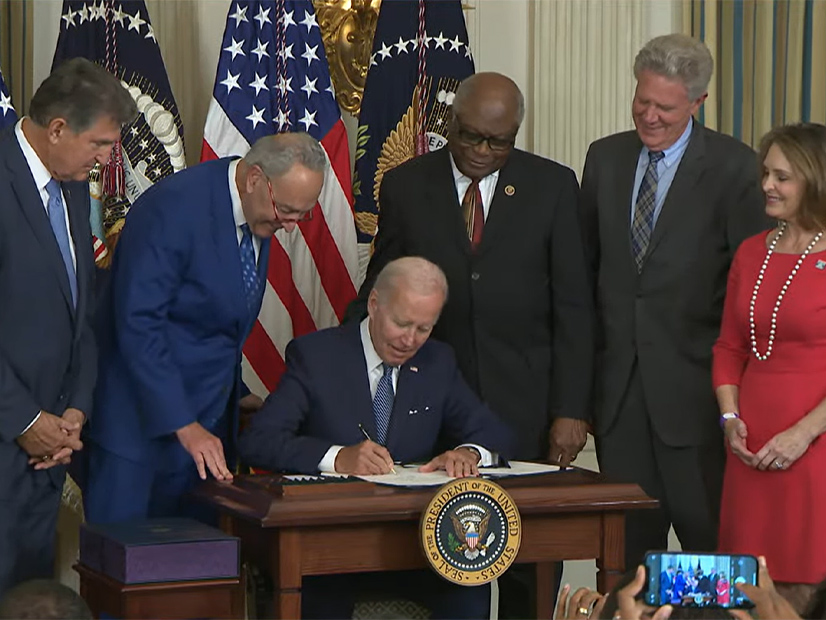

The biggest clean energy story of 2022, hands down, was the passage of the Inflation Reduction Act, rising improbably and miraculously from the ashes of President Joe Biden’s Build Back Better Act of 2021.

The IRA and its $369 billion in clean energy funding, builds on the foundation laid by 2021’s Infrastructure Investment and Jobs Act, which included another $62 billion in funding for clean energy initiatives that began rolling out this past year.

The full impact of the two laws will likely be incremental, unfolding over the next five to 10 years, but 2023 will be pivotal as the Biden administration continues to push forward with its clean energy agenda, and private industry and finance make decisions about adding their own dollars to the billions in clean energy grants, tax credits and other incentives contained in the two laws.

The administration’s focus will be on delivery. In a series of appearances at recent energy conferences, National Climate Advisor Ali Zaidi has called on corporations and private investors to get off the sidelines and put steel in the ground. “For folks in the private sector, the time to make decisions is now. Boards can’t commission study committees; they’ve got to greenlight capital projects,” Zaidi said in a keynote address for a Resources for the Future conference in October.

But implementing the IIJA and IRA also raises complex issues as federal and state agencies hash out the details of legislative language and the intent of the lawmakers who crafted it. Other headwinds include inflation, Russia’s war on Ukraine and the lingering effects of the COVID-19 pandemic on clean energy supply chains.

The NEVI Example

While the IIJA and IRA are both trimmed-down, compromise versions of the original bills Biden and Democratic leaders hoped to pass, getting the laws through a deeply divided Congress was an extraordinary achievement. The often-tense negotiations, in particular for the IRA, required a fine balance between the Democrats’ progressive wing and the swing votes of conservative Democrats Sen. Joe Manchin and Sen. Krysten Sinema, now an independent.

What matters now, with the 2024 presidential election already on the horizon, is the impact the laws will have on the way the U.S. produces and consumes energy and how such changes are perceived by individual consumers. Will the IIJA and IRA deliver new, cleaner technologies, emission reductions and cost savings — as well as the sense of urgency and mission that is required to curb the mounting impacts of climate change?

The IIJA’s National Electric Vehicle Initiative (NEVI) provides an early look at the complexly layered issues that will likely surface as each new program is rolled out. With $7.5 billion from the IIJA, the goal of NEVI is to create a national network of 500,000 EV chargers over the next five years, with 150 kW DC fast chargers located along interstate highways, as well as in rural, tribal and disadvantaged urban communities.

The law provides millions in yearly allocations to individual states, which must submit plans to the Federal Highway Administration, showing how they will use the funds and identifying the specially designated routes and other locations where chargers will be installed. A joint effort of the Department of Transportation and the Department of Energy, the first guidelines for NEVI were announced in February, followed by more detailed technical standards in June.

As required, all 50 states, the District of Columbia and Puerto Rico submitted their plans by an Aug. 1 deadline, which were approved by the FHWA, also on deadline, by the end of September. (See US Completes Review of State EV Charging Plans.)

But many state plans raised a range of concerns about the program’s requirements, such as the mandate for the EV chargers to be located every 50 miles on key interstate and state highways, with charging stations installed no more than one mile off these roads. Highways running through remote or rural regions simply may not have the electric distribution system needed for the high-powered fast chargers or the traffic needed to make the installation of fast chargers pencil out.

Utilities have warned that building out the poles and wires in remote areas will need to occur in stages over several years. Making sure chargers are installed in areas where potential EV owners may live in multifamily apartment houses or other affordable housing is another area where many states are still developing policies and plans.

Installation of the first NEVI-funded charging stations should start this year, but Biden’s vision of a seamless, national network of chargers that will make topping up EV batteries as easy as stopping at a gas station, and banish drivers’ range anxiety, will likely encounter more than a few bumps and detours.

Implementing the IRA’s wide range of tax credits and other incentives could be even more complex, as states and industry stakeholders wait for the federal guidelines needed to put the cash incentives for electric vehicles, heat pumps and other energy efficiency technologies in consumers’ hands.

The Internal Revenue Service ran up against a year-end deadline for issuing guidelines for the IRA’s EV tax credits, without providing detailed guidance on domestic content requirements called for in the law. Manchin quickly called for a hold on the incentives and threatened additional legislation to ensure the IRS follows the letter of the law.

In other words, both sides of the aisle have major stakes in the IIJA and IRA, and the amount of money and scope of the programs involved almost ensure that mistakes will occur, and individuals and businesses will try to game the system.

Federal and state agencies face steep and slippery learning curves in the months ahead, and a small army of whistleblowers and gadflies will be watching their every step.

Inflation, COVID and the War in Ukraine

Even before the IRA was passed, congressional Republicans were talking up plans for whittling away at some of its provisions following November’s midterm elections, in which they had hoped to regain control of both the House and Senate. But, with the Democrats holding the Senate and the GOP winning only a slim majority in the House, efforts to slow or sideline implementation of the IRA will be limited to general political sniping and oversight hearings.

At the same time, the combined effects of inflation, Russia’s war in Ukraine, and the lingering impacts of the COVID-19 pandemic, could present additional obstacles to the implementation of the laws, and Biden’s clean energy agenda in general.

COVID-19 was an early trigger for inflation as factory closings and the resulting production slow-downs hit supply chains, not only in clean energy, but across the economy. After years of steady decreases, prices for solar panels and storage started to inch up, and installations slowed down. According to figures from Wood Mackenzie, solar installations in 2022, estimated at 18.6 GW, fell about 23% from 2021, with new utility-scale deployments falling 40%.

The war in Ukraine triggered a worldwide “dash to gas” as both European and Asian countries faced the immediate and potentially disastrous cutoff of their supplies of Russian natural gas, looking instead to the U.S. to keep their economies fueled and their consumers warm through cold winters. With mounting pressure from Republicans to “unleash” U.S. fossil fuels through increased leasing on public lands and approval of new or unfinished pipelines, the Biden administration and congressional Democrats have had to walk a fine line balancing the immediate needs of U.S. consumers and overseas allies with the impacts of climate change.

Biden and other energy leaders worldwide argued that the short-term need to boost natural gas production should not be used to slow or stop the global move to clean energy, which would provide the best defense against both inflation and Russia’s weaponization of vital energy supplies.

While inflation is nosing down, price increases and supply chain challenges could continue to slow critical clean energy projects. Biden’s goal of installing 30 GW of offshore wind by 2030 prompted a surge of activity last year with the Bureau of Ocean Energy Management holding a series of high-profile offshore lease auctions for sites on both the Atlantic and Pacific coasts.

The auction of six sites in the New York Bight, a curve in the New York-New Jersey coastline, produced record-breaking bids totaling $4.37 billion. At the same time, states up and down the Mid-Atlantic coast are expanding port facilities and drawing in new OSW manufacturers, all vying to become major hubs for offshore construction and operations.

For example, New Jersey’s ambitious plans for a purpose-built offshore wind port could cost between $500 million and $550 million and could create up to 1,500 manufacturing, assembly and operations jobs, according to figures from the state’s Economic Development Authority. (See NJ to Expand Wind Port with Land Purchase.)

But the economics of developing and financing these offshore wind projects — and building the necessary transmission — remain uncertain. The West Coast sites will require floating turbines, which will present another level of technical and financial challenges.

PPAs and Supply Chains

The Massachusetts Department of Public Utilities ended the year with Friday’s approval of contracts, called power purchase agreements, for the 1.2 GW Commonwealth offshore wind project and the 804 MW Mayflower project, despite petitions from both project developers to allow them to renegotiate due to rising costs, as reported in The New Bedford Light.

Following the DPU decision, Craig Gilvarg, a spokesperson for Commonwealth developer Avangrid, said, “The current Power Purchase Agreements do not allow the company to secure the significant financing needed to construct this critical project, and thus the project cannot proceed under these contracts.”

A joint project of Shell New Energies US and Ocean Wind, the Mayflower project will move forward, but the developers have signaled their current plans will focus on completing only an initial 400 MW.

Building out domestic supply chains for offshore wind, electric vehicles, batteries, solar panels and other technologies was yet another major flash point in 2022 — and an easy target for Republican criticism of the clean energy sector’s dependence on China and Russia for critical minerals, including lithium, cobalt and uranium.

Biden has promoted “Made in America” initiatives as a top priority in the IRA’s manufacturing and clean technology tax credits, and the auto industry, in particular, has responded with a series of announcements on plans for new factories and for the retooling and expansion of existing facilities for EV and battery production.

But building out an extensive U.S. clean energy supply chain, especially for critical minerals, will take years, billions in private investment and a willingness by all stakeholders to tackle the essential issue of permitting reform.

Both parties know reform is critical, but whether they will put politics aside and hammer out a deal could be one of the biggest stories of 2023.