Among the topics covered by WECC’s State of the Interconnection (SOTI) report released Friday, one subject stands out for its immediacy: the impact of extreme natural events on the Western grid.

WECC organizes the annual report to highlight its stakeholder-selected reliability risk priorities, which currently include cybersecurity, natural events, resource adequacy, and the impact of changing resources and customer loads on the bulk power system (BPS).

And while growing cybersecurity risks get play across the NERC-led ERO Enterprise, the SOTI makes clear that climate threats are still paramount in the Western Interconnection.

“Last year, the West experienced extreme weather ranging from heat waves and dry spells to extreme winter storms and atmospheric rivers. The frequency, duration and seasons of extreme events have increased over the last 40 years,” WECC said in the report.

The interconnection last year registered 40 reportable reliability events, according to the SOTI, up from 33 in 2021 and tying 2019. WECC said such events have increased in severity over the past four years, based on NERC’s severity risk index (SRI), which “measures the severity of daily conditions based on the combined impact of load loss, loss of generation and loss of transmission on the BPS,” according to NERC.

Among last year’s events were 10 Level 3 energy emergency alerts (EEA-3), nine of which occurred during a late summer heat wave over Aug. 30 to Sept. 10.

“The average duration of the EEA-3s in 2022 was more than 200 minutes, exceeding the average duration for EEA alerts in previous years by almost double,” the report noted.

Last summer’s heat wave also saw the Western Interconnection set a new electricity demand record of 167,530 MW on Sept. 6, exceeding WECC’s peak forecast of 164,650 MW and smashing the previous record of 162,017 MW set in August 2020. The report notes that 1,000 cities in the West saw temperature records fall during the heat wave, with afternoon highs reaching 15 to 30 degrees above historical averages.

Although not detailed in the SOTI, the West averted even higher demand — and rolling blackouts — last summer through California’s emergency measures, which included heavy use of industrial demand response and last-minute calls for residents to consume less electricity during periods of peak usage. (See California Runs on Fumes but Avoids Blackouts.)

The report notes that 22,581 wildfires burned 3.3 million acres across the West last year, with 31 of those affecting the BPS between January and July, down from 70 such fires in 2021.

“There is no strong correlation between wildfire number or severity and risk to the BPS. This is largely because fire location is the dominant driver of risk to BPS elements,” the report said.

The SOTI also highlighted the impact of drought and long-term aridification on the Western grid, with the latter having severely reduced water levels of the reservoirs behind hydroelectric dams on the Colorado River system, with Lake Powell, impounded by the 1,320-MW Glen Canyon Dam, at its lowest level since being filled in the 1960s.

While a series of atmospheric rivers this past winter have restored the reservoir levels supporting California’s extensive hydroelectric system, WECC offered a cautionary note.

“Despite record precipitation over the last few months, much of the West remains in a state of drought, although conditions have improved compared to a year ago,” the report said.

Dual Peaks

The SOTI addresses Western resource adequacy from the perspective of natural events and the changing resource mix. It notes that, over the last 50 years, the U.S. heat wave season has doubled from 34 to 73 days, and that grid planners are dealing with the dual challenges of higher loads in both summer and winter.

“While the Western Interconnection’s peak demand occurs in the summer, many entities are winter-peaking. As temperatures and extreme weather increase, some of these entities are becoming dual-peaking. This presents resource planning challenges for entities that have historically experienced one predominant peak,” the report said.

WECC pointed to a recent example: Just a year and a half after record-smashing heat in June 2021 produced record loads in the Pacific Northwest, a December 2022 cold front also caused record winter peak demand in the BC Hydro, Alberta Electric System Operator and Western Power Pool areas.

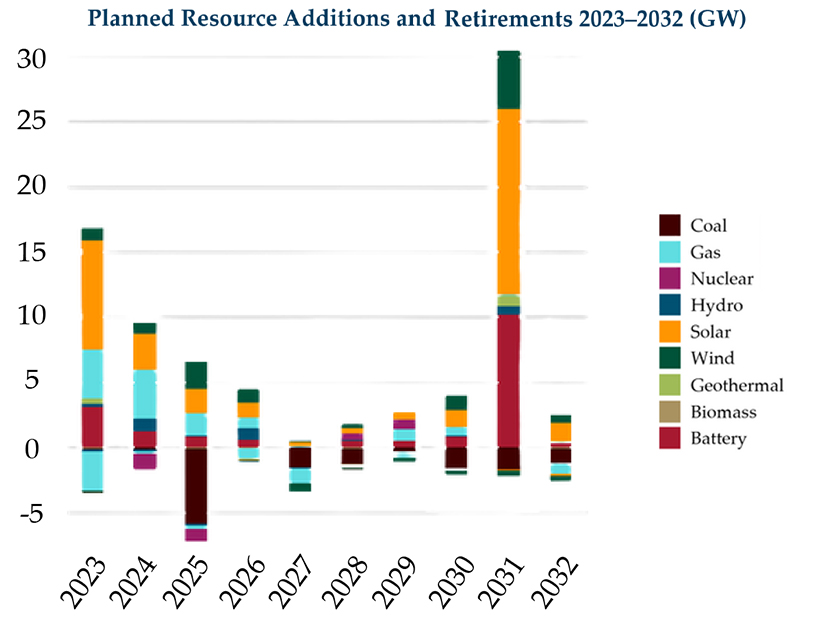

The SOTI pointed to a future Western resource mix that will be much less reliant on coal and nuclear generation by 2032 (with anticipated retirements of 13.4 GW and 1 GW, respectively), and more heavily dependent on solar (31.9 GW of new capacity), wind (9.2 GW) and natural gas (4.7 GW). WECC also projects the region will take on 18.3 GW of new battery storage over that period.

“Variability is a primary driver of resource adequacy challenges, and, based on data provided by entities for WECC’s Western Assessment, variability will increase,” WECC wrote. “Projections for maintaining resource adequacy depend on new resources coming online as planned, with little margin for delay. Factors such as supply chain disruption or siting delays can pose serious risks.”

The report pointed out that WECC and the ERO Enterprise have “focused heavily” on the emerging risks from inverter-based resources (IBRs) such as solar and wind.

“While solar-related IBR events decreased in 2022, battery storage — also inverter-based — is increasing, expanding the potential for increased IBR-related events,” the report stated.

The report also covers transmission-related developments over the past year, including final U.S. Department of the Interior approvals of the Gateway South transmission line across Wyoming, Colorado and Utah; the Ten West Link from Arizona to California; and two segments of the Gateway West project from Wyoming to Idaho.

WECC also points to other projects in the later phases of review or nearing approval, including Boardman-to-Hemingway in the Northwest, Greenlink in Nevada and SunZia in the Southwest.

“While these projects reflect progress, WECC studies show a growing risk associated with transmission availability, particularly regarding growing resource adequacy risks,” the report said.