ISO-NE and NEPOOL last week asked FERC to approve changes to the Inventoried Energy Program to reflect recent volatility in the global natural gas market and gas contracting prices in the region.

The program was designed as a stopgap for longer-term market reforms to ensure winter reliability and is designed to pay resources for maintaining inventoried energy during the next couple winters. The RTO initially filed the program in 2019, and it was approved by FERC in 2020 to go into effect for the winters of 2023/24 and 2024/25.

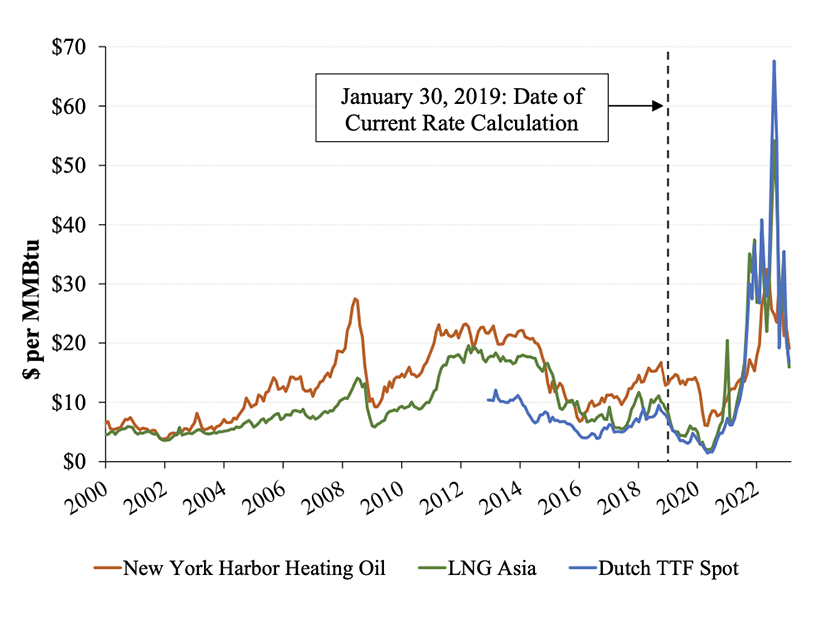

Russia’s invasion of Ukraine last year led European nations to seek alternate sources to Russian gas, which has increased volatility greatly. Demand from Asia has also gone up in the interim, ISO-NE’s consultant Todd Schatzki of the Analysis Group said in testimony filed at FERC.

“Since the commission’s acceptance of the IEP, global energy markets have experienced dramatic and unprecedented changes in pricing levels and volatility,” ISO-NE said.

One of the most significant changes was to replace the fixed rate for resources procured in the IEP to an indexed rate that will be able to reflect any changed prices going forward, as the recent volatility is expected to last for the next couple winters. The initial program featured both a forward and spot rate, allowing resources to sign up ahead of time or during the winter, and both of those are moving to indexed pricing.

The forward rate FERC approved was $82.49/MWh for inventoried energy, but the new price will be based on a formula using the price for liquefied natural gas at the “Dutch TTF” (Title Transfer Facility), a proxy for European prices that have recently set the price of LNG in the entire Atlantic basin.

The formula also includes a liquidation price to reflect the possibility that New England generators might procure too much LNG, which would have to be sold after the winter season when prices are typically lower.

The base rate is capped at $288/MWh, which reflects the opportunity cost from participating in the IEP and liquidation costs and is based on the price needed to secure inventoried energy given real-world constraints.

The spot price now in place is just $8.25/MWh, but the RTO asked FERC to change that one-tenth of the applicable base payment rate, which is consistent with the current market design.

The updates also include changes to natural gas contract eligibility requirements and fuel allocation for shared fuel inventory, which are meant to be better aligned with current contracting practices in New England.

IEP participants will have to submit contracts that do not restrict when the gas can be called on during a day beyond the North American Energy Standards Board’s Wholesale Gas Quadrant scheduling and nomination standards.

The currently effective rules are also too restrictive, ISO-NE and NEPOOL said, because they require a level of gas delivery firmness that is not commercially available from the interstate pipelines that serve New England, so that part was updated to reflect market realities.

If a natural gas contract specifies an indexed strike price, then that specified index must be at one of the Northeast trading locations for which Platts publishes a daily value in order to ensure the contract in question reflects regional prices.

ISO-NE and NEPOOL asked FERC to make the changes effective June 6, which will ensure the rules attract inventoried energy for next winter given the increased volatility in natural gas prices. The new indexed rate will also make it easier for market participants to hedge their program costs.

“Without the proposed changes to reflect actual market prices and contracting practices, the current commission-accepted IEP runs the risk of providing insufficient incentives for participants to procure and provide inventoried energy when needed to ensure reliability on the coldest winter days, when fuel supplies are stretched to their limits,” the filing said. “Relying on well established and reliable price indices ensures that the IEP is providing accurate price signals reflective of the actual costs of providing the service, while avoiding overcompensation at the expense of regional consumers.”