AUSTIN, Texas — ERCOT CEO Pablo Vegas has laid down his markers to redesign the market, framing the Texas regulators’ preferred design construct as a reliability product that will “incentivize development and preservation of dispatchable generation.”

Vegas told his Board of Directors Feb. 28 that the performance credit mechanism (PCM) — which would retroactively reward dispatchable generation that meet performance criteria during the tightest grid periods with incentive payments — addresses the grid operator’s resource adequacy and operational flexibility challenges.

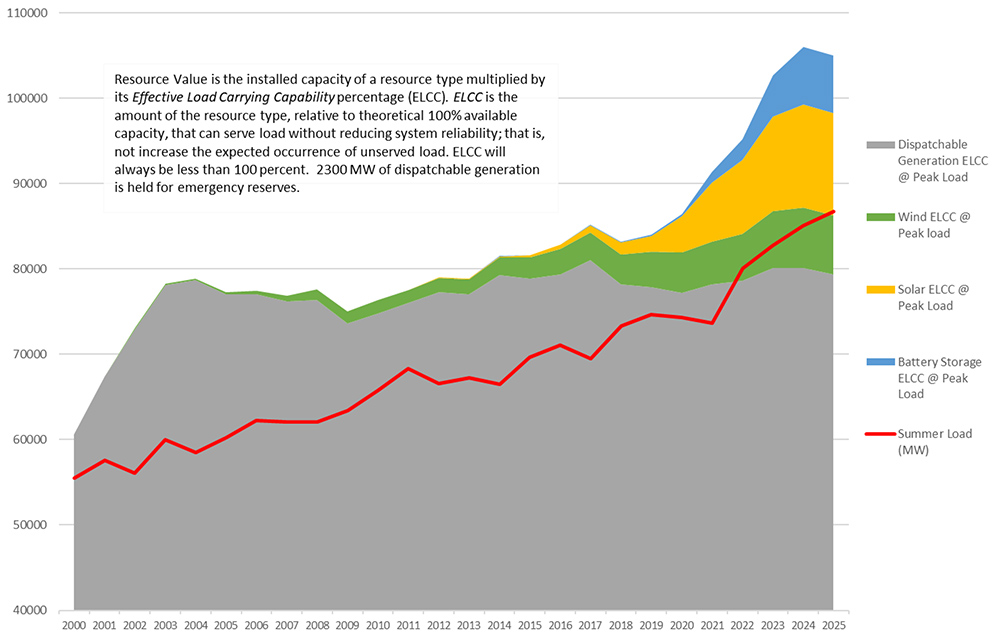

Vegas said ERCOT needs more dispatchable energy, pointing to a chart that showed demand has grown steadily since 2000. (Vegas likes to say Texas adds a city the size of Corpus Christi — population 317,773 in 2021 — every year.) ERCOT’s peak load cracked the 80-GW threshold last year, a more than 5-GW jump in three years.

ERCOT projects thermal contributions to remain steady while renewables increase. | ERCOT

ERCOT projects thermal contributions to remain steady while renewables increase. | ERCOT

Some 27 GW of thermal, or dispatchable, generation in the grid operator’s footprint has been shuttered since 2000. During that time, more than 52 GW of renewable energy has been added; almost as much thermal generation has been added, but it nets out to 24 GW of thermal resources when retirements are taken into consideration.

“We’re now getting to a place where the peak demands require the availability of renewables in order to meet the energy needs of Texas and that’s going to continue to grow into the renewable space,” Vegas told the board. “The reality is, we cannot always predict and plan for when renewables will be available. We can’t control when the wind blows and when the sun shines. With both a correlation of extreme peak and very low performance on renewables, then we can be in an area of risk of significant risks.”

Renewable energy’s growth and its potential swings in availability on any given day create operational risks to the grid, Vegas said.

“The more energy that we carry with renewables as the fleet of renewables have been growing meaningfully across the state of Texas, the risk associated with a real time operations grows at the same time,” he said.

Vegas allowed that renewables offer a “tremendous service” as a low-cost energy source, while also filling the demand gap on high-demand days or when fossil generation outages are up. He said the challenge in ERCOT’s energy-only market is that it allows “the zero cost of those renewables to suppress pricing in the overall market.”

“What that has done is it made it very difficult for dispatchable generators to recover a more significant cost profile to build these large power plants, and they don’t have any federal subsidies to help them do that. It makes it difficult for them to make investments in the state,” Vegas said. “We have to fix the market so that we continue to support the long-term reliability of the grid and look to the future and feel confident that we’ll always be able to meet the needs of Texans, regardless of what’s happening.”

The PCM adds a new revenue stream from generators separate from the energy and ancillary services markets, Vegas said, “specifically created to incentivize generators that can perform when needed and can do so when the grid is tight.” (See Texas PUC’s Market Redesign Dominates ERCOT Market Summit.)

ERCOT expects the PCM to increase total energy costs by $460 million a year, adding a “modest” 2 to 3% to customers’ bills. It has projected implementation will take up to four years and cost between $2 million and $4 million.

Critics say the cost could be much higher.

A report released last week by Bates White Economic Consulting for several industrial consumer groups contends the construct will costs billions “without a meaningful improvement in reliability.” The study reviewed consultant E3’s evaluation of the alternative market options, including the PCM, a dispatchable reliability reserve service (DRRS) and a direct procurement mechanism that could be deployed as a last resort should a dispatchable resources’ shortfall be identified in the future.

The Bates White assessment concluded that a DRRS ancillary service will provide additional market signals sufficient to incentivize new dispatchable generation at a fraction of the PCM’s cost. The latter would create a “tortuously complicated system” that adds costs without improving reliability, the report said.

Bates White said ERCOT’s immediate reliability challenge is to ensure operational flexibility to accommodate continuing additions of intermittent renewable generation. It said the energy and ancillary services markets are the appropriate focus for ensuring flexible and cost-effective operations.

Aurora Energy Research’s Oliver Kerr said during a recent conference that the firm’s analysis found the PCM would be “fairly costly,” ranging from $3 billion to $5 billion across various scenarios.

During the latest legislative hearing on ERCOT’s market design before the House State Affairs Committee last week, Texas Industrial Energy Consumers’ Katie Coleman said the PCM means higher costs “without any guarantee we’ll get anything in return.” The construct will simply shift money from consumers to generators, she said.

ERCOT staff is keeping close tabs on the Texas Legislature, where the PCM proposal continues to run into headwinds. The Public Utility Commission recommended the design to the lawmakers in January but will defer to them on the final design.

At the PUC’s direction, ERCOT staff is soliciting input from stakeholders on a proposed bridging mechanism that would retain existing resources and attract new generation until the final market design is developed. The options include a manually settled PCM, procuring more ancillary services, tweaking the operating reserve demand curve, and a backstop reliability service, previously offered by the PUC, to set aside capacity that is only dispatched during scarcity conditions.

“We’re going to look at what options we can do today to continue to operate the grid as reliably as we have and what can we do to try to send signals to the market, potentially to start developing resources today,” Vegas said.

During a first workshop on the bridging construct Friday, Kenan Ögelman, who oversees the ERCOT market’s design and its commercial operations, asked for stakeholder involvement in the process.

“My goal is to have some kind of matrix summarizing the feedback that we received from you such that there is an easy way for board members to tabulate and figure out where there might be some stakeholder consensus,” he said. “Certainly, I want to recommend something that has some broad stakeholder consensus and that meets the commission’s objective.”

A second workshop is scheduled March 15, during which staff will provide feedback on the comments it has received and seek further discussion on each option. ERCOT plans to bring a final bridging solution to the board for its consideration and approval April 18.