FERC last week ordered ISO-NE to reconsider its market power mitigation rules to address an “unanticipated and highly atypical” situation that Dynegy Marketing and Trade said caused it to lose more than $900,000 during the December winter storm.

In partly granting Dynegy’s request for recovery of more than $903,000 in costs, the commission’s May 5 order also instituted a show-cause proceeding under Federal Power Act Section 206 requiring the RTO to revise or defend its current rules (ER23-1261, EL23-62).

Dynegy Marketing and Trade, which was acquired by Vistra (NYSE:VST) in 2018, operates the Bellingham, Blackstone, Lake Road, Milford, Casco Bay/Independence and Masspower natural gas-fired generation stations in New England.

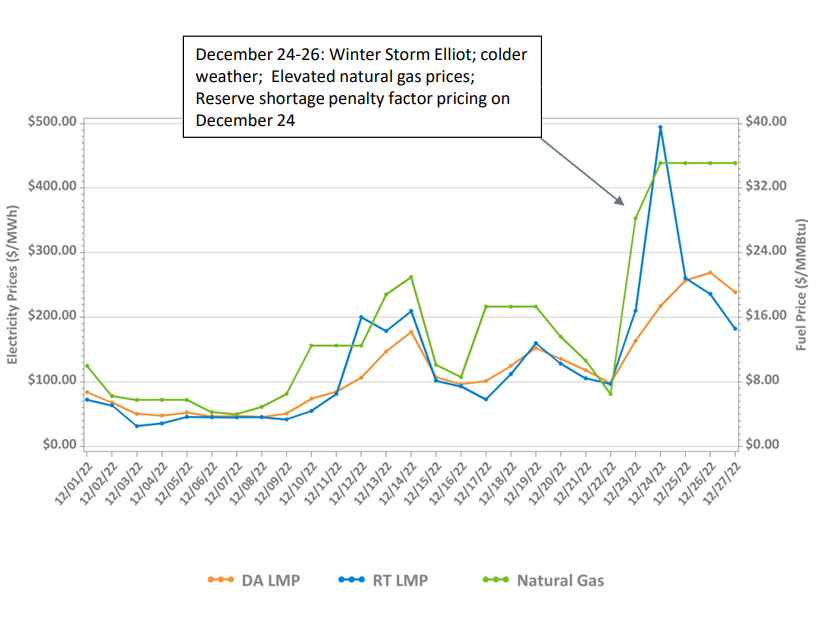

On the morning of Dec. 24, ISO-NE’s Internal Market Monitor determined that the size of Dynegy’s fleet relative to the system supply margin made the company a “pivotal supplier” that could potentially exercise market power.

This “structural” test is one of three screens ISO-NE uses to identify potential market power. The RTO’s “conduct” test determines if the participant offered the resource at a price above its “reference level” — a unit-specific price based on its cost of operations — by a certain threshold. The RTO’s “impact” test determines if the resource changed LMPs by more than 200% or $100/MWh, whichever is lower.

Resources that fail all three tests are subject to mitigation, with the duration of the mitigation determined only by the structural test — meaning that even after a resource’s offers no longer exceed the reference level plus threshold, it remains mitigated until it is no longer a pivotal supplier.

Pivotal Supplier

ISO-NE found that Dynegy was a pivotal supplier during hour ending (HE) 1 through HE19 on Dec. 24, resulting in the RTO mitigating “several” of its resources in the real-time energy market, causing them to under-recover their actual real-time energy market costs as natural gas prices rose in intraday markets.

Dynegy said its under-recovery occurred during intervals in which its supply offers were mitigated to lower reference levels and its resources were uneconomically dispatched higher than they would have been without mitigation (“downward price mitigation”).

The company also had offered segments of its supply curves below reference levels, but the IMM mitigated them to the higher reference levels (“upward price mitigation”), pushing Dynegy’s units out of merit and resulting in lower dispatch levels than the company had expected based on prevailing LMPs. Dynegy also said it under-recovered costs in those hours because it was required to buy back its day‐ahead awards.

The company supported its request with an affidavit from consultant Bill Fowler, a longtime ISO-NE stakeholder, who said he had never before seen the use of upward mitigation, nor heard it discussed in stakeholder processes that developed the current rules.

“If a generator is watching its offers being mitigated [in real time] to higher price levels, with the result being unit output is driven to lower megawatt levels than it desires, the generator no longer has an economic incentive to follow the ISO’s dispatch instructions as required, as it would be more profitable to self-dispatch to the higher megawatt levels,” Fowler said.

The tariff calls for mitigation to continue until a complete hour passes during which the pivotal supplier test is no longer exceeded.

As a result, said Fowler, Dynegy’s “offers became meaningless: They would be mitigated to reference until the [pivotal supplier test] condition was over. Adding to the problem, the mitigation would extend to all offer segments, not just those that were above reference.”

Rules that increase offer prices defeat the purpose of market mitigation and undermine reliability, Fowler said. “It is in precisely these situations — with volatile gas prices in scarcity conditions — that we want generators to take extraordinary steps to find ways to secure additional fuel.”

Dynegy’s request for recovery was supported by the New England Power Generators Association but opposed by the Maine Public Advocate, the Massachusetts Attorney General and the Connecticut Office of Consumer Counsel.

Ruling

The commission granted Dynegy’s request to recover costs related to downward price mitigation and recovery of $62,600 in legal costs but denied its request to recover costs related to upward price mitigation, saying the latter recovery was not permitted by the tariff.

But the commission also said the tariff provision that allows ISO-NE to apply upward mitigation may be unjust and unreasonable and can result in “an illogical outcome.”

Raising a seller’s offer “may potentially lead to suboptimal dispatch, and may increase production costs, because when ISO-NE mitigated Dynegy’s offers to a higher level, the market clearing software dispatched Dynegy resources to lower output levels than would have occurred had Dynegy’s offers not been mitigated upward,” FERC said. “ISO-NE likely dispatched other, more expensive resources to higher output levels to replace the output from the Dynegy resources that were dispatched down.”

FERC gave the RTO 60 days to defend the rule or propose a remedy to its concerns.

It said the RTO should consider whether it is appropriate to mitigate a resource to the lower of its submitted offer prices or its reference level for a given offer segment, rather than automatically mitigating all of a resource’s submitted offer segments to reference levels.

ISO-NE also should consider whether its market power screens should continue testing for conduct and impact beyond the first hour that a portfolio of resources is determined to be pivotal and whether there are other scenarios in which participants would be precluded from recovering costs incurred in situations where their supply offers are mitigated upward, FERC said.

ISO-NE spokesman Matt Kakley said the RTO was reviewing the order and had no immediate comment on how it would respond.

Stakeholders will have 21 days to file comments following the RTO’s filing.