Reliability risks from the addition of variable resources to the Western grid will continue to grow, requiring greater planning reserve margins to mitigate the unpredictability of wind and solar generation, WECC said Wednesday in its third annual Western Assessment of Resource Adequacy.

Last year’s Western assessment showed a planning reserve margin indicator (PRMI) for the Western Interconnection of 16.9%. The 2023 PRMI increased to 18.3% in WECC’s latest assessment.

“Additional [variable energy resources] will cause the PRMI to increase further,” WECC said. “If nothing is done to mitigate the long-term risks within the Western Interconnection, by 2025 we anticipate severe risks to the reliability and security of the interconnection.”

Power producers plan to retire 26 GW of resources, mostly coal and natural gas plants, during the next decade and to add 80 GW of new resources, most of which will be solar and wind generation and battery storage.

“The resource mix in 2032 will look different than it does today, with much higher levels of variability,” the assessment said. “This is because resources like solar and wind are variable, meaning their energy output changes constantly and there is limited dispatchability.”

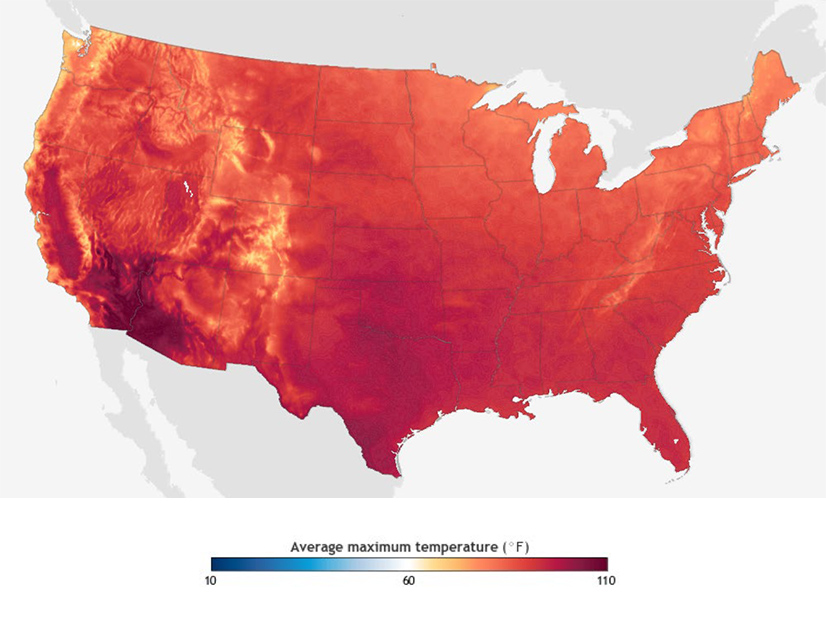

Severe weather events and rising temperatures add to the uncertainty, as do electrification, energy efficiency and emerging technologies, WECC said.

All “will affect how demand looks and behaves over the next decade,” it said. “This added uncertainty exacerbates the challenges facing planners and operators.”

WECC’s other measure of resource adequacy, its demand-at-risk indicator (DRI), showed fewer hours at risk of electricity shortfalls in the next few years. WECC measures DRI for every hour of the year for five subregions: California and Mexico, the Desert Southwest and three regions — central, northwest and northeast — of the Western Power Pool (shown as NWPP in the report).

“Compared to the 2021 assessment, the DRI for the Western Interconnection decreases through 2025 due in part to reductions in the load forecasts in the Pacific Northwest and northern Rocky Mountains, and in part to actions taken after the 2020 heat wave to strengthen resource adequacy,” it said.

“These actions include the addition of almost 3,000 MW of new or expedited resources, the vast majority of which is battery storage, and the delayed retirement of generator resources,” WECC said.

The delayed retirements included the 2,300-MW coal-fired Jim Bridger Power Plant in Wyoming, the 1,600-MW gas-fired Haynes Generating Station in Long Beach, Calif., and the 830-MW gas-fired Scattergood Generating Station in Los Angeles.

“Once these plants are retired, the risk returns and will need to be mitigated,” WECC said. “Delaying the retirements provides entities more time to determine how to mitigate the risks once these plants retire.”

After 2025, each WECC subregion shows an increase in DRI because of retirements in the next decade, the reliability organization said.

WECC introduced its Western RA assessment in 2020 to supplement NERC’s Long-Term Reliability Assessment because Western stakeholders were concerned that NERC’s analysis did not capture all the risks the Western Interconnection faces.

Like the NERC assessment, WECC’s Western assessment attempts to identify the biggest threats to the bulk power system over the next 10 years.

WECC has scheduled two webinars to discuss its findings, a high-level policy overview on Nov. 9 and a “deep-dive technical review” on Nov. 16.