FERC’s Office of Enforcement has concluded that Dynegy “knowingly engaged in manipulative behavior” during MISO’s 2015/16 capacity auction — rejecting the commission’s 2019 order that cleared the company.

As a result of enforcement staff’s heavily redacted 85-page report, the commission will now consider briefs on whether Dynegy should refund $429 million to Illinois ratepayers (EL15-70).

The commission announced a second look at Dynegy’s behavior in June after the D.C. Circuit Court of Appeals ruled that FERC hadn’t sufficiently supported its decision to accept the Southern Illinois capacity price produced in the 2015/16 auction. (See FERC to Take 2nd Look at 2015 MISO Capacity Auction.)

OE’s report, issued in September, said Dynegy participated in a fraudulent scheme to “corner the relevant portion of the market, consisting of those megawatts that MISO would likely need to clear the auction and that could be offered into the auction at a zero price if not held on Dynegy’s unsold books.”

Dynegy, which was acquired by Vistra in 2018, took four steps outside of market fundamentals to make sure it could set prices in the capacity auction, FERC said. Staff described the utility’s actions in the report’s redacted portion and said Dynegy made sure it increased the odds that one of its resources offered into the auction at a non-zero price would become the marginal resource and set the clearing price for Southern Illinois.

FERC staff said Dynegy’s malfeasance began a year ahead of the 2014/15 auction when it purchased 3,152 MW in MISO Zone 4 in Illinois, and 1,241 MW in a neighboring zone, from Ameren. FERC said Dynegy failed to set the price in that auction, when no zone cleared above $16.75/MW-day.

“After failing to set the price in the 2014/15 auction, Dynegy saw an opportunity to set the price in the 2015/16 auction,” FERC staff said.

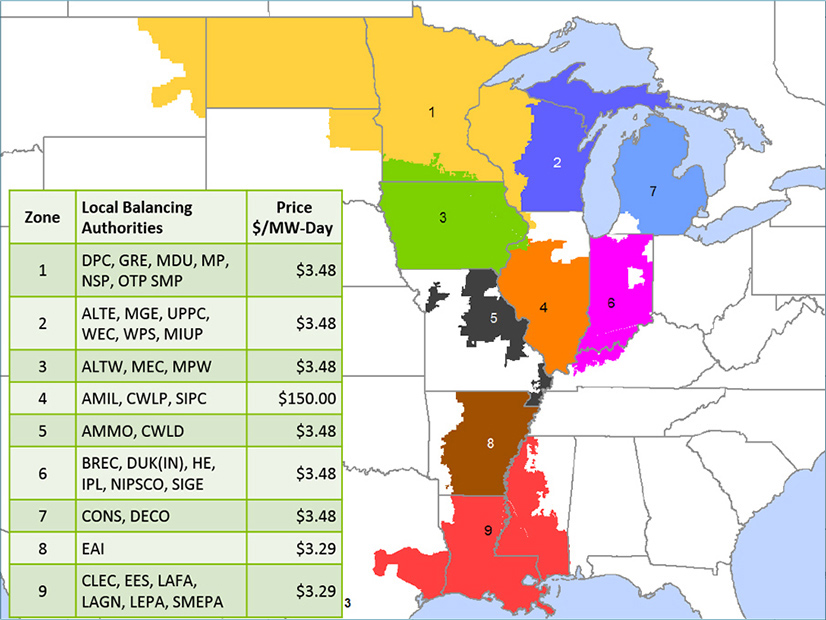

In the April 2015 auction for 2015/16, MISO saw clearing prices of $3.48/ MW-day or lower in all zones except Zone 4, which cleared at $150/MW-day.

2015/16 MISO PRA results | MISO

2015/16 MISO PRA results | MISO

The OE report was compiled using evidence from a three-year, non-public FERC investigation that included testimony from 11 Dynegy witnesses and more than 500,000 pages of documents. The original investigation, which began on a vote by the entire commission in 2015, was ended by then-chair Neil Chatterjee in 2019 without giving notice to his fellow commissioners.

That prompted a dissent by current Chair Richard Glick when the commission voted 3-1 in July 2019 that Dynegy had not committed market manipulation and that the $150/MW-day clearing price was just and reasonable. The commission said a clearing price isn’t unjust simply because it’s higher than expected (EL15-70).

Glick contended Chatterjee prematurely “cut short” the investigation. Chatterjee said he was acting within his purview as chair and did not need to consult with his colleagues. (See FERC Clears MISO 2015/16 Auction Results.)

Staff’s report gives no indication of Chatterjee’s reason for closing the probe. The report said the original investigators agreed in mid-2017 that Dynegy had engaged in market manipulation and that the company’s responses in 2017 and 2018 failed to change staff’s conclusion.

Vistra Rejects Staff Findings

Vistra said last week it “strongly disagrees with staff’s allegation in this report” and contends that it “acted in accordance with all applicable market rules and procedures.”

“This matter has thoroughly been investigated several times and adjudicated,” Vistra spokesperson Meranda Cohn said in an emailed statement to RTO Insider. “When FERC cleared Dynegy in 2019, they found that no market manipulation occurred and that the MISO 2015/2016 capacity auction results were just and reasonable. No new facts, circumstances or evidence have come to light in the three years since this decision.”

Cohn said in the “years-long process, the same allegations have been periodically repeated but have routinely been disproved by experts and independent regulatory authorities, including FERC and the Independent Market Monitor for MISO.”

Financial Impact not Disclosed

OE staff calculated the financial impact of Dynegy’s actions, but the details were redacted.

Public Citizen and the Illinois Attorney General asked FERC in February to recoup $428.6 million, plus interest from June 1, 2015, to load serving entities in Illinois in MISO Zone 4 to reimburse their customers.

Tyson Slocum, the director of Public Citizen’s energy program, told RTO Insider he believed the company raised capacity costs by about $100 million, an estimate he said was “confirmed by reams of non-public Enforcement staff conclusions.”

In addition to the $100 million in direct rate impacts, Slocum said, there are “hundreds of millions of dollars in cascading rate impacts.”

In ordering OE staff to reconsider Dynegy’s actions in June, the commission said it would determine any remedy in a later phase of the proceeding. On Oct. 7, the commission ordered initial briefs on the remand report by March 1, 2023, and reply briefs on May 1, 2023.

Cohn said that Vistra will “continue to vigorously defend Dynegy’s conduct.” She said FERC staff’s actions are “unwarranted, without merit, beyond the scope of the remand order and inconsistent with prior decisions and action by FERC.”