected.”

The groups countered that the board should take action “to address the profound disparate treatment in which some resources in the capacity market are now accredited recognizing fuel and weather-related correlated outage risk (ELCC resources), and the remainder (thermal resources) are not.”

“To the extent that there is discrepancy between the deliverability determined through CIRs at the time resources interconnected and the ELCC capacity accreditation methodology that was adopted later, we note both that (1) this discrepancy did not take place due to any action taken by existing resources, and (2) is instead the result of adopting ELCC only for some of PJM’s generation fleet,” they said.

While PJM applies ELCC to wind, solar and storage, they said, thermal resources are given capacity rights up to their nameplate capacity — reduced only by the unit’s equivalent forced outage rate (EFORd).

“This effectively subjects wind, solar, and storage resources to an ever-shifting capacity value based upon fleetwide entry and exit decisions,” they said.

“PJM’s current approach treats 93% of PJM’s fleet — thermal generators — as near perfect capacity resources with no correlated outage risk. … As recent events such as Winter Storm Uri have demonstrated, this implicit assumption is demonstrably false.”

At the committee’s Feb. 23 meeting, PJM insisted its implementation of ELCC complies with the RAA, contending that only 5 MW of renewable generation with signed ISAs that are not yet in service may not be deliverable under proposed, higher deliverability standards. The RTO said it would cost $7 million in transmission upgrades in the 2026 Regional Transmission Expansion Plan to increase CIRs for those resources. The board echoed that position in its March 4 response to P3 and the environmental groups.

Upcoming Meetings, Nonbinding Poll

PJM’s Brian Chmielewski said stakeholders will be asked in a nonbinding poll to choose a solution proposal after special PC meetings scheduled for Tuesday and Sept. 23. At the Tuesday meeting, PJM will present a comparison of the six current proposals, whose cost implications depend on how they are implemented in regards to the transition plan the RTO included in its June tariff filing proposing to change its interconnection process from a serial “first-come, first-served” approach to a clustered “first-ready, first-served” cycle (ER22-2110). (See FERC Issues Deficiency Letter on PJM Queue Overhaul.)

PJM says two alternative proposals before stakeholders that would not introduce the higher CIRs for wind and solar ISA holders until transition cycle 2 would result in $2 billion in baseline upgrades that would be allocated to load.

Four other proposals would result in about $700 million in costs to load by introducing the higher CIRs for wind and solar ISA holders in cycle 1 instead of cycle 2. The $1.3 billion difference would be paid by cycle 1 resources as increased network upgrade requirements, PJM said.

Shanker and others say PJM is pushing to allow existing wind and solar resources their CIRs at no cost by giving away 7,300 MW of existing “headroom” and allowing them to jump ahead of resources already in the interconnection queue. Shanker said PJM’s $2 billion estimate “is clearly a lower bound.”

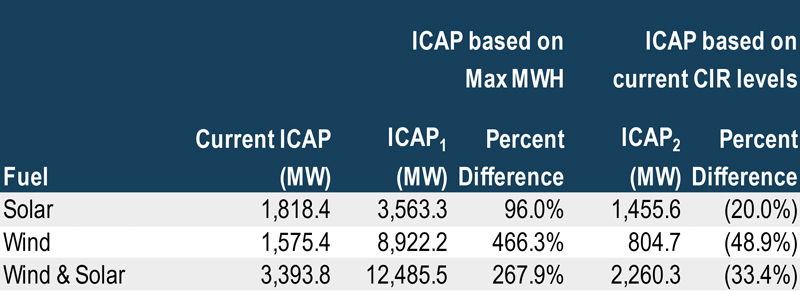

The Independent Market Monitor said in February that PJM has given wind and solar resources an installed capacity (ICAP) of 3,393.8 MW when they should only claim 2,260.3 MW, based on CIR levels — an excess of 1,133 MW. Based on the Monitor’s estimate, Shanker said he believes the practice suppressed prices in the 2022/23 Base Residual Auction by $200 million.

PJM estimated a slightly larger impact in June, saying that capping wind and solar at their current CIR level in the ELCC studies would reduce their capacity by about 1,300 MW. A sensitivity simulation found that removing the 1,300 MW would have cost load $230 million for the 2022/23 BRA, PJM said.