New Jersey officials hope to engage in “horse trading” with other PJM states over the cost allocation of transmission needed to meet their climate goals, a key state regulator said last week.

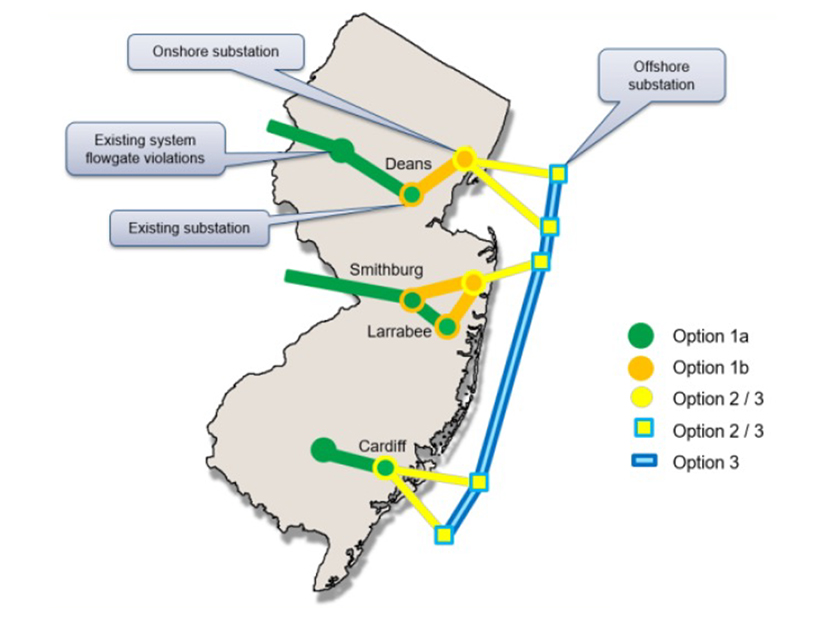

PJM’s Offshore Wind Transmission Study: Phase I, released last year, concluded that a coordinated transmission plan to integrate 14 GW of offshore wind and all existing state renewable portfolio standards would cost about $600 million through 2027 and $2 billion to $3 billion through 2035. (See Tx Upgrades for PJM OSW, Renewables Could Cost $3.2 Billion.)

Abe Silverman, New Jersey Board of Public Utilities | Raab Associates

Abe Silverman, New Jersey Board of Public Utilities | Raab Associates

The New Jersey Board of Public Utilities has estimated costs would be $5 billion to $34 billion in a “piecemeal” approach, BPU General Counsel Abe Silverman said during the second panel of Raab Associates’ New England Electric Restructuring Roundtable in Boston on Friday.

“The other clean energy states and PJM are looking at billions of dollars of transmission upgrades if we do it the way we’re doing it now, when we can meet all the needs of the entire PJM region at approximately the same price,” he said. “So there’s a lot of room for horse trading, if we can get the parties to the table.”

Silverman said the BPU will announce later this month whether it will select any of the 80 proposed transmission projects PJM received in response to its solicitation for 7,500 MW of offshore wind transmission. The solicitation was conducted under PJM’s State Agreement Approach (SAA), which makes New Jersey responsible for all of the costs.

The SAA leaves New Jersey “almost in a hostage situation at the moment,” Silverman said. “The transmission projects that we are planning benefit many states in PJM; they will see lower production costs as a result of these upgrades. But because of the way the system works, we are solely responsible for the cost. That needs to change.”

MISO Planning Efforts Win Praise

Silverman said the SAA shouldn’t be the only option for states such as New Jersey. “And this is where I think we really need the ISOs to step up and do the kind of long-term proactive planning that MISO, frankly, has been doing now for a decade.

“I’m just in awe of what MISO has done over the past couple of years,” he added, saying the RTO is “probably five to 10 years ahead of the rest of us.”

Following more than two years of planning, MISO identified 18 transmission projects that could add 50 to 60 GW of new resources in the MISO Midwest subregion at a cost of $10.3 billion. The RTO says benefits from its Long-Range Transmission Planning Tranche 1 will be shared among all Midwest subregions and produce a benefit-cost ratio of at least 2.1:1 for all zones.

Overlapping the Tranche 1 study was MISO and SPP’s Joint Targeted Interconnection Queue (JTIQ) study, which resulted in five seams projects that will enable 30 GW of new generation.

Aubrey Johnson, MISO | Raab Associates

Aubrey Johnson, MISO | Raab Associates

“The LRTP deals with deliverability; the JTIQ deals with injectability,” said Aubrey Johnson, MISO’s vice president of system planning, who appeared at the Roundtable via video.

“One of the things that we talk a lot about is we’re not trying to maximize the transmission; we’re trying to maximize the value of the transmission that we propose,” Johnson said. He said MISO is “extremely conservative” in identifying benefits. In “our state of North Dakota, it’s against state law to consider decarbonization [benefits]. … The No. 1 thing that [the projects solve] is congestion.”

But Johnson said the broad benefits have not eliminated “friction” over cost allocation. “Cost allocation is a full-contact sport,” he said, adding that he has created a team to help identify improvements in its cost allocation methodology.

NYISO’s New Transmission

Doreen Harris, NYSERDA | Raab Associates

Doreen Harris, NYSERDA | Raab Associates

Also speaking at the Roundtable was Doreen Harris, CEO of the New York State Energy Research and Development Authority (NYSERDA) and co-chair of the state Climate Action Council. Harris discussed the state’s Power Grid Study, which identified distribution and transmission upgrades needed to achieve the state’s climate goals, including meeting 70% of the state’s electric energy demand with renewable sources by 2030.

Achieving its goals will change the state’s grid from peaking in the summer to in the winter by the mid-2030s, Harris said, with peak demand doubling to about 45 GW.

To reduce New York City’s reliance on fossil fuels, NYSERDA is procuring 2,550 MW of new HVDC transmission capacity through the Champlain Hudson Power Express, a 1,250-MW line spanning 339 miles from Quebec and Clean Path NY, a 1,300-MW transmission line that will run 175 miles from Delaware County. Both lines will terminate in Queens.

NYSERDA is procuring 2,550 MW of new HVDC transmission capacity through the Champlain Hudson Power Express and Clean Path NY. | NYSERDA

NYSERDA is procuring 2,550 MW of new HVDC transmission capacity through the Champlain Hudson Power Express and Clean Path NY. | NYSERDA

“It is not simple to move these projects forward by any stretch,” said Harris. “What we are procuring is actually quite unique. So we’re procuring, in this instance, renewable energy attributes delivered to Zone J [New York City]. And so that was what the RFP was looking for. It was not saying, ‘Here’s the [transmission] project to bring forward.’ It was saying, ‘Here’s the problem; solve the problem.’”

ISO-NE Sees Widespread Tx Overloads

Robert Ethier, ISO-NE | Raab Associates

Robert Ethier, ISO-NE | Raab Associates

ISO-NE also expects its electric demand to switch to a winter peak by 2035, said Robert Ethier, vice president of system planning for the RTO.

By 2031, ISO-NE forecasts the region will have 1.1 million air-source heat pumps and 1.5 million electric vehicles. By 2050, the RTO says its modeling shows there would be overloads on 50% of its transmission lines without major upgrades to the system.

“So if you build all the things that are required to meet the state goals, and you run everything off electricity in 2050, what does the transmission system look like?” he asked. “The short answer is, a lot more expensive, which is not really a surprise. So the real question is, where does that money get spent?”

Ethier said it was “humbling” to hear the other grid operators discuss their challenges.

“There’s just so much going on in this space,” he said. “I feel good about what New England is doing. I think we’re doing a lot; I think we as a region are moving forward. But boy, you listen to these other regions, you realize every region is kind of in the same boat.”

Obstacles to State Goals

During the question-and-answer period, Fran Cummings of Peregrine Energy Group asked whether grid planners had contingency plans in case worsening climate impacts forces changes now expected in 2050 to be accelerated to 2040.

“The holdup is not going to be the planning, it’s going to be the building,” responded Ethier. “What we’re seeing now is siting is a problem; permitting is a problem; and the supply chain is a problem. We have large wind farms that are delaying their in-service date because of supply chain issues. And we see a lot of that going on in the queue as well: People want to slow down their interconnection process, because it’s ahead of where their project really is.”

Johnson said MISO planners have discovered that resource changes originally expected by 2040 are likely to occur by 2030.

“Procuring a 345-kV transformer is not trivial. Movement of them in the United States is not trivial. The people actually needed to do the work is not trivial. So my concern is that if you try to force an acceleration of all the work that is being considered, the cost of those is going to increase,” he said.