PacifiCorp on Thursday became the first Western utility to commit to joining CAISO’s proposed extended day-ahead market (EDAM) for its real-time Western Energy Imbalance Market, assuming the market design wins approval next year.

“With this important and timely announcement, we are hopeful that many of our other valued partners across the West will join PacifiCorp in positioning the EDAM as the next major step in Western market integration,” CAISO CEO Elliot Mainzer said in a statement.

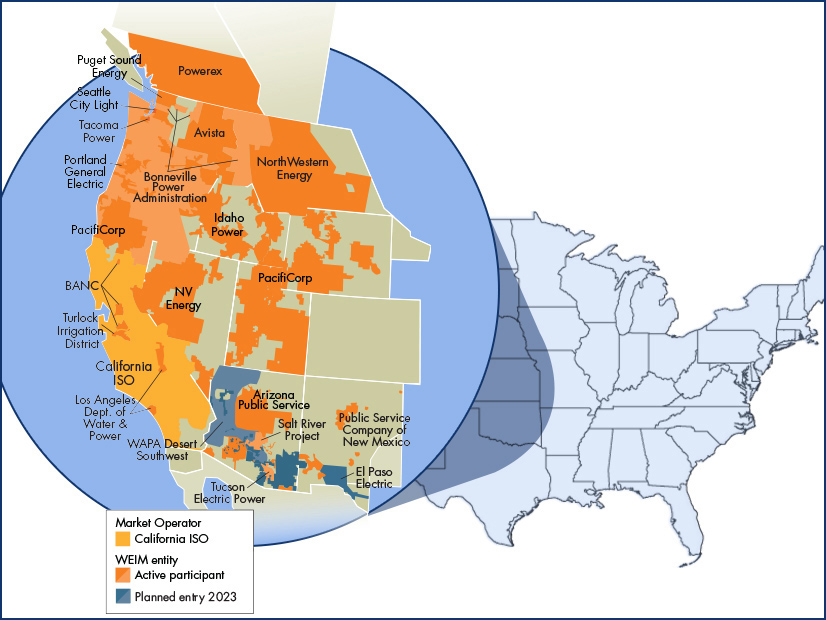

PacifiCorp helped design the WEIM and joined as its first member in 2014. The market now includes 19 participants and has generated more than $3 billion in economic benefits, including $500 million for PacifiCorp, which has also helped design the EDAM.

“This next step to a day-ahead market is another game-changer to increase the triple benefit to our customers of cost reductions, increased reliability and reduced emissions,” Pacific Power CEO Stefan Bird said in a news release. Pacific Power is the PacifiCorp division that serves customers in Oregon, Washington and a small part of California.

The news of PacifiCorp’s commitment came a day after CAISO issued a final proposal for the EDAM that it plans to present to its Board of Governors and the WEIM Governing Body on Dec. 14. Both governing boards are scheduled to vote on the plan in February. FERC approval would be next.

The final proposal makes changes to the draft final plan published Oct. 31. They include clarifications and enhancements that respond to stakeholder comments.

Transmission commitment has been a thorny topic in the EDAM planning effort, which CAISO fast-tracked starting late last year.

“Availability of transmission to the market is critical for efficient transfers of supply across the EDAM footprint to serve load and maintain grid reliability,” the plan says.

Stakeholders have had questions and concerns about what, exactly, transmission availability and commitment mean in the EDAM design.

“The final proposal clarifies, in response to stakeholder comments, the transmission requirement for resource participation in the market,” it says. “In particular, the final proposal clarifies that a resource must be a designated network resource under the terms of the Open Access Transmission Tariff, have reserved firm point-to-point transmission (of any duration), or have a legacy transmission contract.

“If transmission has not been reserved, the resource would nevertheless be able to participate in the market and the EDAM entity transmission provider would assess a charge for using transmission based on the rate for the lowest duration of firm point to point transmission service established by the OATT.”

The final proposal also introduces two enhancements to proposed transmission availability rules.

It “enables eligibility for historical revenue recovery associated with historical sales of monthly firm and non-firm point, in addition to the already eligible weekly, daily and hourly transmission products.” And it clarifies the “treatment of, and the ability to exercise, transmission rights between an EDAM balancing area and a non-EDAM balancing area to support continued service to load and meeting obligations under existing or emerging programs around the West.”

The Western Power Pool is moving forward on its Western Resource Adequacy Program. Stakeholders have raised question about how that program’s requirements might clash with the EDAM’s rules. PacifiCorp and 10 other utilities said Thursday they intend to join the WRAP.

Resource Sufficiency Tweaked

Another sticking point has been the plan for a resource sufficiency evaluation (RSE) to keep participants from leaning on the EDAM to serve unmet internal load. How resources will be counted and penalties for failing the RSE have worried some stakeholders. (See CAISO Tackles EDAM Design in Stakeholder Meeting.)

The final proposal tries to ensure that demand response, as a resource, is “accurately captured and tracked.” It details how generation-only balancing areas will be treated in the RSE. And it retains the consequences for failing the RSE outlined in prior versions but clarifies the proposed surcharges for failing the test.

The final plan further modifies the EDAM design by allowing participants to elect whether to allow convergence bidding within their balancing area after they join and removes a “mandatory transition to convergence bidding after one year of participation” contained in earlier drafts.

“The ISO will further evaluate and derive a more permanent EDAM convergence bidding policy leading up to the two-year anniversary of EDAM operation,” it says. “The stakeholder process will permit for consideration of EDAM operational experience and EDAM entity readiness in deriving the convergence bidding policy design.”

CAISO has promoted the EDAM this year as an effort to bring greater cooperation to the balkanized Western Interconnection, which has more than three dozen balancing authorities.

SPP has been trying to do the same with its planned Markets+ day-ahead offering, which would eventually subsume participants in its real-time Western Energy Imbalance Service. The WEIS has had limited success competing with CAISO.

SPP, however, also plans to launch a Western edition of its Eastern RTO, called RTO West. Utilities in Rocky Mountain states have indicated interest in joining SPP, which has a reputation for including voices from multiple and varied regions of the South, Midwest and Great Plains states.

Legislative efforts to expand CAISO’s governance to include members from other states have been unsuccessful in the past, but increased competition and studies that have shown up to $2 billion in annual benefits from a Western RTO might help sway lawmakers. A California Assembly resolution passed last year asks CAISO to prepare a report on recent market studies for the Legislature when it reconvenes in early 2023.