VALLEY FORGE, Pa. — PJM members failed to find consensus on any of four proposed sets of capacity auction parameters Wednesday, with the RTO’s proposal winning support from slightly more than half of members but falling below the necessary two-thirds threshold.

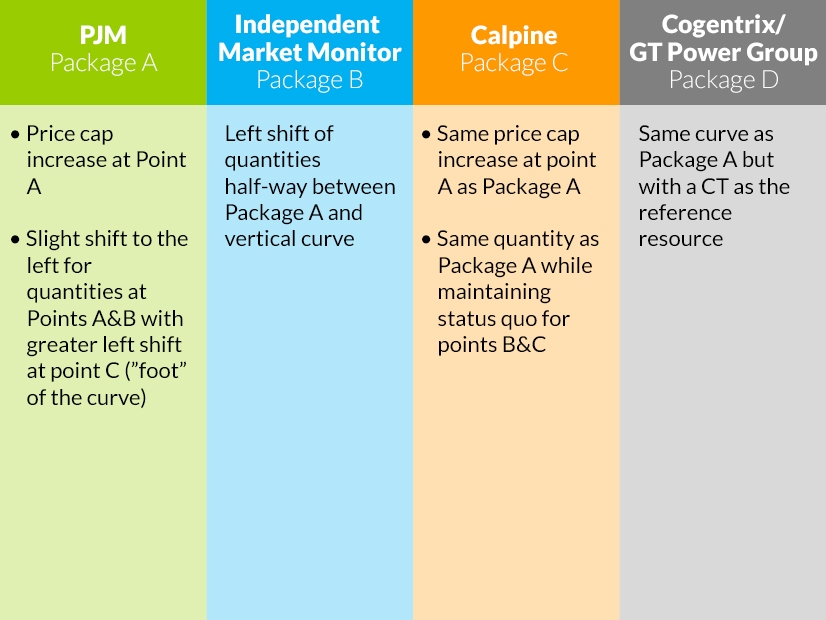

Proposals by the Independent Market Monitor, Calpine and GT Power Group in the 2022 Quadrennial Review all received less than 50% support in the sector-weighted votes. (See “2022 Quadrennial Review,” PJM MRC/MC Briefs: July 27, 2022.)

The parameters include the shape of the variable resource requirement (VRR) curve, the cost of new entry (CONE) for each locational deliverability area, and the methodology for determining the net energy and ancillary services (E&AS) revenue offset.

PJM’s proposal received a sector-weighted vote of 52%, with support of most Transmission Owners, Electric Distributors and End-Use Customers, but little support from Other Suppliers or Generation Owners. GT Power’s proposal on behalf of Cogentrix was the second favorite, winning 41%, with most support from the GO and OS sectors. The Monitor and Calpine packages trailed with 22% support each. Only 16% favored retaining the status quo parameters without changes.

Immediately after the meeting, the Members Committee approved a motion to forward the results of the MRC vote to the Board of Managers. The board is expected to file changes with FERC by Oct. 1; the changes would be effective with the July 2023 capacity auction.

Packages Explained

While PJM’s proposal includes major maintenance in variable operations and maintenance for recovery in the energy market, the Monitor’s would provide for recovery through the capacity market.

Both Calpine’s and GT Power’s proposals would continue to use historic net E&AS offsets, rather than switching to forward-looking as proposed by PJM and the Monitor.

GT Power’s would also continue to use a combustion turbine rather than a combined cycle plant as the reference unit because of the latter’s greater dependence on volatile E&AS revenues. All other packages would switch to the combined cycle plant.

CEJA Impact

Before the vote, economist Paul Sotkiewicz, representing generator J-Power USA, said the rules for the ComEd zone should reflect the shortened lifespan for new fossil-fired generation as a result of the Illinois Climate and Equitable Jobs Act (CEJA), which requires the state to move to a 100% carbon-free power sector by 2045.

Melissa Pilong, PJM | © RTO Insider LLC

Melissa Pilong, PJM | © RTO Insider LLC

Sotkiewicz said the gross CONE will need to be updated to reflect the shortened economic life of new fossil units, noting a gas plant that went into service in 2026 would have only a 19-year lifespan rather than the 20-year assumption. “You can look at the [Illinois] legislation,” he said. “It’s clear as day.”

PJM’s Melissa Pilong said RTO staff had determined that no change in the lifespan was currently required.

Although PJM’s tariff mandates consideration of the parameters every four years, “nothing prevents us from changing parameters between Quadrennial Reviews,” MRC Chair Stu Bresler said.

DC Circuit Ruling

Sotkiewicz said PJM’s position ignored the D.C. Circuit Court of Appeals’ Aug. 9 ruling setting aside FERC’s order in April that rejected NYISO’s use of a 17-year assumed lifespan for a peaking plant in its capacity parameters (21-1166).

NYISO had cited the New York Climate Leadership and Community Protection Act (CLCPA), which mandates that by 2040, “the statewide electrical demand system will be zero emissions.” The ISO concluded that a gas-fired plant built between 2021 and 2025 would have an average lifespan of 17 years because the CLCPA “requires electricity demand in New York to be served by 100% zero-emission resources” by 2040.

FERC rejected NYISO’s proposed amortization period and required it to return to 20 years, noting that the CLCPA allowed the state’s Public Service Commission to relax the emissions rules if needed to maintain reliability (ER21-502-001). FERC said the ISO’s proposal was “premised on the speculative assumption that all fossil-fueled resources will cease operation in 2040.”

The D.C. Circuit granted the appeal of the Independent Power Producers of New York’s (IPPNY), noting that FERC’s review of Federal Power Act Section 205 filings is limited to whether the proposed rates are reasonable and not whether the proposal is more or less reasonable than alternative designs. The court said FERC’s decision to reject NYISO’s filing based on the possibility that the PSC might alter the CLCPA’s requirements was “squarely inconsistent with its precedents.”

FERC can abandon its precedents as long as it provides reasoned explanation for its action and acknowledges that it is changing its position, the court said. “FERC’s order neither recognized nor explained its departure from precedent,” it said. “That was arbitrary.”

The Sierra Club’s Casey Roberts said the D.C. Circuit ruling was unpublished and lacked much detail. “I don’t think it requires upending the Quadrennial Review,” she said.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said the review “has been a great process,” although he said “most advocates still have a concern about over-procurement. It’s something that costs consumers billions.” He said most advocates would support the Monitor’s proposal.

Susan Bruce, of the PJM Industrial Customer Coalition, said the ICC supported both the PJM and IMM proposals. The loss-of-load expectation (LOLE) was “much higher” for the other proposals, she said. The others also produce results far beyond the one-day-in-10-years LOLE reliability standard, increasing customers costs.

Roberts said the most recent capacity auction procured 13 GW in excess of the RTO’s reliability requirement.