A group of New England suppliers is raising worries about the costs of the cost-of-service agreement between ISO-NE and the Mystic Generating Station heading into what many believe could be the priciest winter for gas in recent memory.

In a letter to ISO-NE officials dated Sept. 29, the group of load-serving entities pointed to the high costs of the agreement for its first few months of existence this summer: $13 million for June and $48 million for July. Heading into this winter, they warn, the “costs could balloon to levels not contemplated in 2018,” when the agreement was put into place.

The suppliers said they don’t take issue with the need for the agreement, which is staving off the retirement of Mystic, a critical gas-fired plant in Massachusetts, until 2024. But they do want to try to protect themselves and consumers from the costs of the program.

“We have grave concerns regarding the winter months, when gas prices will be at their highest, and the costs that we could face under the agreement,” the companies wrote. “No one in 2018 could have predicted how much more volatile and unmanageable hedging these costs would become considering world events.”

To try to manage the risk, the companies asked ISO-NE to provide more information and transparency about the agreement, including a cost estimate for the whole agreement and a cost estimation worksheet for its first months.

“The LSE group recognizes the challenges ISO-NE has faced that led to the Mystic COS agreement and the hard work that ISO-NE is doing to prepare for this winter,” they wrote. “The primary goal here is not to thwart those efforts but instead to work together to mitigate the costs associated with the Mystic COS agreement as much as possible.”

The companies are Brookfield Renewable Trading and Marketing, ENGIE Energy Marketing, NextEra Energy Marketing, Shell, Vistra and Vitol.

At the NEPOOL Participants Committee meeting on Thursday, ISO-NE COO Vamsi Chadalavada promised that the grid operator will work with them.

“ISO understands and appreciates the gravity of the situation,” he said.

Chadalavada said ISO-NE experts will present on the administration of the contract at the Markets Committee this week. He also said the grid operator is planning to do a scenario analysis to help inform cost estimates for the winter months. And he said the RTO is reaching out to LSEs, states, consumer advocates and transmission owners to talk about possible changes to cost allocation for the second year of the agreement.

Other PC Action

It was a busy day for the PC, which also saw a number of significant votes and presentations.

Chadalavada presented the latest iteration of the RTO’s 2023 work plan, which includes intensifying focus on the development of a day-ahead ancillary services market and resource capacity accreditation. Both will be regular topics of NEPOOL meetings in the coming months, and the grid operator is planning to file to FERC on both by the end of 2023.

Work on energy adequacy, including considering changes to the Inventoried Energy Program, is another highlight.

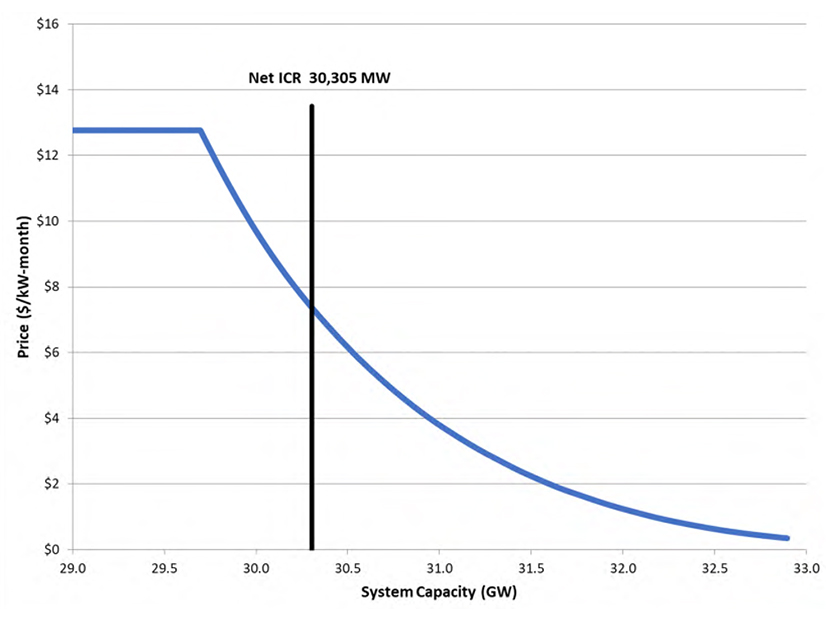

The committee also approved ISO-NE’s proposed installed capacity requirement values for Forward Capacity Auction 17, despite longstanding stakeholder frustration over the methodology for calculating ICR and the assumptions about imports from New York.

The systemwide demand curve for the 2026/2027 capacity commitment period | ISO-NE

The systemwide demand curve for the 2026/2027 capacity commitment period | ISO-NE

The approved ICR for the 2026-2027 capacity period is 31,306 MW, and the net ICR is 30,305 MW.

The PC also signed off on the 2023 budgets for ISO-NE and New England State Committee on Electricity.

And stakeholders approved a rule change that would allow storage-as-a-transmission-only-asset projects in New England. (See ISO-NE Weighs Allowing Storage as Transmission.)