CAISO on Friday released a draft report on Western regionalization that is intended to restart talks on the ISO becoming an RTO and bolster a likely legislative effort this year to open its governance to residents of other states.

The report examined 41 regionalization studies in response to last year’s Assembly Concurrence Resolution 188, by State Assemblyman Chris Holden (D), chair of the Assembly Appropriations Committee and a proponent of CAISO expansion. ACR 188 asked the ISO and the state’s eight other balancing authorities to report to the legislature on recent and relevant studies of regional market impacts by Feb. 28.

“It’s time for California to revisit a broader regional market,” Holden said in a message accompanying the bill, which passed unanimously in the State Senate and Assembly.

Prior attempts by Holden in 2017-2018 to allow CAISO to become an RTO failed, but circumstances in California and the West have changed significantly since then. (See Plans Revive to Make CAISO a Western RTO.)

“Expanding CAISO to become a multistate regional transmission organization is an option that ACR 188 calls out specifically,” the report notes.

To avoid appearances of bias, CAISO commissioned the National Renewable Energy Laboratory (NREL) to write the report. “As a national laboratory of the U.S. Department of Energy, NREL is independent of any particular stakeholders and state policies,” the report says.

NREL researchers examined dozens of studies that concluded California and most other Western states would benefit from increased collaboration in terms of cost savings, resource adequacy and meeting climate goals. They included a June 2021 study that found an RTO covering the entire U.S. portion of the Western Interconnection could save the region $2 billion in annual electricity costs by 2030 and cut carbon dioxide emissions by 191 million metric tons.

The study, funded by the U.S. Department of Energy, was led by Utah Gov. Spencer Cox’s Office of Energy Development and energy offices in Colorado, Idaho and Montana. (See Study Shows RTO Could Save West $2B Yearly by 2030.)

A “large, multistate RTO is one of several options,” the report says. “It could provide the largest margin of benefit, including the greatest visibility into operational performance, efficient dispatch and lower-cost reliability. Other forms of enhanced regional cooperation, such as a regional energy market, a regional mechanism for resource adequacy or even the expansion of an RTO to only a few neighboring states, would also provide some measure of cost savings, reliability improvements and reduced carbon emissions for the benefit of all participants.”

However, “some of the technical studies included in this review suggest that the benefits of more comprehensive forms of regional cooperation might not be spread evenly across participating states and their utilities,” the report said. A section detailing the “distribution of benefits among states” in one or more Western RTOs is still being drafted.

“The CAISO is working with NREL to expand this section to be responsive to the legislation,” the report says.

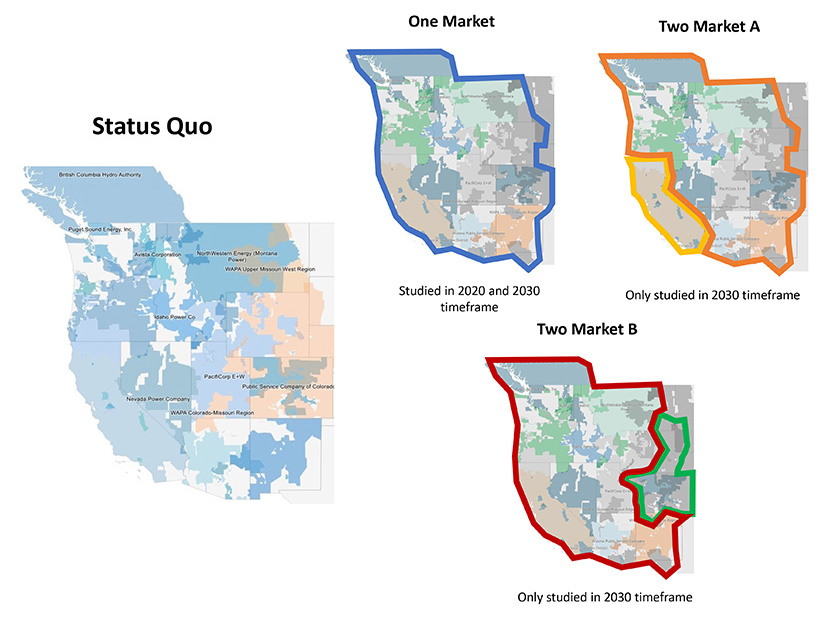

The state-led study found “that a single RTO would provide California and all other states greater capacity savings than two Western RTOs. For a day-ahead market, all states except Colorado would see greater capacity savings with one market rather than two.”

A separate study conducted by the Colorado Public Utilities Commission at the behest of Colorado lawmakers determined that the state would benefit more if there were two RTOs: one led by CAISO, and another by SPP that includes most utilities in Colorado and some in Wyoming.

“This study found significant cost savings to Colorado if its utilities were to join a regional RTO,” the report says. “Interestingly, the benefits were slightly greater for joining SPP: a 9% savings in total system costs over the status quo reference case, compared to 8% for a [WECC-wide] RTO and 7% splitting Colorado between SPP and a WECC RTO.”

If Colorado participates in a WECC-wide RTO, “higher power prices in the West [especially California] lead to slightly higher prices in Colorado,” it said. “The marginal cost of serving demand in Colorado under a WECC RTO was about 16% higher than it would be if Colorado utilities were in SPP. Colorado also retired more coal capacity under the SPP RTO.”

In the past two years, a handful of Colorado utilities decided to join SPP’s real-time Western Energy Imbalance Service instead of CAISO’s larger Western Energy Imbalance Market, with some exploring membership in SPP’s RTO. (See Colorado Utilities Choose WEIS over WEIM.)

The ACR 188 report comes as CAISO and SPP continue to vie for Western market share in a region primed for one or more organized electricity markets.

SPP plans to launch its Markets+ offering with many of the services of an RTO and later to introduce a Western version of its Eastern RTO called RTO West. CAISO intends to add a day-ahead market to its successful real-time WEIM, which could eventually develop into an RTO. The Western Power Pool (formerly the Northwest Power Pool) is seeking FERC approval for its Western Resource Adequacy Program, a possible RTO launchpad. And Colorado and Nevada have ordered transmission-owning utilities to join an RTO by 2030.

The retirement of coal generation and increase in wind and solar resources in remote parts of the West is a major factor driving the need for regional transmission planning, the report notes. Strained grid conditions during heat waves have shown the need for better a resource adequacy framework, and a growing number of states are adopting clean-energy goals, requiring more interstate transactions, it said.

CAISO has scheduled a stakeholder call for this Friday to discuss the report.

“The ISO values stakeholder input on this preliminary draft and plans to incorporate feedback received during the Jan. 20 stakeholder call, and in written comments submitted by the deadline on Feb. 3, into future iterations to ensure the accuracy and value of the final report,” the ISO said last Friday in a message to stakeholders.