CAISO’s first-quarter Western Energy Imbalance Market benefits report offers another footnote to the debate over the market’s role in responding to the January deep freeze that brought parts of the Northwest to the brink of rolling blackouts.

“The Western Energy Imbalance Market’s cumulative benefits rose to $5.49 billion during the first three months of this year, while also demonstrating the value of regional coordination by helping maintain system reliability during a January cold snap that stressed grid conditions in the Northwest,” the ISO said in a press release accompanying the April 30 report.

The report shows the WEIM produced $436.3 million in economic benefits for its participants during the first three months of 2024, a 4% increase from a year earlier and a new first-quarter record.

That bump was partly from the addition last spring of three new members, including the Avangrid balancing authority area in the Northwest, El Paso Electric and the Western Area Power Administration Desert Southwest Region (WALC). The market now includes 22 participants representing over 80% of the load in the West — including CAISO itself.

The unsettled debate over the Northwest cold snap began to take shape shortly after the Jan. 12-16 weather event triggered five energy emergency alerts (EEAs) in the Northwest, including one critical EEA 3 in Idaho Power’s territory.

The dispute has centered on disagreements over how vital CAISO and the WEIM were in supporting the Northwest during the event, with some parties contending that the region’s utilities relied heavily on imports from the Desert Southwest and Rockies region to support operations, while others argued the ISO and its real-time market were key to facilitating those transfers.

The debate has become something of a proxy for the broader competition for market participants between CAISO’s Extended Day-Ahead Market (EDAM), which builds on the WEIM, and SPP’s Markets+ day-ahead offering, which has attracted strong interest in the Northwest and Arizona. (See NW Cold Snap Dispute Reflects Divisions over Western Markets.)

The Economics of Rebalancing

The quarterly benefits report adds modestly to the 80 pages of analysis CAISO released March 6 on the WEIM’s January performance.

That paper focused on how the WEIM helped manage energy flows throughout the West during the cold snap, attempting to answer critics arguing that the ISO’s status as a net importer of energy during the five-day event offered evidence that the Southwest was the real source of the Northwest’s rescue. The analysis noted that the WEIM transfers into CAISO were not the product of limited supply within the ISO but the result of the “economic displacement and opportunities optimized by the market and bounded by the transmission and transfers availability in the wider footprint.” (See NW Freeze Response Shows WEIM Value, CAISO Report Says.)

The benefits report riffed off that theme.

“During the winter conditions experienced in January 2024, the Western Energy Imbalance Market economically rebalanced supply across the West to meet increasing demand as real-time conditions evolved over the Martin Luther King Jr. Day weekend,” it said.

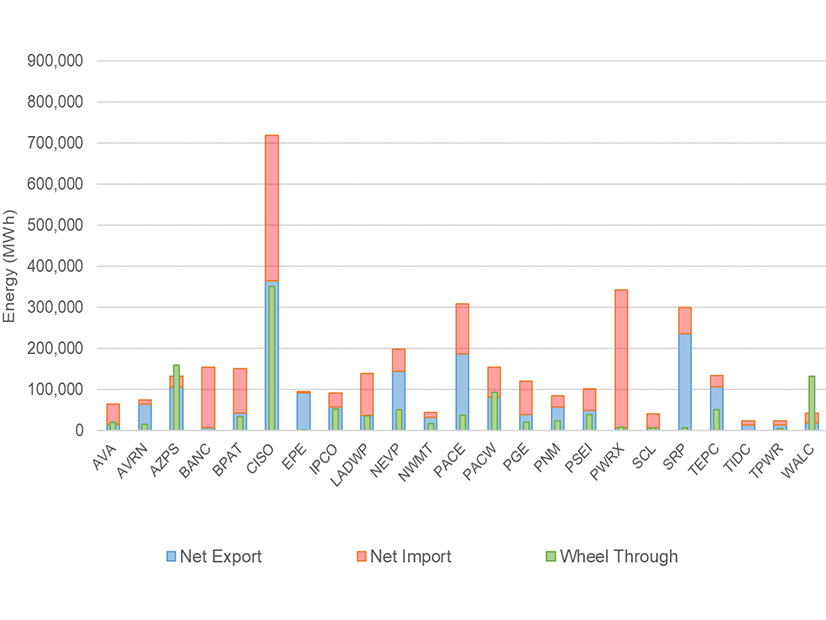

On the surface, the data contained in the report seems to back up that contention, even if it doesn’t drill down into specific days. The data show that in January, the CAISO BAA facilitated 350,271 MWh of WEIM wheel-through transfers, a 46% increase from the same month a year earlier. The ISO’s net exports for the month also increased 46%, to 363,837 MWh, while net imports decreased by 21% to 353,353 MWh.

The areas with the next-largest volumes of January wheel-throughs were Arizona Public Service (158,625 MWh), WALC (130,870 MWh) and PacifiCorp’s West BAA (92,240 MWh).

The second-largest net importer of energy through the WEIM that month — behind CAISO — was British Columbia’s Powerex at 336,809 MWh (compared with 177,954 MWh in January 2023), as the province and other parts of the Northwest dealt with record electricity demand during the cold snap.

“The market identified least-cost solutions within the wider WEIM footprint, transferring lower-cost electricity from the Southwest into California. These transfers allowed exports scheduled in the day-ahead and hour-ahead markets to flow to the Northwest, replacing more expensive generation while managing congestion on key transmission lines,” the report said.

According to the report, PacifiCorp earned the largest share of WEIM benefits during the first quarter, at $73.83 million, followed by CAISO ($54.33 million), the Los Angeles Department of Water and Power ($46.80 million), Puget Sound Energy ($25.88 million) and Powerex ($24.83 million).