NYISO on Thursday presented the Installed Capacity and Market Issues Working Groups (ICAP/MIWG) with further revisions to its proposed rules for distributed energy resource aggregations based on stakeholder feedback, but the groups’ members continued to express concern and confusion.

As it is never clear exactly which resources in an aggregation are providing electricity, NYISO has proposed to calculate their reference levels based on lists of average marginal costs for different resource types. “Aggregation-level offers will include a resource type from this list for each hour to indicate the highest-cost resource that is available to produce energy in the aggregation,” according to the ISO. “The NYISO-estimated marginal cost of that resource type will serve as the reference level for the entire aggregation for that hour.”

But there was extensive discussion and questions at the meeting about how exactly NYISO would do this, and how this would influence market bids and signals.

Aaron Breidenbaugh, director of regulatory affairs at CPower Energy Management, questioned NYISO’s proposed cost-based approach and why it didn’t stick with locational-based marginal prices. He said market participants who possess variable operations, such as crypto miners, may struggle to produce granular reference points to decide whether to make offers and may see “their net revenues being held hostage.”

NYISO responded that LBMPs and bid-based reference levels are based on 90-day historical data, but an aggregation’s composition can change day to day. A cost-based approach would enable aggregators to dynamically reflect different technology types, though the ISO expects that when someone “makes an offer based on their estimated marginal cost of production, they should be able to reflect that.”

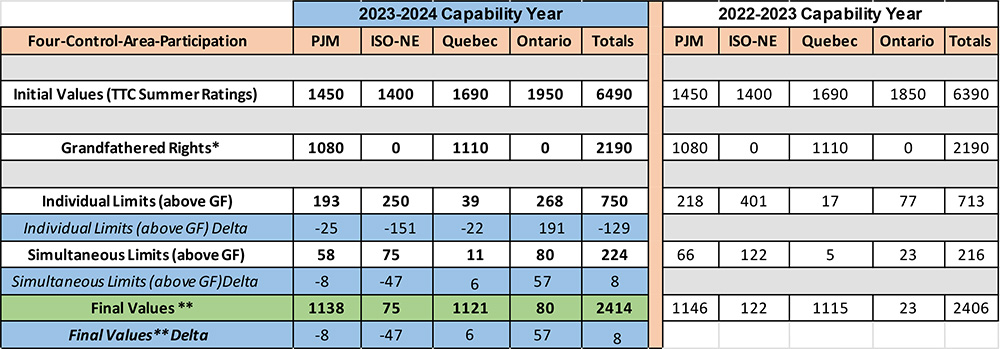

2023 Import Rights for Neighboring Control Areas | NYISO

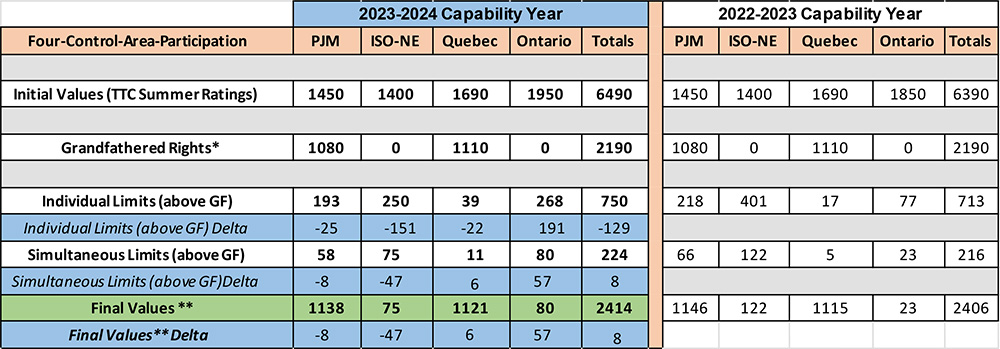

2023 Import Rights for Neighboring Control Areas | NYISO

Stakeholders also continued to express confusion over how aggregations would be deployed and the timing for the transition to the new construct. (See NYISO Stakeholders Still Concerned About DER Participation Model.)

Julia Popova, NRG Energy’s manager of regulatory affairs, said she was concerned that dispatched generators would not be compensated in the real-time market, even though they made bids based on ISO economic forecasting in the day-ahead market showing their units being profitable.

“In real time, there is opportunity to buy out our position, but with everything else going on with DERs, it does not work every time as intended,” Popova said.

“If NYISO can’t give us to the tools to make sure we aren’t dispatched uneconomically, then it is not fair to penalize us” because “we did what we said we would do based on [the] day-ahead,” Breidenbaugh chimed in.

NYISO offered stakeholders offline discussions in response to concerns and told them about upcoming training opportunities to help with onboarding. It expects to begin accepting customer registrations for DER aggregations in mid-April and anticipates the proposed tariff revisions becoming effective in early summer.

The ISO will seek approval of revisions from the Business Issues and Management Committees on Feb. 15 and Feb. 22, respectively, and will return to the ICAP/MIWG to continue discussions on necessary manual revisions.

Capacity Accreditation Kickoff

NYISO kicked off its capacity accreditation modeling improvements project, one of many that the ISO wants to prioritize this year. (See NYISO Outlines Timelines for 2023 Projects.)

Zach Smith, NYISO capacity market design manager, said the effort “allows a twofold change”: more accurate representation of installed reserve margins (IRMs) and locational capacity requirements (LCRs) in resource adequacy models, and more accurate capacity accreditation factors for capacity accreditation resource classes.

NYISO scoped out four topics that need to be addressed:

- gas constraints for fuel availability;

- long start-up notification requirements;

- modeling of special-case resources (SCRs); and

- dealing with non-fuel-related correlated derates, as identified by the Market Monitoring Unit. (See NYISO Over-crediting Poorly Performing Units’ Capacity, Monitor Says.)

NYISO does not currently capture natural gas constraints, nor start-up notifications for non-baseload units, in the IRM/LCR models. SCRs, although currently modeled, were found to not align with their expected performance and obligations.

But Smith said the ISO expects to spend most of its efforts this year on tackling the problems identified by the MMU by better capturing how ambient conditions impact correlated derates of combined cycle and combustion turbines.

NYISO will spend the first and second quarters analyzing areas for enhancement; the third quarter identifying any solutions; and the rest of the year either prototyping these solutions or making implementation recommendations. It plans to return to the ICAP/MIWG next month to discuss gas constraints, SCR modeling and the correlated derate issues.