Price-responsive demand has long been supported by economists, but despite the significant investment in advanced meters, it has yet to take off.

Price-responsive demand has long been supported by economists, but despite the significant investment in advanced meters, it has yet to take off outside a few jurisdictions.

The Energy Systems Integration Group (ESIG) is releasing a series of papers this year, which Associate Director Debra Lew said are intended to raise awareness in the industry of how important it is to make the demand side a more active player going forward.

“We’re going to need that flexibility for high levels of renewables and high levels of electrification in the future,” Lew said in an interview.

In EPA’s recent rule, which it expects to greatly increase the number of electric vehicles purchased, it specifically pointed to time-varying rates as a way to charge all those cars without overloading the grid. (See EPA Releases Emissions Rules Aimed at Boosting EVs.)

Plenty of attention has been paid to programs such as demand response, or the aggregation of distributed energy resources under FERC Order 2222, but less focus has been paid to reducing demand through some kind of time-varying rate.

“Every time I bring up pricing, I always get told, ‘We don’t want to touch that with a 10-foot pole,’” Lew said. “So, I think it’s a really important, critical piece of the problem, and we’re hoping to shine a light on it, and to get industry to pay more attention to this, because it is a critical way of getting demand to provide that flexibility.”

Pricing should be part of the industry’s holistic planning process, where they can help avoid major spending on new resources, she said.

“If you’re thinking about adding storage to your system, maybe you should do time-of-use rates instead,” Lew said. “Think about some of these rates as replacements for resources that you might add to your system. If you’re thinking about adding a gas peaker, maybe instead you should do a peak-time rebate or critical-peak pricing.”

The idea of making the demand side more active is far from new, with the first DR programs going back decades and advanced metering infrastructure being rolled out to most customers in the country over the last decade-plus.

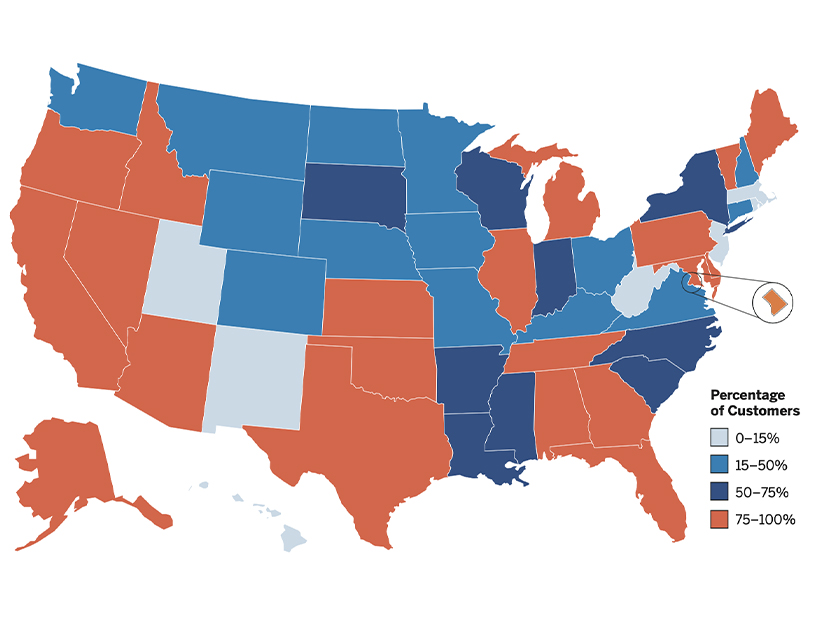

“As of 2021, I think there are approximately 115 million installed smart meters, and this is representing roughly 80% of all U.S. residential customers,” Brattle Group Principal Sanem Sergici said in an interview. “But when you go to [the U.S. Energy Information Administration] and look at their most recent data, only about 6% of the residential customers are on some sort of a time-varying rate.”

Time-varying pricing has not followed the rollout of smart meters because of inertia around how electricity has already been priced and some fear of the unknown, said Sergici, who contributed to ESIG’s reports and has tracked the issue for Brattle for years.

“Although, if you ask me, it’s not unknown anymore,” she added. “I mean, we have so much data. We have so much experience under our belts at this time when it comes to understanding customers response to these dynamic prices.”

Many industry veterans have bad memories about the first wave of DR programs 30 years ago that did not work as well as expected, but Lew noted much has changed since then. The industry has access to more advanced communications and control technology; the changing dynamics of the grid make the need more acute; and sophisticated customers such as data centers have shown that they can be very flexible if they get the right signals from the grid.

“I don’t think this is rocket science,” Lew said. “I think that it’s kind of ridiculous that it’s taken us this long to take this seriously.”

What to Charge?

Economists generally favor raising prices when demand is higher and having them lower when it is not, but former FERC Chair Jon Wellinghoff, who is now the chief regulatory officer at the aggregation firm Voltus, said that that would never fly politically. Dynamic pricing means customers must pay more when they use power the most, such as running their air conditioners on the hottest days of the year.

“That’s a penalty for consumers,” Wellinghoff said. “What they should be doing instead is rewarding consumers for not using energy during that time and paying them to not do that. And if they, in fact, gave them a reward, instead of a penalty, it would flip the whole thing on its head; it would make it much more palatable and much more acceptable for consumers.”

Voltus is working with Ameren Illinois to pay some of its mass-market customers who have smart thermostats to reduce usage during peak demand times. Wellinghoff argued that is much more attractive to customers than any kind of time-varying prices.

Price-responsive demand programs were sold as the key to advanced meters’ consumer benefits, but despite the meters being rolled out to most consumers, such programs have not been to nearly the same extent.

“I think it was oversold as to actually what it would be able to do and how it would be able to help consumers,” Wellinghoff said of advanced metering.

The meters rolled out to most residential customers are only collecting prices every five minutes, which makes them inadequate to really help with the sophisticated load management programs that Wellinghoff supports, he said.

FERC Order 2222, which requires RTOs to accept aggregations of distributed energy resources, is one way that the industry will be able to get the demand side into the market, but that transition needs to happen faster, said Wellinghoff. Getting Order 2222 fully implemented and demand more into the markets is going to require some changes from the distribution utilities.

“I think they’re sort of feeling afraid of being left out. And they’re not sure what their role should be. And they don’t want to accede their role to simply being a wires company. They want to do other things. But they’re not good at doing those other things, because they have never had experience in the competitive arena.”

Having the utilities focus on expanding the distribution system, while an independent distribution system operator (DSO) handles balancing various resources with flexible demand would lead to the kind of grid Wellinghoff sees in the future.

Utility Perspective

The concept of a DSO is just an idea at this point, so balancing all the activity on the distribution system is still firmly in utilities’ control. That has made implementing Order 2222 tricky, Portland General Electric Senior Vice President of Advanced Energy Delivery Larry Bekkedahl said in an interview.

“I don’t think that folks really thought through the full extent of the impacts on the distribution system, when we have traditionally been really good in the transmission generation space and bidding and markets in that space,” Bekkedahl said. “But to go to the distribution, you’ve got to be able to communicate with those that are operating the distribution system in the same way you do with the generators and transmission folks. We have not been set up for that.”

Without significant additional work bringing the utilities that run the distribution system into that picture, it will never be fully optimized, and it just has to deal with whatever extremes are placed on it, he said.

While Bekkedahl has some doubts about opening everything to third parties, virtual power plants and increased demand flexibility are a key part of the Oregon utility’s plans to keep the grid balanced. Going forward, Bekkedahl expects about a quarter of all supplies will come from distributed resources and that growing percentages of the rest will be from intermittent renewables.

“If we’re going to get to our decarbonization targets … we absolutely need as much flexibility in the load as possible because we’ve added all this variability in the generation side with wind, solar, etc.,” he added.

That flexibility will benefit from distributed batteries and direct load control (DLC) programs, in which customers can sign up for programs that allow utilities to turn up their thermostats a few degrees on the hottest days.

Most utilities in the country use their assets at about a 30 to 35% range, but PGE is starting to exceed its peaks on that usage, and it would like to be able to bring its asset usage up to 40 to 60% while meeting peak demand, Bekkedahl said. That is going to require significant flexibility.

In September 2022, the Western grid hit its all-time peak demand at 167 GW, and prices were up to $2,000/MWh, when normally they sit around $100/MWh at most. Those kinds of peaks make demand flexibility very cost effective.

“So being able to flex with customers and what used to be demand response programs now become these flexible programs that can keep the lights on for everybody,” said Bekkedahl. “And it also helps us to meet our greenhouse gas emission targets.”

How High Can Prices Go?

Reflecting the system conditions to mass market customers can be handled in a variety of ways, from standard time-of-use rates that go up over predetermined hours and are lower in others, to just passing the wholesale price signal directly to consumers.

The experience of the retailer Griddy in the winter storms that knocked out power to millions of Texans in February 2021 often came up in interviews with RTO Insider as an unfortunate, cautionary tale. The firm had grown its customer base by passing along normally cheap wholesale rates without any markup to cover the cost of hedging. But then the winter storm came through, pushing up natural gas prices, knocking power plants offline and eventually leading the Texas Public Utility Commission to set prices at $9,000/MWh for most of a work week. (See Texas Court Reverses PUC’s Uri Market Orders.)

Those wholesale prices led to some ridiculously high electric bills that customers ultimately did not have to pay; Griddy was forced out of the market, and its business model banned by subsequent legislation.

“ERCOT was living in this imaginary world were very infrequent, really high prices would automatically take care of all the issues that a capacity market takes care of in PJM,” PJM Independent Market Monitor Joe Bowring said in an interview. “It clearly didn’t work when push came to shove, and you had extreme weather. That’s the problem because then prices are extraordinarily high, and you can do a massive amount of damage in a very short period of time to companies as well as the customers.”

Some retailers ran into similar issues when PJM faced similar conditions during the polar vortex of 2014, though the RTO kept the lights on.

“In order for it to work, we have to have wholesale pricing that reflects shortages but does not reflect it to an extreme degree,” Bowring said. “I mean, some economists say that really high prices are essential. I don’t think that’s true.”

Prices can go up to $1,000/MWh, or maybe $2,000/MWh in extreme conditions, and still send the right signals to the market, including any customers on time-varying rates, he added. Prices also generally should not stay that high for long because they are only meant to go up to attract additional resources that tend to bring them back down.

Load-serving entities can design rates that would never expose their customers to such high prices, having a hedge kick in before prices shot up to their highest possible levels, Bowring said.

While the capabilities of smart meters were oversold, Bowring said, part of the reason dynamic pricing at retail has not taken off is that often third-party firms do not get access to the data that utilities have from those meters that would enable such programs. Bowring has long argued that DR should come from retail programs because he believes the wholesale DR programs PJM runs are far less efficient than that alternative.

Every time demand is triggered, it automatically leads to higher prices, which is the exact opposite effect demand is supposed to have, Bowring said.

“The place for demand side and where it can be most valuable to real customers is to have it on the demand side and to empower people to be able to reduce loads when they need to and to pay less for capacity and energy when that happens,” he added.

Some Skepticism from Consumer Advocates

California is one state that has defaulted to time-of-use rates for its residential customers, but that program needed a carveout for low-income customers in the hotter parts of the state, such as the Central Valley, Marcel Hawiger, staff attorney for TURN – The Utility Reform Network, said in an interview.

“Dynamic pricing has the potential to lower rates if, and only if, any actual reductions in demand flow through to real reductions in utility spending,” said Hawiger. “We hope that happens.”

But charging more money for power when customers need it the most can also harm them, especially low-income customers who lack the ability to pay for the automation and changes in lifestyle needed to maximize its benefits, he added. When it comes down it, dynamic pricing is “using prices to ration a needed commodity.”

“If you can afford it, you’ll just use as much as you want on a hot summer afternoon and cool your home,” Hawiger said. “And if you can’t afford it, you’ll cool less and have a warmer home because you can’t afford it.”

Many decry utility DLC programs, but they offer voluntary opportunities for customers to have their major appliances controlled by the utility in exchange for a rebate, which appeals to more customers and offers utilities more certainty over the resource, he added.

California only recently moved to default time of use rates for customers and TURN fought to exclude those who could not adequately respond. TURN looks forward to getting a look at the data on how the new rates in California have impacted customers, Hawiger said.

Where Else Has it Taken off?

Outside of California, some kind of time-varying rates have been fully deployed by Detroit Edison in Michigan, Xcel Energy in Colorado and the Long Island Power Authority in New York. Arizona Public Service and the Salt River Project in Arizona have high levels of participation in their programs, said Brattle Group’s Sergici.

Those programs show that dynamic pricing can work, Sergici said, and it is just a matter of willpower between the industry and regulators to get it in place in more jurisdictions. The transition the grid is going through, with the growth in renewables and more distributed resources, will only grow its benefits.

The shift to renewables means that instead of generation having to constantly track shifting demand, generation will be intermittent and would benefit from having the demand-side track its output at least somewhat, he said.

“Pricing actually is a very great tool to moderate the pace of that investment cycle that we’re going to go into because if you can manage some of the capacity growth through dynamic pricing, that means that you need to either defer that capacity build or you can even avoid some capacity build,” Sergici said. “And that will only help to make this transition more affordable and reliable.”

While dynamic pricing has been slow to take off, Sergici believes that is likely to change soon as the grid changes and more and more of the industry gets comfortable with it. The change will be like Ernest Hemingway’s description of how a character went bankrupt in “The Sun Also Rises”: “gradually then suddenly.”

“I think that it’s happened very slowly for a very long time,” Sergici said. “And I am now seeing this big momentum. And I think that it will happen suddenly, in the next five years, that more and more utilities will decide to have time-varying rates to be the default rates for their customers.”